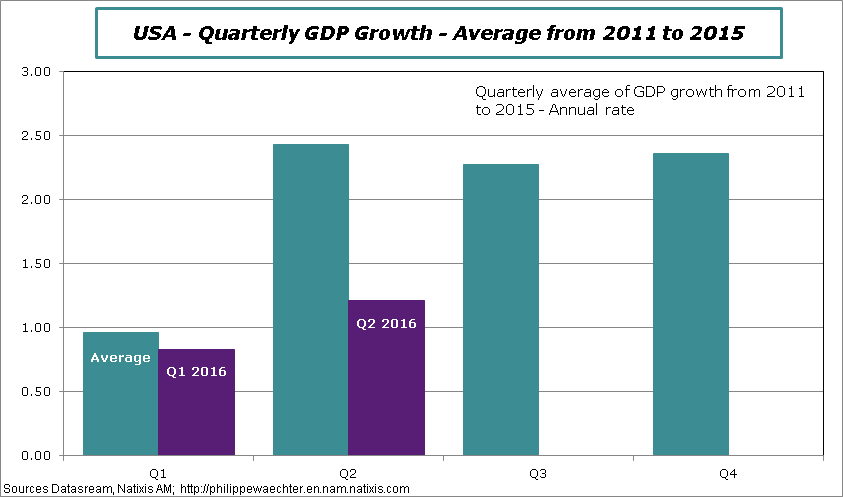

What a shock!!! GDP growth for the second quarter was just up by 1.2% after 0.8% during the first three months of 2016.

The comfortable framework that was used after the publication of the first quarter no longer holds. The expected rebound is not there as the graph below shows.

This may put at risk the forecast for 2016. It the Q2 growth figure is maintained (in the second and third estimates), the growth number for the year could converge to 1.5%. The carry over is a mere 1% for 2016 at the end of the second quarter. For the whole year, 1.5% will be attained if growth is 2.4% in the third and the fourth quarters. This figure (2.4%) is close to what was seen on average for the last five years. This would lead, this year, to a simple 1.5%. Not that strong.

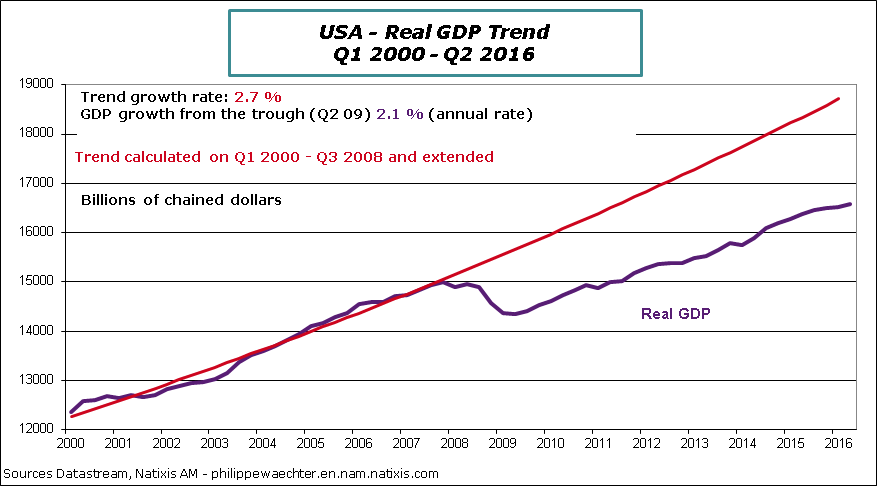

It’s interesting to see the profile of the GDP level. There is no catch-up but a divergence with the pre-crisis trend.

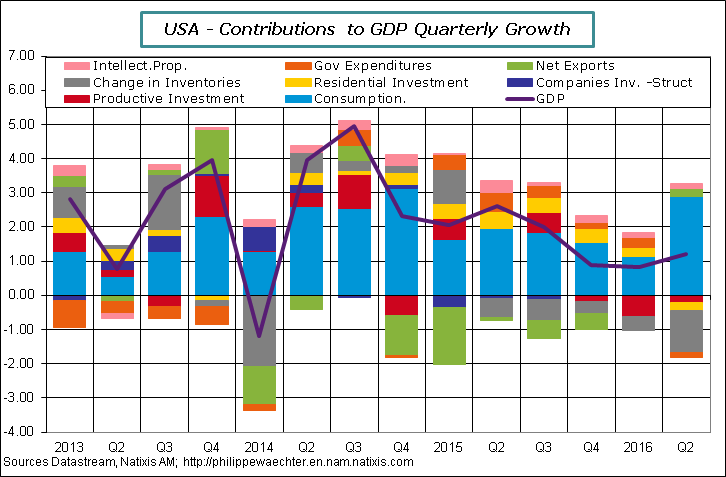

The analysis of contributions to GDP growth is amazing. The sole growth driver was households’ consumption. Investments whether corporate or residential were creeping downward and government expenditures are almost neutral. When we look at capital goods orders the probability is high that there will be no rebound in productive investment in coming months.

What can we think of this situation?

1 – Will consumption be able to continue at the same pace? Probably not. Since 2013 the consumption contribution to growth was 1.9% on average. It was 2.9% during spring. Can we see a structural change that would keep households expenditures at this level? Wages are not growing rapidly enough to allow that.

2 – The main question is about investment. At the eve of an important presidential election will companies invest a lot?

This question is new as there are two very different programs when comparing Hillary and Donald. The economic framework would be different depending on the new president (that’s new). What could happen if the US limits and reduces its contribution as a provider of global public goods? In other words, we have to imagine that new discussions on existing trade agreements and may be the withdrawal from the World Trade Organization (WTO), as it has been proposed by Trump, could create uncertainty. Incentives for companies to postpone their investments would be important in that case. It’s not judgemental, it is just that the current framework would no longer work. If all this create negative incentives for investment we have to expect a GDP growth below 1.5% and a lower employment momentum.

3 – We can’t imagine that the Fed could change its monetary policy stance in this type of environment. So no monetary policy normalization is expected this year.

Philippe Waechter's blog My french blog