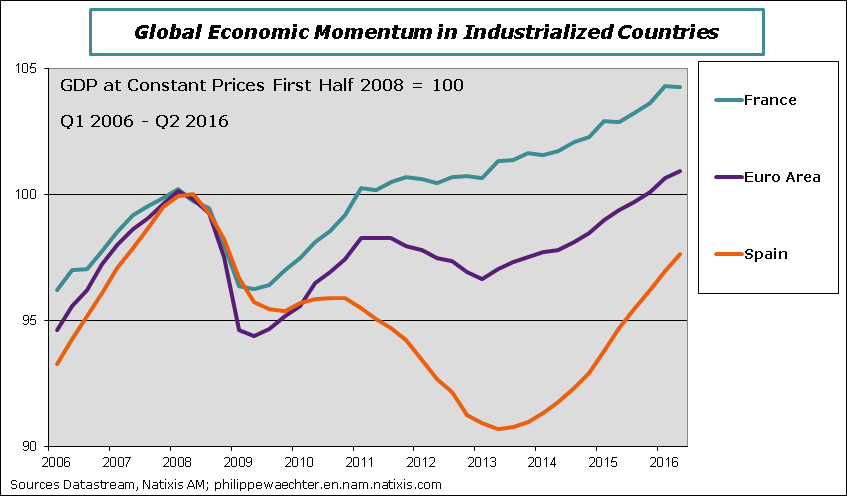

The GDP growth number for the Euro Area was halved in the second quarter when compared to the first. During the first three months of the year, GDP was up by 2.2% at annual rate. During spring it was up by a mere 1.2%. For France, GDP growth went from +2.7% in the first quarter to -0.2% in the second. In Spain, growth momentum is still buoyant at 2.8% after 3.1% during the first three months of the year.

The carry over for 2016 at the end of the second quarter is 1.3% for the Eurozone, 1.1% for France and 2.6% for Spain.

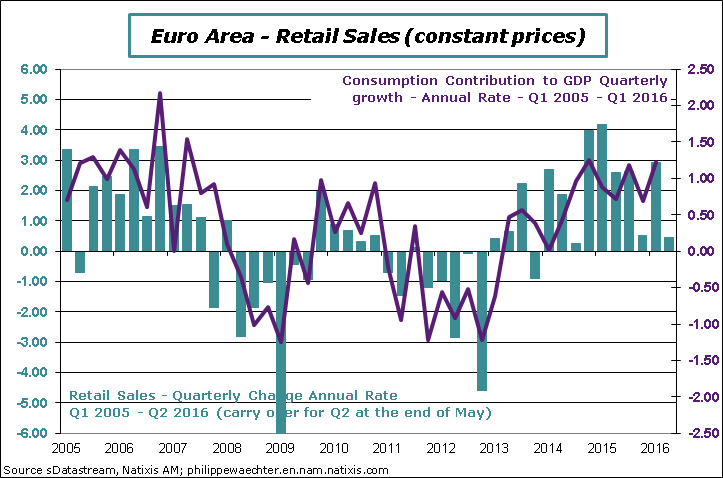

The main reason of the slowdown in Europe is associated with a lower momentum with the internal private demand. This shows that the trend is weak. We don’t have the detail yet for the Euro Area but the households’ consumption follows a weaker dynamics in Q2 and corporate investment was probably lower if we look at what has happened in France.

A second remark is that the Spanish growth momentum is still very strong. The GDP level is still below its pre-crisis level but its recent trajectory is impressive. For France, there is a sudden stop.

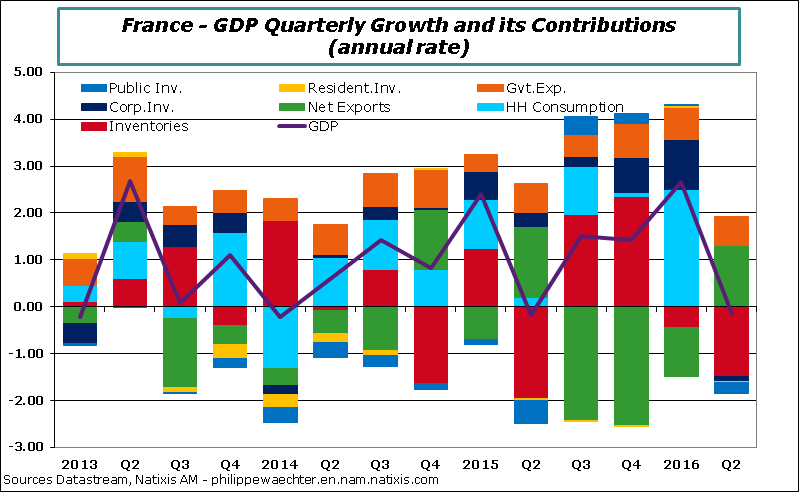

Details for France show that it is the internal private demand that collapsed during spring. Its contribution was +3.6% during the first quarter, it is negative at -0.1% during the second quarter. Households’ consumption has had a contribution that was null in Q2 after 2.5% in Q1 and the corporate investment contribution to growth plunged from 1.1% to -0.1%.

Government expenditures and net exports have had a positive contribution. Just keep in mind that the net export contribution reflects a more rapid fall in imports than in exports; not a good situation.

For the Eurozone we can expect 1.6% growth for 2016 and circa 3% for Spain. In France the government target at 1.5% is at risk. To converge to this target a 2.2% growth is necessary in Q3 and Q4. It’s probably too high.

To revive internal demand the accent must be put on corporate investment. I consider that consumption will rebound after a temporary drop in Q2.

The point is that the current economic environment is at risk after the Brexit and the political situation in Europe and specifically in France after the attacks is not clear. Companies could postpone their investment as far as uncertainty is important. So there is a role here for the European Union to create an impulse in order to reduce uncertainty. Instead trade within Europe will slow and the business cycle peak could be behind us. That’s not what we had in mind. There is an important role for every government and to the commission to improve the environment rapidly.

Philippe Waechter's blog My french blog