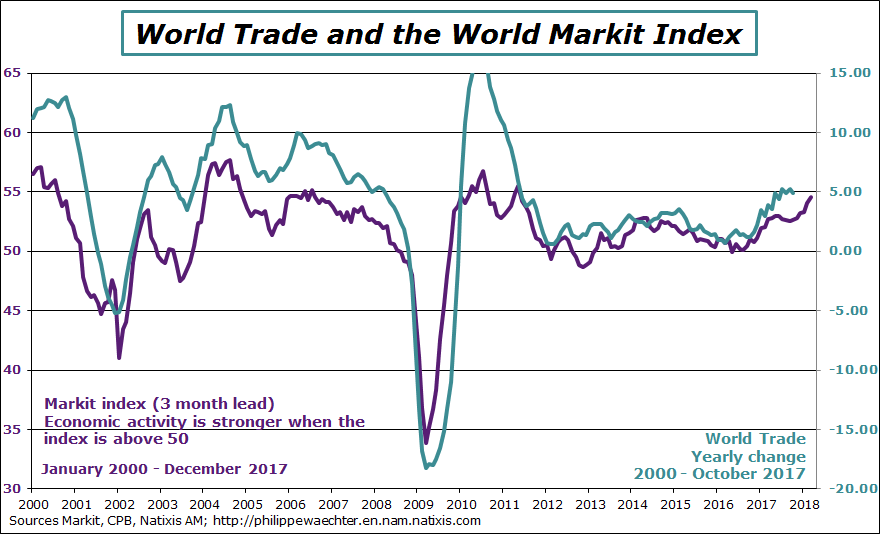

The year ahead gives us a number of reasons to be optimistic that I would like to share with you. World trade has taken an upturn, oil prices remain reasonable, and business leaders worldwide have a positive take on their environment. So the starting point for 2018 is solid.

Growth, along with the ensuing employment, will provide an opportunity for all citizens to regain a foothold in a complex and difficult world. Economic policymakers will be responsible for adopting the right reforms to set the stage for a recovery that provides enhanced job creation and reduces uncertainty for each and every member of society. In this respect, France has high hopes on the reforms that will be debated in 2018: the reform to vocational training and job skills lies at the heart of the French government’s roadmap and the policies the authorities adopt in this area will provide the key counterpart to the labor law decrees in making the job market more efficient.

Yet now is when the problems are really going to start, precisely because things are going well. The world economy is moving into its post-crisis period with growth looking robust for the second year in a row, and it is exactly because growth is strong that now is the time to implement ambitious reforms: the French government has truly grasped this. In this new context, we will also see pressure to scale back the influence of monetary policy. It has been incredibly accommodative and has driven the improvement witnessed over recent years, but many feel that these ambitious policies go too far, so pressure to cut back incentives from monetary policy is therefore set to mount.

Growth remains limited in developed countries (2% in 2018 according to the IMF vs. 2.9% on average between 1980 and 2007), while inflation in these markets is still too sluggish (1.7% in 2018 according to the IMF vs. 2.9% on average between 1980 and 2007), so there is danger involved in seeking to move too fast. I therefore do not believe that interest rates will surge massively, as a significant hike would be a huge risk for the macroeconomic balance.

So just how agile will the global economy be in its adjustment capabilities? A further reason behind current solid growth comes from sustainably low interest rates, and an abrupt hike would have a negative effect on economic activity.

However, this strong growth also goes alongside a lackluster productivity profile. A solid economy must involve a sustainable rebound in productivity, and innovation should be the key to this upward shift in productivity. However, this is not yet the case and we do not know when the positive impact on productivity is set to materialize – in two years, five or ten – it is impossible to say.

Against this backdrop, an abrupt shift in monetary policy conditions could disrupt the current smooth path and in this respect, in the US the nomination of new members to the Fed Board in Washington will have a major impact. Will the new look Board adhere to pledges made by previous governors? And will it continue its monetary policy steering, involving gradual monetary policy normalization as it navigated a steady path for the financial markets? Meanwhile, on the other side of the pond, the ECB does not want to rush into any changes as it thinks that the growth profile will take much longer to normalize than everyone would like to believe.

