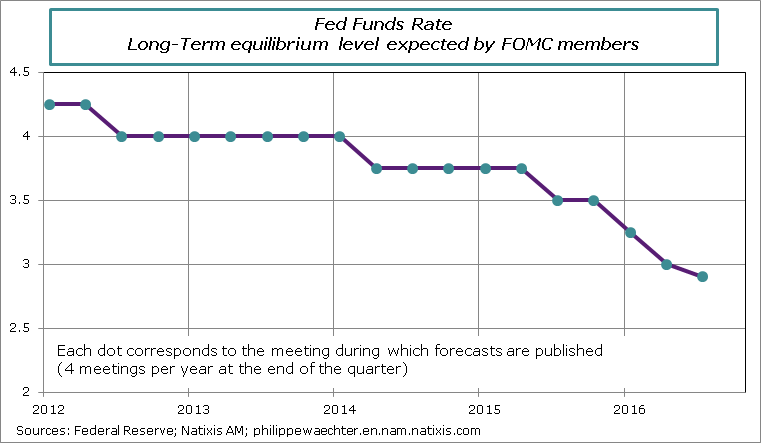

The Federal Reserve continue to think that the long term value of the fed funds follows a downward adjustment trend. This reflects an almost pessimistic perception of the US economic trend even if no recession is expected.

In the short run the Fed expects to being able to increase its rate in December 2016 without creating damage on the economy. The US central bank wants to catch some degree of freedom in the way it manages its monetary strategy. But a hike in December doesn’t mean a strong upward trend for 2017.

The Fed’s message is almost pessimistic on the long run as it expects the level of its rate (the fed funds rate) will follow a downward adjustment. Last June this long term level was anticipated as being at 3%. In September it is expected at 2.9%.

The Federal Reserve thinks less and less that the economic cycle will converge to its pre-crisis features. It’s important as it reflects a kind of secular stagnation with low growth and limited inflation in the long-term. If we follow the Fed’s forecasts then we see that the nominal GDP growth is never expected to be above 4% Before 2007 it was fluctuating between 4 and 6%. The Fed thinks that the US economy will not go back to this corridor and that’s the main reason for low interest rates.

This corresponds to the fact that the equilibrium real interest rate is perceived as lower than in the past. This allows lower adjustment on the upside and then on the downside in case of recession. Saying this point differently, the Fed will not have, in the business cycle, to increase and then to drop its interest rate with the same magnitude than in the past because the real equilibrium interest rate is lower than in the past. This can explain partly this low long-term level of the fed funds. (On this monetary strategy see the Fed’s working paper here and the critics by Krugman, an interesting paper from the Bank of England must be read on the lower real equilibrium interest rate)

In the short run, the Fed is almost optimistic on the economic activity. It expects a stronger momentum in 2017 than in 2016. That’s why the central bank wants to catch some degree of freedom in the management of its monetary policy. The FOMC members anticipate the possibility of a rate hike at the December meeting. The fed funds rate would be up by 25bp and the corridor will then go from [0.25; 0.50%] to [0.5; 0.75%].

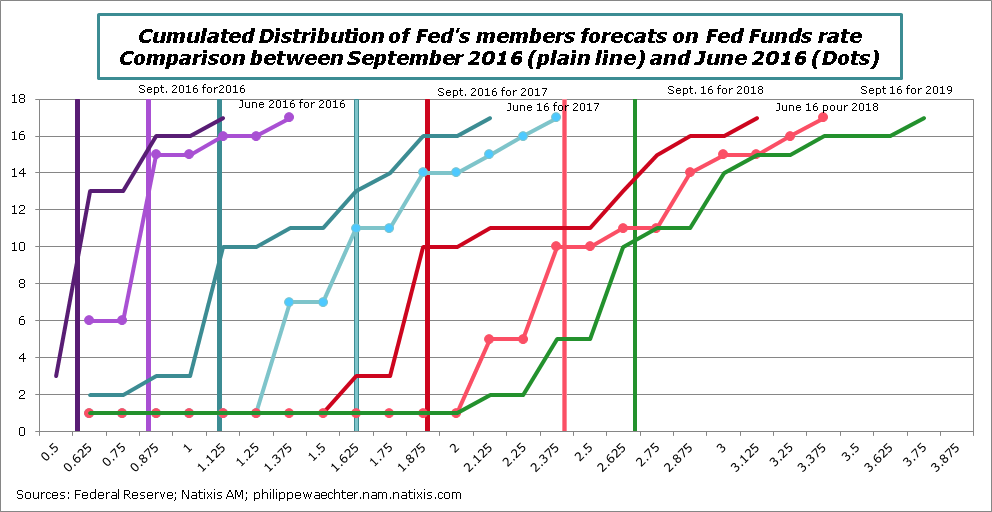

This can be seen on the graph below which shows the distribution of the dots graph (see the first line on the left). But it is also written in the press release: “The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives“(italics are mine).

A rate hike in December has a strong probability but will have the same flower than the previous hike of December 2015. It won’t be recurrent. The Fed’s forward guidance will be weaker than last year. In December 2015 there were an increase in the fed funds rate and also strong expectations on the Fed’s behavior in 2016. The US central bank was expected to increase its rate by 4 times. It was a source of volatility and large fluctuations on financial market at the beginning of the year. We had to wait a speech from Janet Yellen in February to reduce these expectations to almost nothing. This time the forward guidance will be weaker. When we look at current expectations, the Fed could go up twice in 2017. I’m not sure that the Fed will be committed by these anticipations.

The Fed wants to gain some degree of freedom in the management of its monetary policy that the reason why it wants to have higher rates. Nevertheless the pace of increase will remain slow and with a with periodicity (currently once a year)

On the graph we see that the distribution is translating on the left meaning that expected rates in the future are lower. We can see that with the strong translation of the median of each distribution

Philippe Waechter's blog My french blog