The complete document in pdf format is available here

Economic Weekly-February 23, 2015

Key element of the week starting February 16

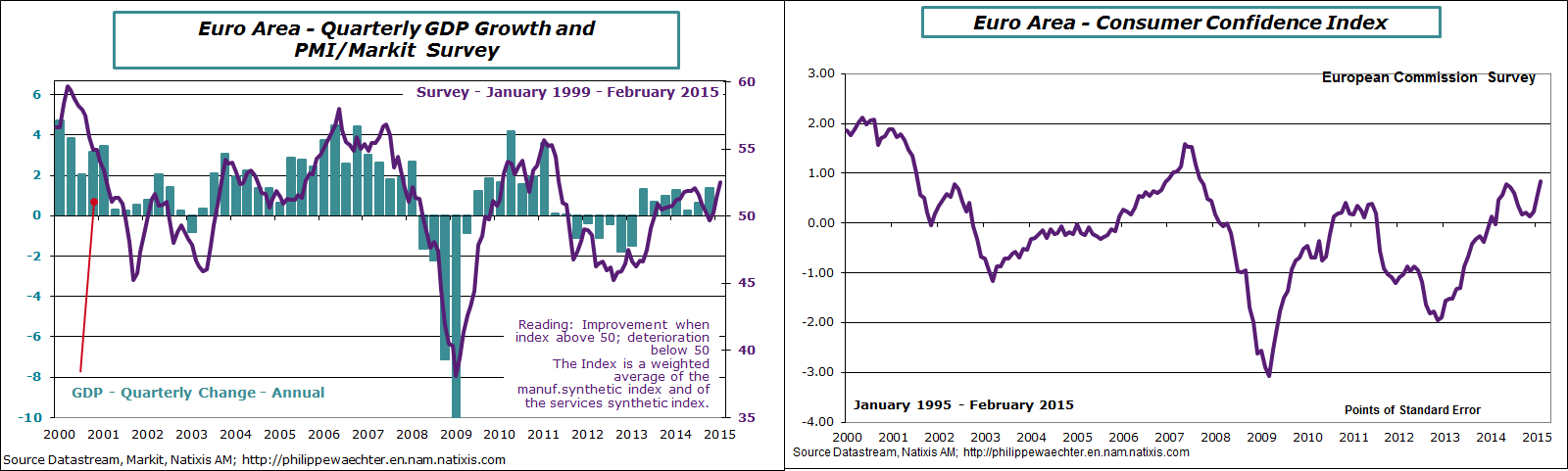

In February, in the Euro Area, companies and households have sent a positive message on their expectations. Confidence indices were up for both. The PMI/Markit index is at its highest level since June 2011 and the European Commission Consumer Confidence index has never been so high since September 2007. Two points to be noticed: constraints are not binding as strongly as they did. This is related to lower euro, lower rates and lower oil price in the Euro Area. Every economic agent has more capacity to adapt to its environment and to make arbitrage. The other issue is that uncertainty on Greece and anxiety linked to Ukraine haven’t had impact on companies and households’ behavior.

The PMI/Markit index has a profile which is consistent with GDP quarterly growth and the consumer confidence index is well correlated with consumption momentum. Both indicators will be supportive for stronger growth. In other words, these two types of signal suggest that the economic situation is changing on the upside in the Euro Area.

The ZEW survey for February in Germany gave the same signal.The combinationof all these indicators may show the real start of the Eurozone economic expansion.

Other Important Issues

- The agreement last Friday on Greece is just a way to postpone the deadline that was fixed on February 28. Greece may have 4 months to find a new deal if the arguments presented to the Eurogroup on Tuesday 24 are convincing (phone agreement by the Eurogroup expected tomorrow). But the bailout conditions have not been removed. The situation is still tight.

- In the USA, the industrial production index has followed a slower trend during the last couple of months (+0.06% in December and +0.18% in January). The PMI/Markit index was slightly higher (54.3) but the new orders index is stable at 54.7 and the new exports orders index is showing a slower momentum. This can probably linked to the dollar strength.

- The Federal Reserve doesn’t want to hurry to lift-off its interest rates (Fed’s minutes)

- Since last week and referring to the meeting that was held on January 22, the ECB now publish minutes of its council. It will be interesting to follow the evolution of the balance of strength between meeting’s members.

- The inflation rate in France was -0.4% in January – Close to deflation as the contribution of the index ex energy was just 0.2%. It’s clearly not enough.

- Strong recovery in Japanese exports in December and January. Positive on economic growth

- Stronger CBI survey in the UK in February – Higher real wage rate due in large part by a drop to 0.3% of the inflation rate: good for purchasing power – Trend in retail sales remains good

What will happen this coming week?

- The main point this week will be Janet Yellen testimony at the Congress. It will be on Tuesday 24 (and repeated on 25). We expect insights on the Fed’s monetary policy during the Q&A session.

- Surveys in the Euro Area with IFO (Monday in Germany), INSEE (Tuesday in France) and Istat (Thursday in Italy) to have a clearer view on the short term outlook

- Inflation in the US (Thursday) and details in the Euro Area (Tuesday)

- In France, consumer confidence & unemployment (Wednesday), consumers’ expenditures (Friday)