The Federal Reserve has kept unchanged its main interest rate in the corridor [0.25; 0.50%]. It will continue to reinvest the proceeds of its portfolio.

5 points to keep in mind

- In the press release the main change is related to the absence of reference to the global economy. It’s no more a source of break in the short term. The message on the economy is focused on the domestic side and on its momentum

- On this point the Fed is not worried. The central bank notices that employment and consumers’ real income follow strong trajectories. Nevertheless there are remarks on the low dynamics of investment and net exports.

- The balance of risks on growth and on inflation is not mentioned. The risk of a break in the economic momentum has been reduced in association with the withdrawal of references to the global context.

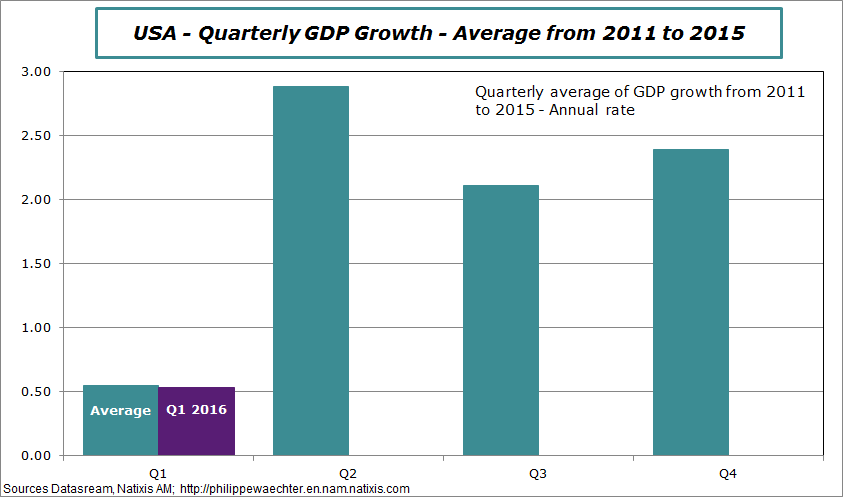

- The Fed doesn’t give signals on a possible rate hike at its next meeting in June. There is no specific message focused on June meeting, contrary to what was seen in October’s press release before the December meeting during which the Fed increased its main rate. Nevertheless the door remains open if it’s necessary. I doubt that the economic momentum will improve rapidly. I’m not convinced by the systematic catch-up of the second quarter (see the graph at the bottom of the post)

- There will be another question in June. The global environment will probably be more complicated. The Fed’s next meeting will be on June 14th and 15th. This will be just before the Brexit referendum (June 23rd). Nobody knows the issue of the referendum but it could create uncertainty in the UK and in Europe. Moreover we will also have general elections in Spain (before June 26 probably), the second round in Austrian presidential elections and we don’t know yet how the Greek issue will be solved. In other words, if systemic uncertainty grows on Europe, US assets could be perceived as safe haven. Therefore, in this environment the Fed could keep its rate unchanged at its June meeting.