The Euro Area inflation rate jumped at 1.8% in January after 1.1% in December 2016.

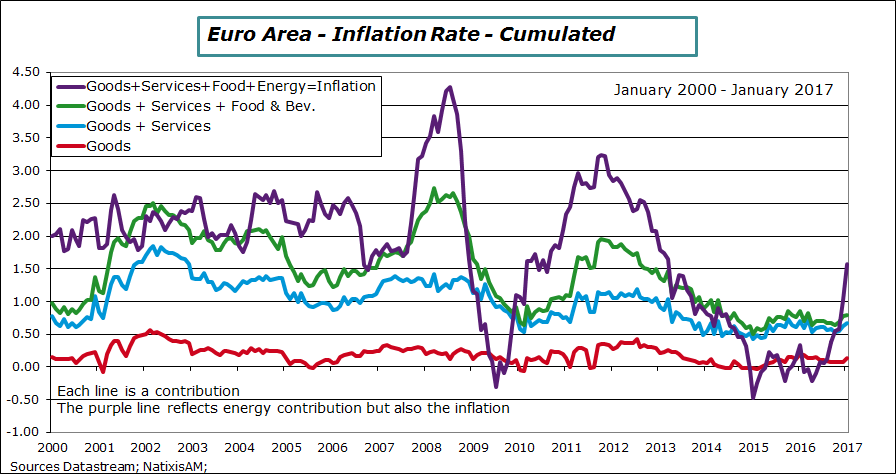

The graph below shows the cumulated contributions to the inflation rate. It can be read in the following manner: the red line is the goods price contribution to the inflation rate; the blue line is the sum of the red line plus the services price contribution to the inflation rate; the green line is the sum of the blue line and of the food price contribution to the inflation rate. Alle these prices represent more than 90% of the Consumer Price Index. The green line is almost stable; its range is 0.6% – 0.85% since mid-2014. There is no surge in inflation through all these prices.

The last line, the purple one, is the sum of the green line and of the energy price contribution to the inflation rate. The purple line is by construction the inflation rate. The picture is now very different. The inflation rate is volatile and was sometime negative in 2015 and 2016. It is now at 1.8% and this represents the impact of the oil price.

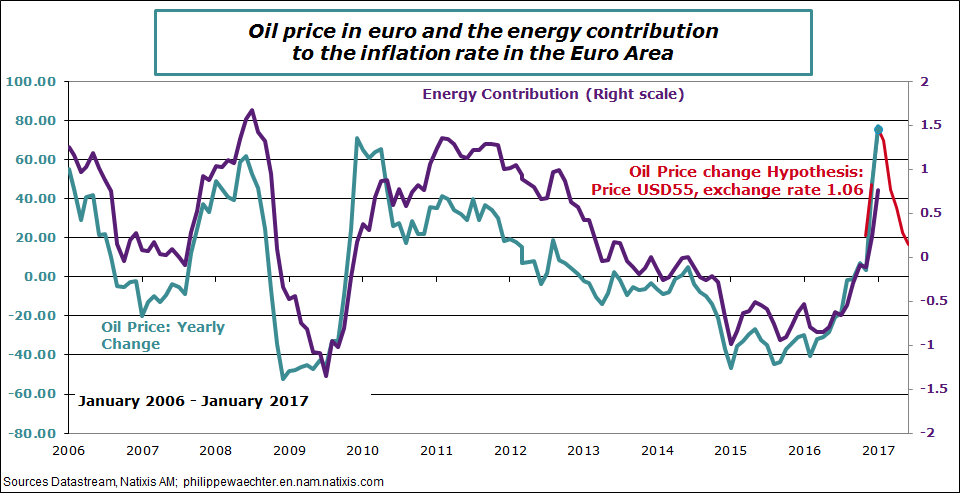

With the hypothesis that the oil price remains at USD 55 in the coming months, then the peak of the oil price change was seen in January. That’s what the second graph shows. The blue line is the oil price annual change in euro. The red line is the change until June 2017 if the price remains at USD 55 with a euro exchange rate at 1.06.

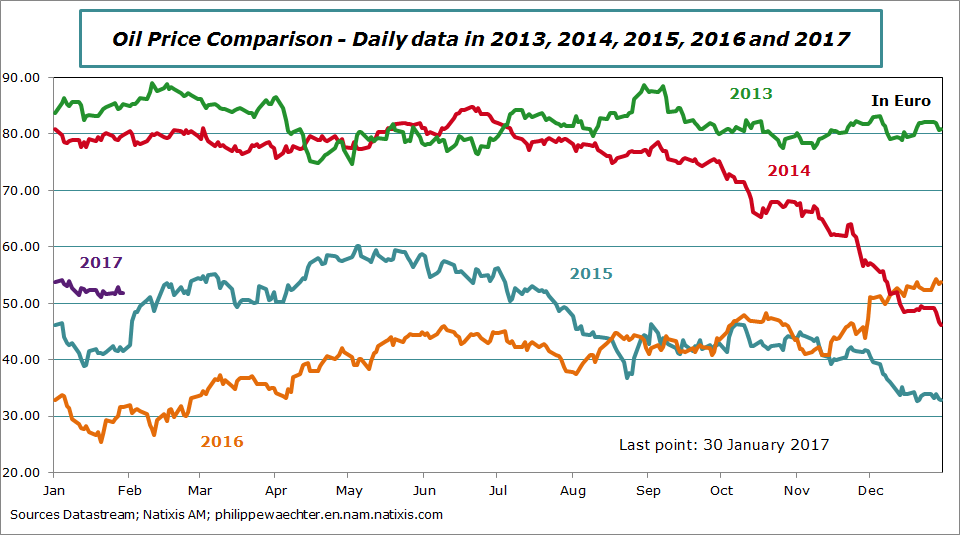

On the third graph we can see the oil price profile year after year. We see that 2017 is very high compared to the same period in 2016. That’s the reason of this positive contribution from the oil price. With a oil price at USD 55 and a euro at 1.06, then the price in euro is at 51.8. In January it was at €52.4. Therefore, we see on the graph that the convergence to 51.8€ will lead to a smaller oil price contribution.

There is lag in the CPI and probably the energy contribution is not at its peak yet. Therefore, the inflation rate could go higher in February. After it will slowdown converging to the core inflation rate at 0.9%

We see here the reason of stability of the monetary policy stance from the ECB. The spike in the inflation is transitory.

In most countries the inflation rate acceleration has the same roots than in the Eurozone. It’s only a matter of oil price. I believe that the oil price will remain in a corridor around USD 55, then inflation rates in every country will slowdown. Then it will cool pressures on long term interest rates.

The last graph compares the oil price year after year. The discrepancy between 2016 ans 2015 was high at the end of 2016. This is still the case for 2017 compared to 2016 in January. This will vanish progressively.

Philippe Waechter's blog My french blog