The significant upward revision of retail sales in the US in March and April and the strong increase in May forced to revise the profile of American cycle in Q2.

The data published previously gave the signal of a poor rebound in households’ spending after the low figure for the first quarter (0.6% annualized rate). This figure has been revised upwards to 1% and especially its profile allows a more robust profile and a higher trajectory for the 2nd quarter.

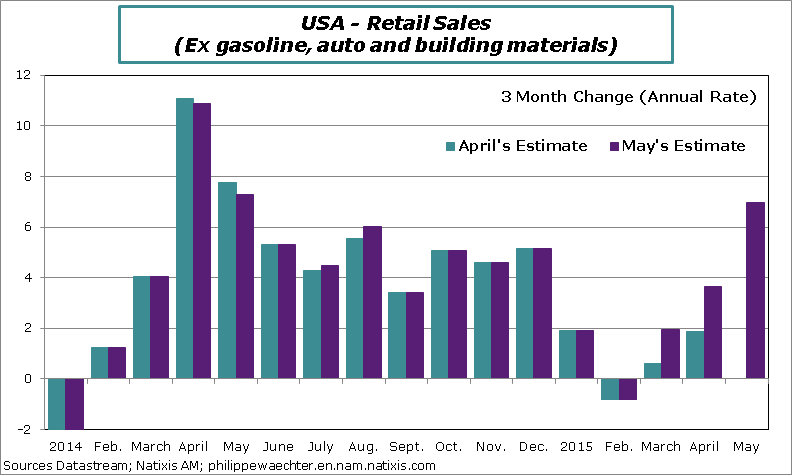

This is shown by the graph below. It represents the 3-month change in retail sales excluding autos, gasoline and building materials. This indicator is used in the construction of consumer goods expenditures by the Bureau of Economic Analysis in the GDP estimates.

The May 2015 figure is now comparable to that of May 2014. Consequently and given the weight of consumption in GDP, Q2 growth expectations will inevitably be revised upwards. This is what the Atlanta Fed has already done, going from 1.1% annualized rate to 1.9% after the publication of retail sales.

Philippe Waechter's blog My french blog