The Federal Reserve has maintained its main interest rate in the corridor [0.25; 0.50%] at its July meeting. Last December it increased it by 25 basis points from [0; 0.25%].

In the press release (see here) published after the meeting, the US central bank has just added a sentence in the part related to its action and to monetary policy (see here). It said that “Near-term risks to the economic outlook have diminished”.

In other words, headwinds are no more a strong drag for economic growth. This is notably the case for external elements as the Brexit referendum and China.

This doesn’t mean that the Fed will normalize its monetary strategy rapidly even if its perception on the economic activity is more positive (this is the first part of the press release). There are no worries about a rapid spike of the inflation rate. Pressures on wages are still limited.

I maintain the idea that the Fed may hike its interest rate may be once, not more but the probability of 0 hike is high.

Two remarks on the Fed’s monetary policy

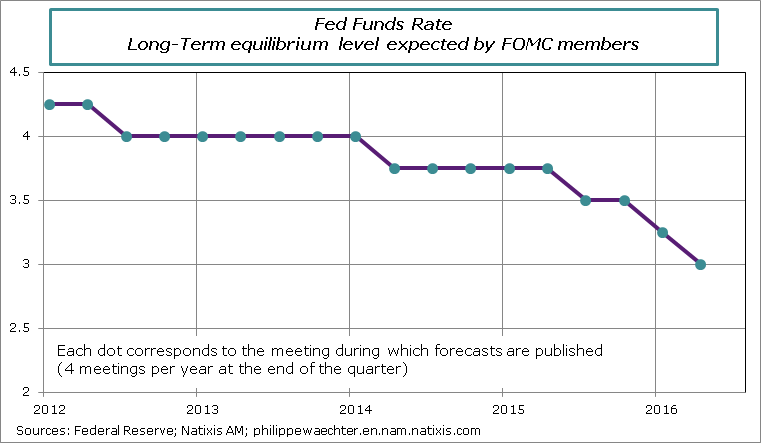

The long-term equilibrium level for the fed fund rate.

The FOMC members consider that the long-term equilibrium level for the fed fund rate is now 3%. It’s way below the level of 4.25% that was expected at the beginning of 2012. The Fed’s perception of the business cycle has dramatically changed. The US central bank doesn’t believe anymore that it will converge to its pre-crisis profile. The expected trajectory of the US economy is much lower now. The framework that prevailed before the crisis is no longer the good one but the Fed says us that a new framework hasn’t been found yet. The Fed lacks of certainties

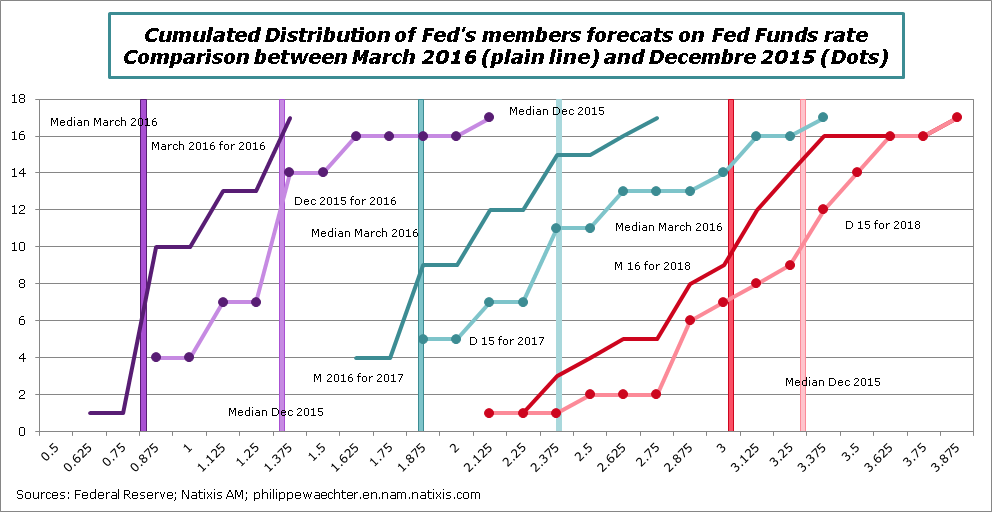

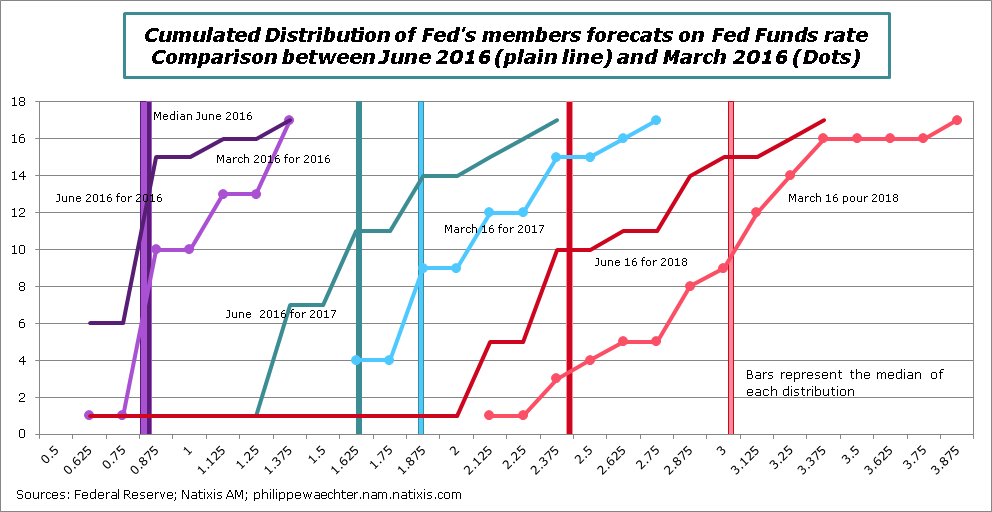

The second remark is on the rapid change in expectations by the FOMC members. The 2 graphs below show the evolutions of FOMC members for the fed fund rate in 2016, 2017 and 2018. They show the cumulated distribution in December 2015, March 2016 and June 2016. I show also the median for each distribution (the median in the above graph is the long-term equilibrium to which there will be convergence in the long-term).

Between December 2015 (meeting during which the Fed increased its rate) and March 2016 expectations strongly shifted on the left for the three maturities. The shift was repeated in June for 2017 and 2018. Expected rates now are way below those anticipated in December. The Fed clearly lacks of certainties.

Philippe Waechter's blog My french blog