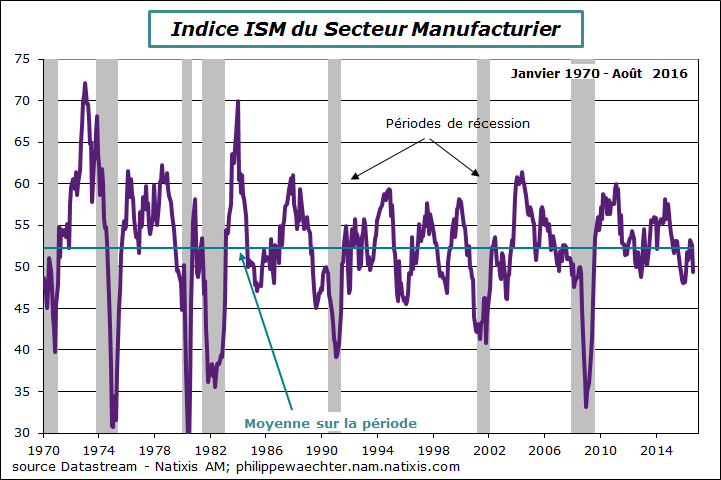

The synthetic index of the ISM survey in the manufacturing sector crashed in August. It is again below the 50 threshold. We can imagine that the recent improvement was temporary as the index was below 50 from October 2015 to February 2016. The August 2016 level is way below its historical average.

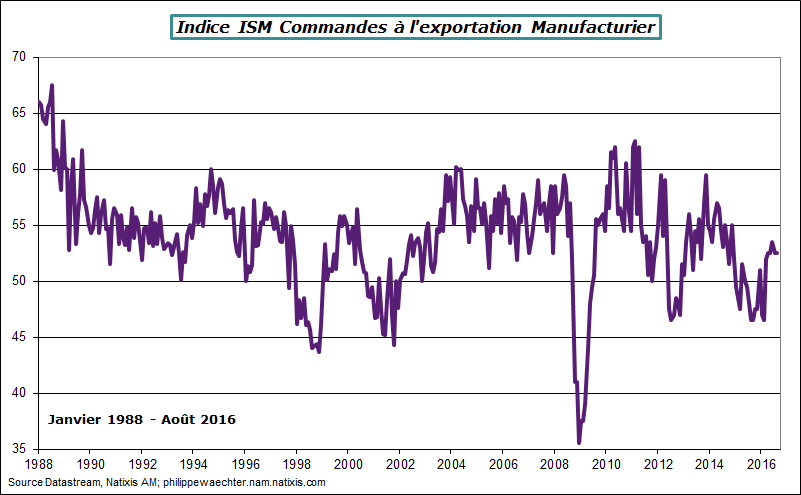

The drop in the ISM index reflects mainly the fragility of the domestic market as the new export orders index is stable above 50. This drop may be temporary but it shows that the American economic is not able to rebound strongly and permanently. That’s worrisome

I’m not sure that the US economy is close to the targets defined by the Federal Reserve and mentioned recently by Janet Yellen and Stan Fisher. We will still have to wait before the Fed hikes its main rate if it does it.

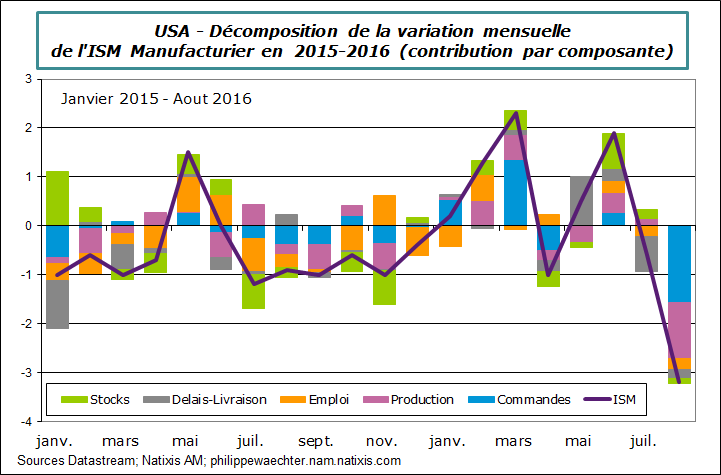

The retreat of the ISM index comes from every component of the index. But New orders and production were the main contributors by far.

The slower momentum of the New Orders index doesn’t come from a negative external shock as the New Export Orders index is stable

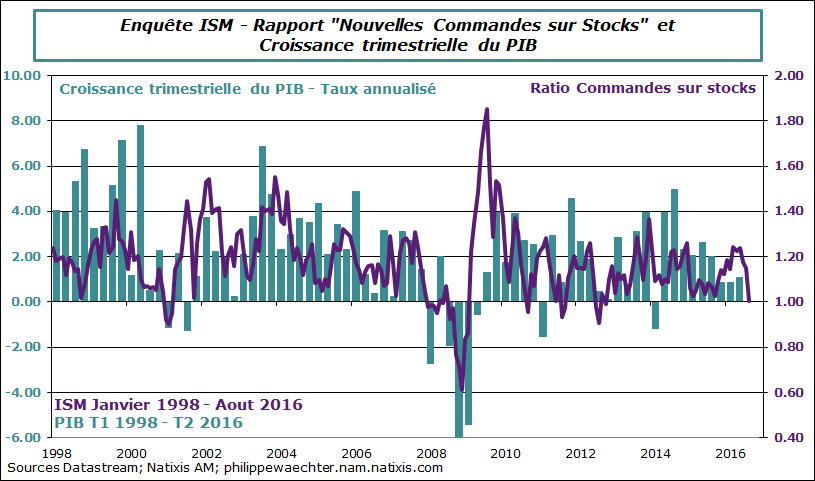

That’s the reason why the downward shift of the New Orders to Inventories ratio is an issue. It shows that the domestic momentum is low. It could be problematic as the two series below are consistent and the lower ratio could be a negative shock on the GDP

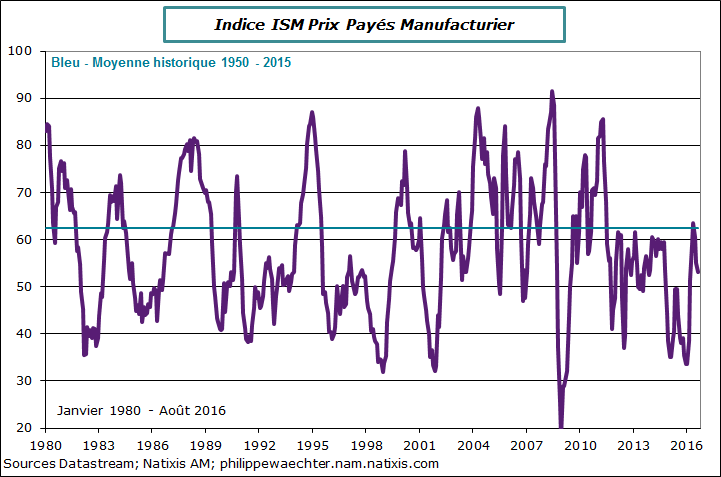

No pressures on prices

Philippe Waechter's blog My french blog