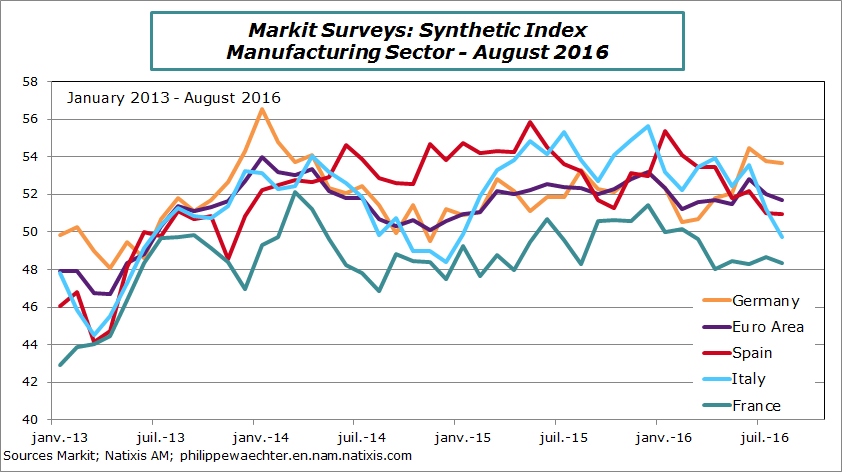

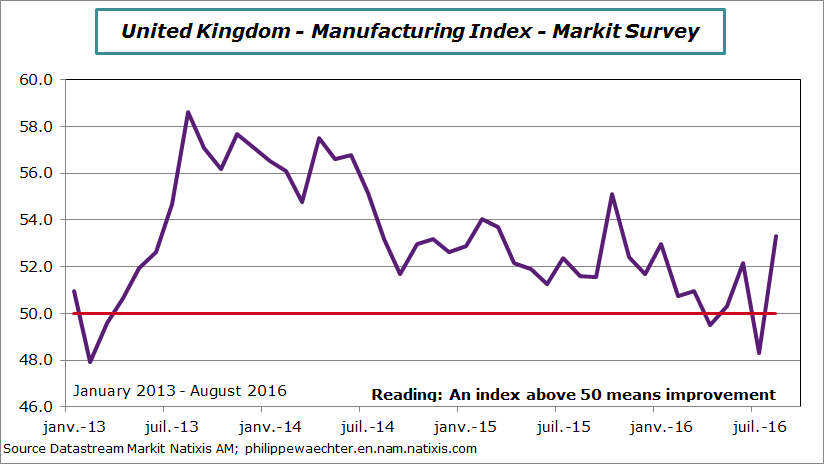

The manufacturing sector momentum is faltering in the Euro Area in August but there is a real rebound in the United Kingdom.

The synthetic index for the Eurozone was at 51.7 in August after a local peak at 52.8 last June. In the UK, the index is at 53.3 way above the July figure of 48.3 that followed the referendum on Brexit.

The first graph shows indices in the main countries of the Euro Area. Germany is robust with an index close to 54 (53.6). But there is a significant drop of the Italian index which now is below the threshold of 50. It’s the first time since January 2015. The Spanish index is at 51 for the second month in a row. Such a weakness hasn’t been seen since the end of 2013. France is in a “comfortable place” under the threshold of 50 since March 2016.

We see that France has not been able to follow the Eurozone momentum since at least the beginning of 2014. It must be a concern in France at the eve of the presidential election.

In the United Kingdom, the index was strongly up in August. This was also seen yesterday with the consumer confidence index. The Brexit procedure has not started yet and the expected negative impact it could bring to the UK economy are not seen yet (see here and here).

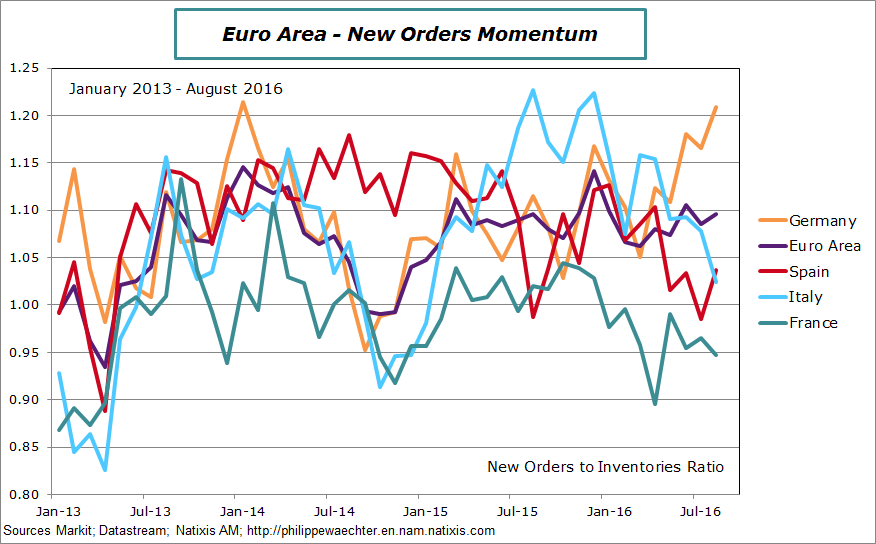

The immediate future is on a limited dynamics except in Germany. The New orders to Inventories ratio is high in Germany and this will be a support for the economic activity. But it is no longer the case for Italy and for Spain even if for this latter there is a rebound in August. The ratio in France is too low.

This means that the flow of orders is almost matched by inventories and it will not provoke an extra production. That’s the problem for Italy, France and Spain.

For the Euro Area, the influence of Germany is important.

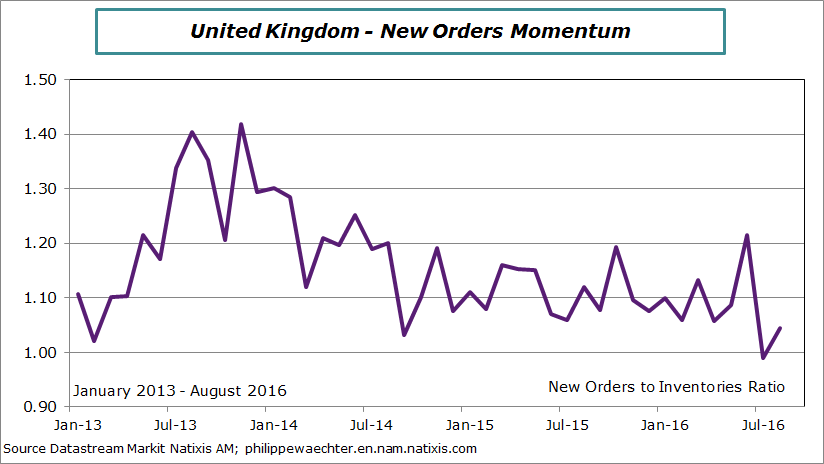

In the UK, the magnitude of the rebound in the ratio is lower than on the synthetic index. Its level is back to early 2013. Not sure we can expect a strong and long lasting improvement.

What is worrisome for the Euro Area is the absence of endogenous improvement. We had in mind that a stronger competitiveness would create a self sustained cycle. It doesn’t seem to be the case. The economy suffers from headwinds and is not able to improve by itself. That’s why we talk a lot of a more proactive fiscal policy in order to support domestic demand. Without such an impulse the risk is to follow a weak trend putting growth forecasts at risks in coming months.

Philippe Waechter's blog My french blog