Higher bonds yields in the Euro Area could suggest that the economic situation is on the way to normalization and that areas of shades, that characterized the current situation, will fade rapidly. This suggests that the first three months of the massive quantitative easing program from the ECB have been sufficient to definitely improve the growth prospects of the Eurozone.

Isn’t it a bit too fast?

In other words, are there pressures on the economy that could rapidly push the ECB to change its monetary policy? The main question is there: will the ECB be forced to change its monetary policy?

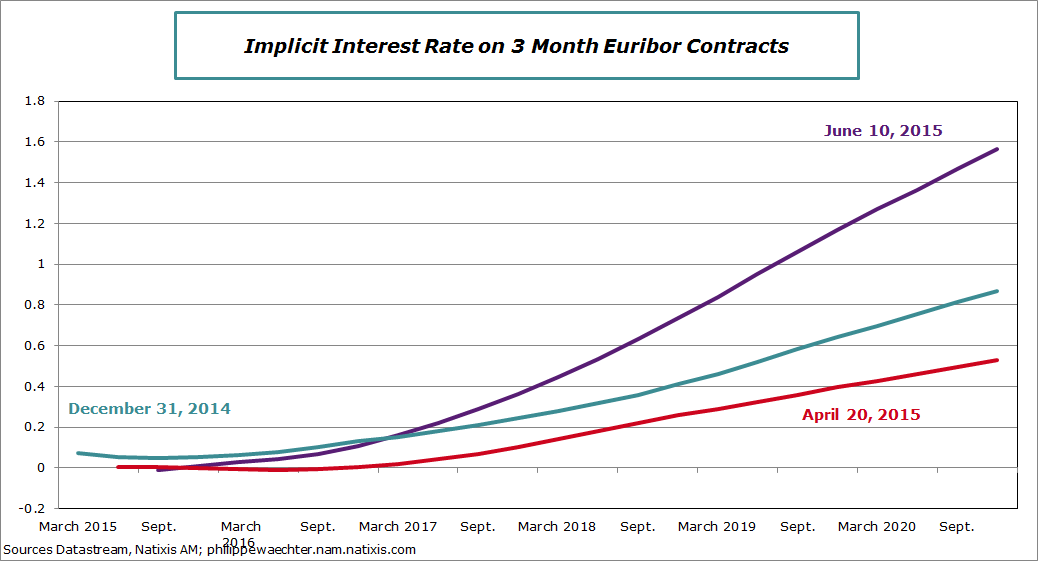

Implicit rates on 3 month Euribor contracts with maturity in 2017 or 2018 show strong expectations with interest rates that are much higher than those currently recorded. This seems to be excessive and not consistent with the stage of the business cycle.

After 5 months in 2015 and some positive growth figures, must we imagine that the recovery is strong enough and sustainable? Is the economy converging to a strong trajectory with a higher inflation rate? That’s what we expect but this is not currently the case.

Moreover the prospects associated with the higher rates are too deterministic. There are still risks on the economic momentum. The convergence to a more virtuous business cycle will not be monotonic. That’s why we think that the current rates are too high and could limit the current improvement.

There are still areas of shades in the current dynamics. The inflation rate is too low even after the ECB new forecasts . An inflation rate at 0.3% in 2015 (ECB new forecast) is still very far from the 2% target. This means that monetary policy have to remain accommodative. The core inflation rate was at 0.9% in May because of strong base effect that will disappear in June. It will go lower as there are still no pressures on the economic system to push prices on the upside.

To have a clearer view on economic prospects, stronger capital expenditures are needed. That will be the catalyst that will be able to push the economy on a higher and sustainable trajectory. Currently investment is still too low.

Beside the Euro Area characteristics, we have to keep in mind that the world economy is not performing well and that the world trade momentum remains low. As a consequence, the Eurozone mustn’t expect a rapid and strong improvement from outside to converge to a more robust situation. It has to create its own dynamics and for that there is still a need for an accommodative monetary policy in the foreseeable future.

We mustn’t have a deterministic view of the economy as if everything was already played. We have to keep in mind that “markets” were a strong support for austerity policies and they were persuaded that it was the clue for a stronger growth. A rapid reduction of public deficit was seen as a necessary condition for growth. The experience has shown that it was not the case as the Euro Area has recorded a long recession, its longest recession. We have to escape this way of thinking. There are still risks in our profile.

The ECB needs to have a long-lasting action in order to support the recovery in a more autonomous framework. In the short-term, on rates, there will be a imbalanced situation during the summer as bonds issuance net of the ECB purchases will be negative (It was strongly positive in May and can also be a source of explanation). Interest rates should then go lower this summer and be at a level that will be more consistent with growth, inflation and the uncertainty that still exists in the Euro Area.