The document in pdf is available here Economic Weekly-NatixisAM-03-30-2015

Key element of the week starting March 23

Confidence indicators follow a stronger profile in the euro zone.

Households and companies have a more positive perception of their foreseeable future.

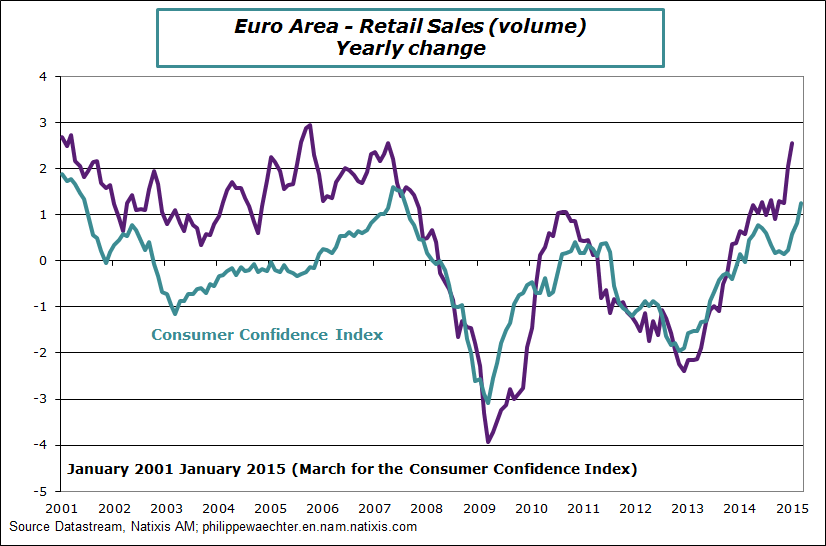

For households, confidence indicator is back, in March, to its 2007 level if we follow the European Commission survey.

The situation is changing as a result of the cheaper oil, low interest rates and a more buoyant labor market (employment was up in 2014 for the Euro Area (+0.6%) This will continue in 2015.

This more robust perception of the future is seen through stronger retail sales. (April 8 for February data)

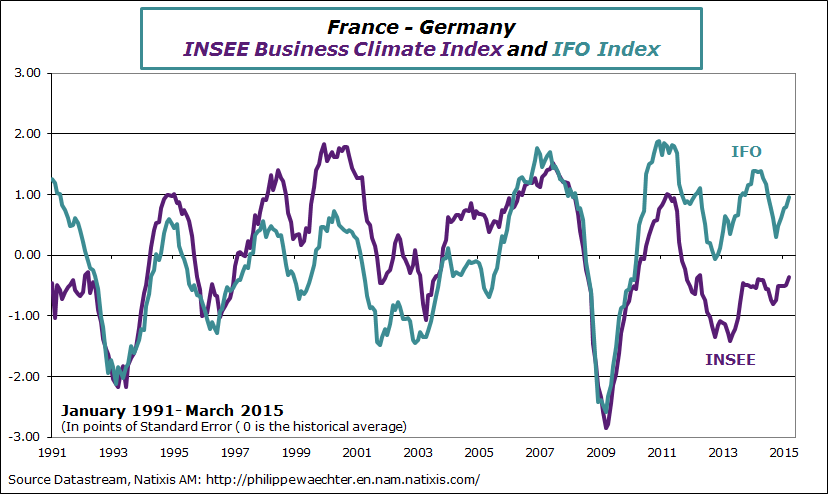

On companies’ side indices also are improving. Markit indices for March are more robust and are consistent with an increase in activity in the first quarter. The momentum in orders and employment suggest an increase in business dynamics leading to the convergence towards a virtuous circle.

The IFO survey rose rapidly in March as it did in recent months. German indicators appear robust and Germany seems to be the engine of recovery with a stronger internal demand

The INSEE business climate index rose slightly in March. 3-month improvement is significant, but does not reflect a violent acceleration of activity.

Other Important Issues

- Janet Yellen speech in San Francisco suggests that the Fed’s president wants to see higher fed funds this year. If the economy converges to the Fed’s scenario then the FOMC will have to increase rates. The argument that inflation will accelerate due to the improvement in the labor market is not completely convincing. The idea of defeating inflation before it starts follows the assumption that the moment where inflation will accelerate is known in advance. Some Very Serious People point to a high probability of high inflation since 2009 and the implementation of unorthodox monetary policies, but with little success. The inflation rate is just 0.3% in February following the PCE index.

- The Markit index for Chinese manufacturing was down in March but the average figure for the quarter was the same than the 4th quarter average at 50- The activity is still sluggish

- In the US, the Markit index is up but the average T1 is slightly lower than that of T4

- The US inflation rate has registered a slight increase of 0% in February (-0.1% in CVS) and 1.7% underlying rate – Do not forget that “Shelters” in the index has a contribution of 0.95%. Other dub-indices do not change a lot.

- In Japan, retail sales improved moderately and the gap with the first quarter of 2014 (before the VAT rate hike) is still 6.5%. Decline in industrial production in February

- British inflation was 0%. This is the lowest figure since March 1960. Retail sales where strong in February

What will happen this coming week?

- Employment figures in the US for March are the key number this week. It is reinforced by the fact that Yellen conditions even more now her strategy on employment. It will be Friday at 14:30 (Paris time)

- In the euro zone, the inflation rate in March and the unemployment rate for the month of February will be released Tuesday at 11 am. The inflation rate should approach 0%

- Markit and ISM surveys for the manufacturing sector will be published Wednesday. Then we will have a fuller understanding of the global economic dynamics.

- On 1 April, the Bank of Japan will release its Tankan quarterly survey

- Publication of household spending in France for the month of February, Tuesday morning