The Greek crisis, with its uncertainties related to the place of Greece within Europe and with the constraints associated to the banking sector shutdown since the beginning of July, has provoked a deep drop in economic activity.

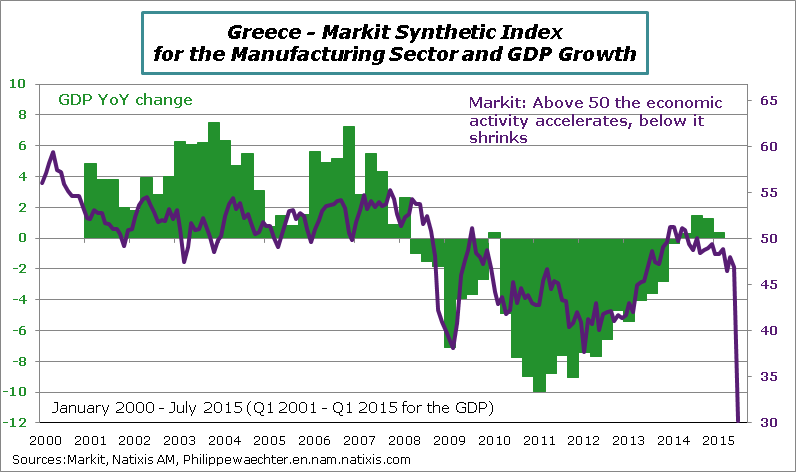

The Markit survey for July shows a synthetic index at 30.2 for the manufacturing sector. An index below 50 implies a reduction in economic activity. The index is at its lowest level ever, much lower than during the 2008/2009 recession. That’s what we see on the graph below. The impact on the GDP profile will be dramatic in the third quarter.

Three remarks

The Markit index will not remain at 30.2 as in July. It will probably converge to 50 rapidly. This doesn’t mean that there is a rapid and strong improvement of the economic situation but simply that it stabilizes.(an index at 50 means that economic activity is stable from one month to the other). An index below but converging to 50 will mean that , in trend, the situation is stabilizing progressively.

Comparing the current situation with 2008/2010 is fallacious. At this moment, every country, from the USA to China and Europe, had a plan to reshuffle the economic activity. This is no longer the case. OK the European growth is a bit stronger but it’s not sufficient. And the world trade momentum is currently not strong enough to expect a strong spillover on the Greek economy (see here). This means that Greece will have to find sources of growth in its own economy, in its internal market. But with a 10 points hike for its VAT rate and lower pensions we cannot expect a strong rebound in internal demand. As there is a target of a primary surplus at 3.5% of GDP in 2018 we can expect that recessions forces are here to stay.

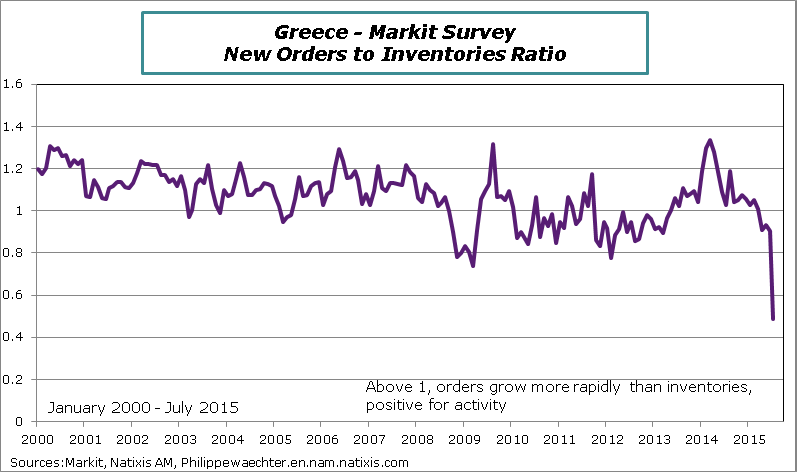

In the short-term, the most important point would be a stronger banking sector. The ECB must relax its constraints on liquidity. By maintaining the level of liquidity at the beginning of July (after the referendum announcement) the ECB has created an uncertain environment. Usually in a bank run, the central bank must provide liquidity to avoid a kind of “sudden stop” of the banking sector with its negative effects on the economy. By reducing liquidity to the Greek banking system, the ECB has provoked a confidence crisis.

The EUR 25bn of recapitalization for the banking sector (with 10bn in August) would create conditions for the convergence to a more balance banking system.

The retreat in economic activity in July will be persistent and with a negative effect on employment. The 3rd bailout plan that is currently discussed must be accompanied by measures to support growth. They are not there yet. As a consequence, a Grexit is not yet a story of the past.