The current acceleration of the inflation rate creates a complex situation in the United Kingdom as it weighs on households’ purchasing power.

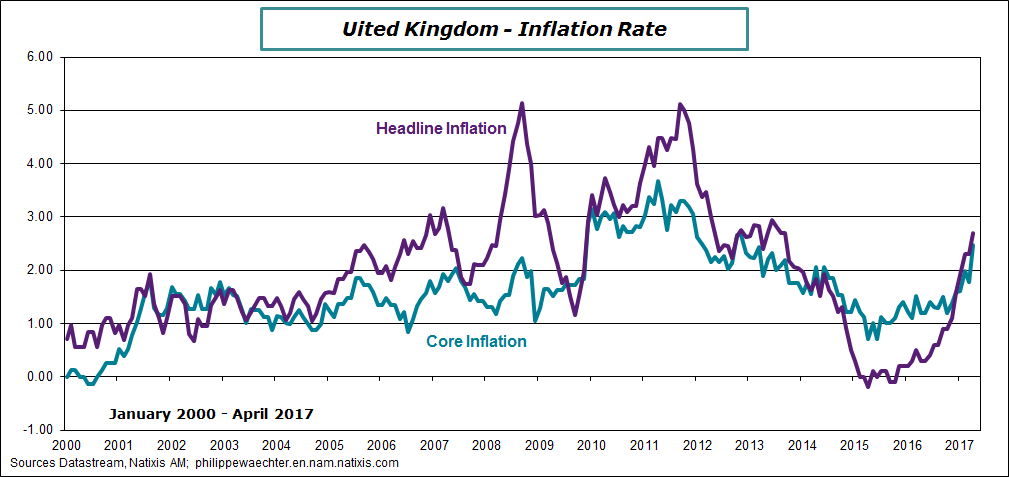

In April the inflation rate was at 2.7% and the core inflation rate was at 2.5%. The inflation rate has not been so high since the fall of 2013 and november 2012 for the core rate. This is mainly the impact of the depreciation of the currency after last june referendum on Brexit.

A year ago the inflation rate was at 0.3% and the core inflation rate was at 1.2%. This latter magnitude is worrisome as the economy is not growing more rapidly.

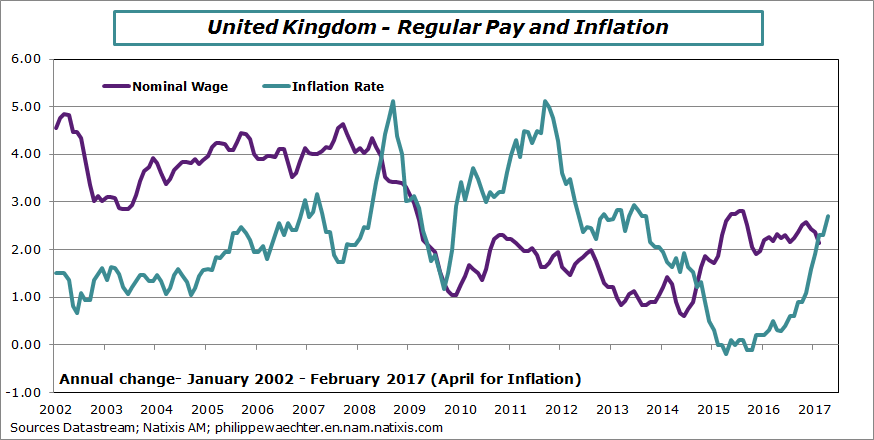

The main issue is that wages momentum will not follow the inflation profile.

My expectation is that Brexit will have a persistent and negative impact on the economic activity and on employment. (the main issue of the negotiation between the UK and the UE is the statute of European non British people living in the UK. They have been a strong source of momentum on the labor market during the recovery since 2014)

The exit from the single market must be interpreted as a deep change in trade rules between the UK and the rest of the world notably with the UE countries. My guess is that this change in rules will create uncertainty which will be negative for trade and economic activity. This will have a impact on the labor market and on wages. We can expect that wages will not grow while the inflation rate will remain above the 2% target of the BoE. This will be negative for the purchasing power.

Theresa May and the Bank of ENgland are the only two who think that Brexit will just be a temporary phenomena and that the UK economy will be better off after.

Philippe Waechter's blog My french blog