Interesting time in the UK as the Bank of England is facing an important arbitrage. There are potentially two types of shocks in the UK.

One is associated with the consequence of the Brexit on the growth momentum. And the other reflects higher inflation rate (above the 2% target).

The BoE meeting this morning has shown that MPC members may have very different views on monetary policy drivers. At this meeting the vote was 5 for rate stability and 3 for higher rates.

Just a reminder: the BoE has reduced its main rate to 0.25% last July just after the referendum on Brexit in order to accommodate the possible negative risk associated with the referendum result.

Two graphs on recent data can illustrate the MPC dilemma.

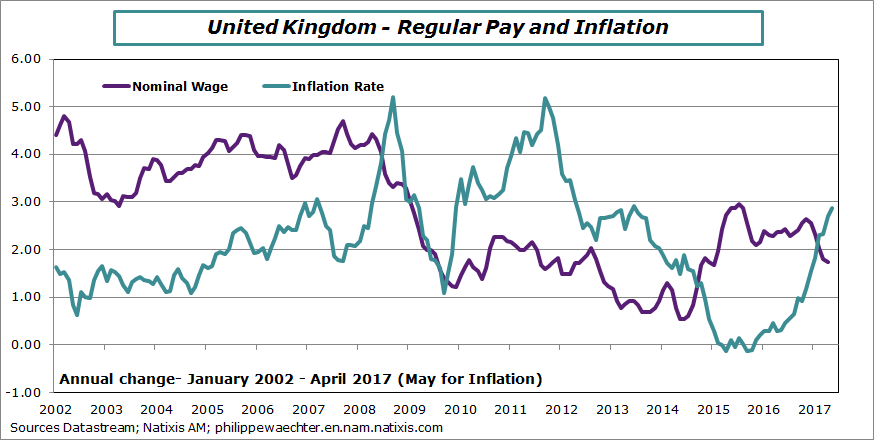

The first compares earnings and inflation. It shows a spike in the inflation rate but also a drop in nominal wage. Purchasing power is now trending down in negative territory.

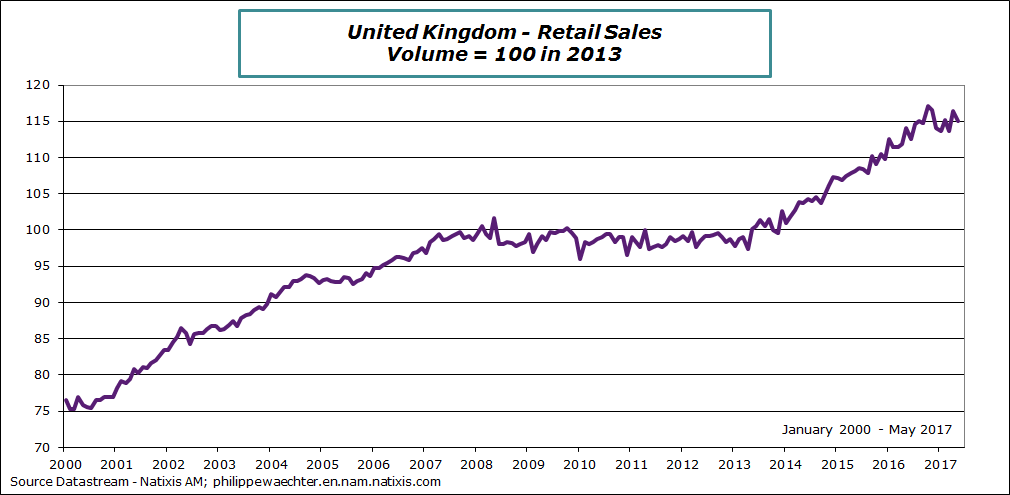

The second graph is on retail sales. We clearly see that since the end of last year there is a persistent change in trend. It will have an impact on consumption profile and on growth trend

Negative real wage trend and retail sales reflect a negative shock on the economic activity momentum. Inflation at 2.9% in May (above BoE expectations) could go higher.

Is it preferable to fight inflation way above the 2% target or should we accommodate with higher inflation trying to boost internal demand?

Moreover the context is one of political uncertainty (hung parliament) and before the effective start of the Brexit negotiation with the EU (19 June).

The Federal Reserve, the ECB and even the BoE before said that monetary policy was asymmetrical and that short term risk was on the economic activity momentum. The inflation rate could be temporary higher due to a lower sterling. Therefore it’s better to keep monetary policy unchanged in order to avoid taking high risk on growth.

Brexit will be a persistent negative shock and it’s not necessary to increase constraints on the economy. Fighting inflation is just a way to say that the Brexit shock will only be short lived. For different reasons that’s not what I have in mind (see here). Brexit will change rules for the UK economy implying higher and persistent uncertainty. It’s not the moment to limit the capacity of the economy to adjust and to adapt to this new environment. It’s better to keep interest rates low.

NB Kristin Forbes who is an external member of the MPC will leave in June 2017. This was her last meeting and she will go back to the MIT. Before this meeting she was the only one to vote for higher interest rates.

Philippe Waechter's blog My french blog