Europe will have to deal with a twofold change in its world context.

From an economic standpoint, the continent will no longer be playing catch-up, as it was in 2016 and 2017. Growth momentum will be very different and more dependent on the worldwide environment. In other words, economic policy in Europe must again take on its role, and economies will have to adjust to a new framework, while also improving efficiency.

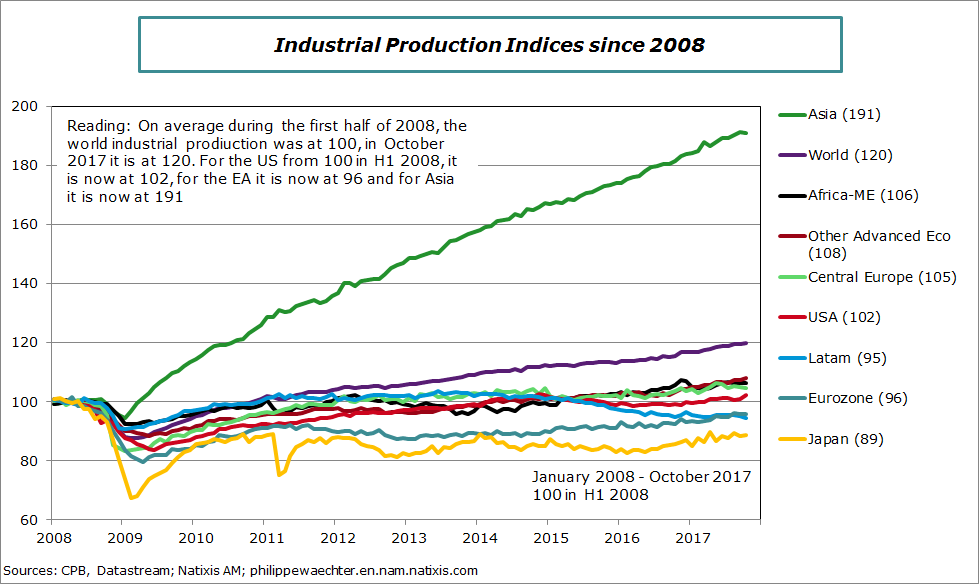

The other point is that the scales of the world economy have tipped drastically in Asia’s favor in this post-crisis period. The chart opposite reveals this radical change that took place alongside the crisis. Developed countries no longer drive world growth, so the process of reacting to deal with shocks will be more painful than before as these countries are no longer in the driving seat and average growth is weaker.

The political landscape is also changing dramatically and this is a source of opportunities for Europe. The post-crisis period has taken on a less cooperative and more dictatorial dimension. The US is clearly no longer playing the political cooperation game, not even with its usual partners. Its tax reform program’s clear protectionist slant will promote US companies to the detriment of the rest of the world, and in particular developed countries, reflecting a more belligerent stance than in the past. Meanwhile in China, Xi Jinping has shored up his position and taken China a step further towards globalization. This shift towards a less cooperative world can also be seen in the United Kingdom’s move to exit the European Union. The British people think that they will be better off outside any cooperative channels.

The current reshuffling of the world’s political cards must be used as an opportunity for Europe and this will require Germany to set up its government and take a resolutely European stance. This will be vital in fostering greater cooperation in Europe, which the world at large has failed to do, thereby helping reduce populism on the old continent, such as that seen in Austria and as we may see in Italy after the March 4 elections.

Europe and France can play a key role in this world economic and political order. They must take advantage of the current robust economic cycle to take the necessary steps and set up the necessary institutions required to maintain a cooperative approach. Fostering cooperation will be a major challenge as a number of issues can no longer be addressed at a mere country-wide level: the climate, terrorism, globalization, pollution and security must all be tackled on a global scale. Weaker worldwide cooperation on these issues is very worrying as none of these various matters can be effectively addressed.

So economic optimism on the year ahead must be set into context against this view of a world where trends are not systematically converging as had previously been expected. Europe must be a driving force, as European citizens are well aware that a less cooperative world is not a positive one.

Philippe Waechter's blog My french blog