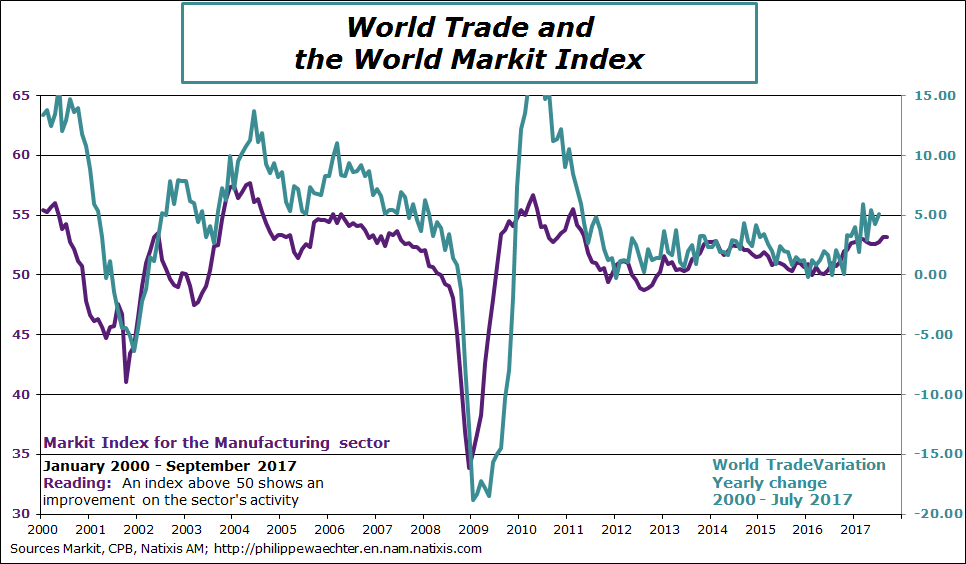

The world trade rebound will continue in the forthcoming months. That’s what the graph between world trade growth and the Markit index suggests. The robust level of the manufacturing index is consistent with a stronger momentum on world trade.

Every region of the world shows an improvement in the manufacturing activity according to Markit. This will support a balanced growth scheme at the world level.A higher Markit index will boost trade and therefore world growth.

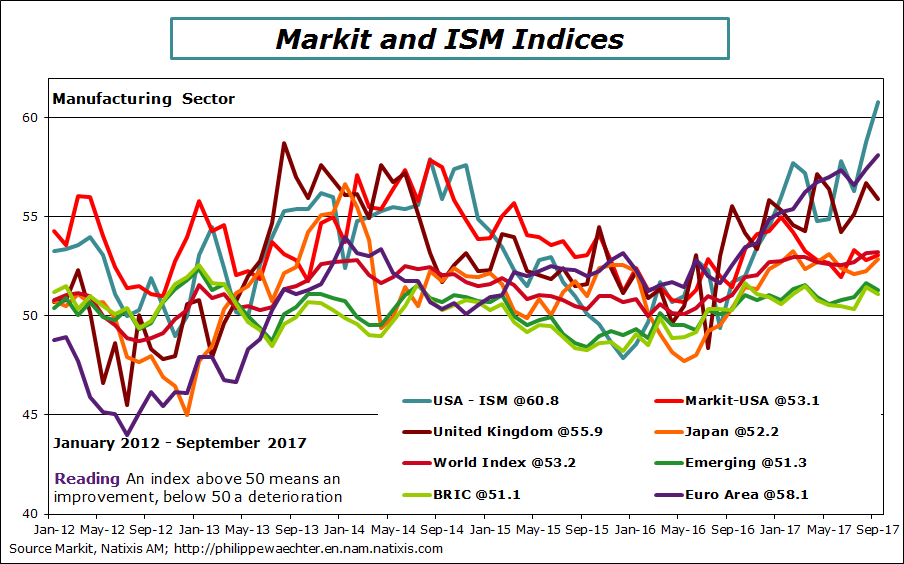

The momentum at the world level is strong and robust. The Euro Area is in a catchup period with a high momentum on new orders and on employment. The business cycle is virtuous. There are reasons to be optimistic on the Eurozone environment.

The situation is more specific in the US after hurricanes. The most important contributor to the ISM increase is the item on delivery. There were strong needs and it was difficult to deliver due to disruption and delays.

The situation is robust in Japan and the Brits are still optimistic on their activity.

Indices for emerging countries are robust. The situation is good for emerging countries: growth in developed countries + higher commodity prices + growth in China is steady + good financial conditions (the impact of Fed’s hikes on interest rates have been very limited)

The marginal slowdown is associated with a marginally lower index in China.