Is the US economy’s current pace set to trigger major imbalances, disrupt the current cycle and spark off a significant downturn in economic activity?

The stockmarkets’ severe recent downturn reflects investors’ concerns on forthcoming trends for the global economy, and in particular the performances we can expect from the US. Firstly, they reacted to the change in stance from the Federal Reserve on forthcoming inflation trends, expected to converge towards the central bank’s target of 2% and stay there in the long term. Secondly, rising wages confirmed this idea of nominal pressure, even if the 2.9% gain announced in January’s figures was probably a result of the reduction in number of hours worked due to unusually cold weather conditions. Lastly, the handover at the Fed added another level of uncertainty. Janet Yellen did a good job of steering the US economy, will Jay Powell do the job equally well?

I have already written at length on these matters, and an article published on Forbes.fr will provide details on the uncertainties surrounding Powell’s arrival to chair the Fed. However, looking beyond these factors, a number of other questions are being raised about the US economy.

The first question involves economic policy and the way fiscal and monetary policies can coordinate against a backdrop of full employment. This coordination has worked pretty well so far. The US economy nosedived in 2009 and both policy areas instantly loosened: it was vital that every effort be made to avoid a drastic chain of events that would end up creating higher unemployment and a long-term hit to the standard of living. This approach was successful and the country hit its cycle trough in the second quarter of 2009, moving into an upward phase that has lasted ever since. Monetary policy continued to accommodate, but fiscal policy became restrictive in 2011 and then converged to a sort of neutral situation to avoid hampering the economy. This policy combination drove the US into one of the longest periods of growth it has enjoyed since the Second World War: the pace of GDP growth was admittedly not as brisk as before, but it did not trigger any major imbalances, as reflected by an economy running on full employment and continued moderate inflation, remaining below the Fed’s target.

This period of slower but balanced growth is coming to an end.

The economy is growing at a steady pace and unused resources are fairly limited. Production capacity utilization rates are on the up, employment for the 25-55 age range (labor market core age group) is high, although slightly lower than before the crisis at 79% vs. 80%, while involuntary part-time work is now well below its long-term average.

Against this backdrop, the best economic policy approach is to gradually take a step back. The economy is self-sustaining, so extra impetus is not required, and it is even advisable to take steps to recover leeway so that the authorities have the wherewithal to act when economic conditions do take a downturn: the Fed’s rate hikes since December 2015 should be seen as part of this strategy, as it acted very transparently and steered its communication to ensure that investors in the US and elsewhere knew what to expect.

With moves to cut back taxes and hike spending, the public deficit is set to move beyond 5% of GDP this year. Fiscal policy is taking on an expansionary dimension, while monetary policy still maintains its highly accommodative slant, so the task over the months ahead will be to coordinate these two strategies. Each provides a springboard for faster growth, but this could run into a stumbling block of an economy already running on full employment. These two policies need to be carefully steered to avoid overheating, which would swiftly debilitate the US economy. There is some leeway for unemployment to fall slightly, but room for maneuver is very limited.

We can assume that monetary policy will become more restrictive and we should expect the Fed to hike its rates at a faster pace than expected – four hikes at least this year, rather than four at most.

In an article published this weekend, The Economist outlined three reasons not to worry unduly over the US situation: it is not clear that the economy is really running on full employment, inflation is not about to take a sharp surge, and tension on the labor market as a result of the acceleration in economic activity provides benefits for workers who have not really gained from the recovery.

I only fully agree with the second point: inflation risk is indeed limited. Meanwhile, looking to the first aspect, I believe that we are close to full employment, and as regards the third point, growth has primarily benefited the highest earners: this is a usual feature of the US economy and I cannot see what aspects of the current situation are likely to change this, or at least fiscal policy will not help change it. Growth provides clear benefits for the wealthiest, who enjoy the lion’s share and this is why we should raise questions on a GDP growth target in such an unequal society.

Looking at the absence of inflation, an article in this weekend’s NY Times suggested that wage trends have changed dramatically, and this could provide some explanation. Employers prefer one-time bonuses rather than salary increases: bonuses paid out once a year are inherently flexible and do not involve a definitive commitment from the company, whereas salary increases are permanent. This new remuneration mix trend is gathering pace within companies and is changing wage-price momentum.

The question is whether this situation can persist when the economy is at full employment? The answer is probably yes, for the reasons I mentioned last week. The US economy’s value-added sharing and its declining unionization do not point to strong bargaining power for workers. However, it is reasonable to assume that a long-term drop in the jobless total below the 4% mark should lead to slightly higher wage pressure. However, this should not have a very strong impact on long-term interest rates and long-term inflation projections should not accelerate sharply. I therefore do not expect a dramatic upturn on US long-term rates.

Economic policy coordination will involve tighter monetary policy and hence a further flattening of the yield curve, which will obviously be bad news for the average consumer, who will suffer from the hike in short rates but not really derive much benefit from tax cuts in the long term.

The economic equilibrium in the US is shifting dramatically as a result of fiscal policy coming out of the White House and Congress. The additional budget deficit of at least $1,100 billion over 10 years is triggering a real watershed and creating a long-lasting imbalance.

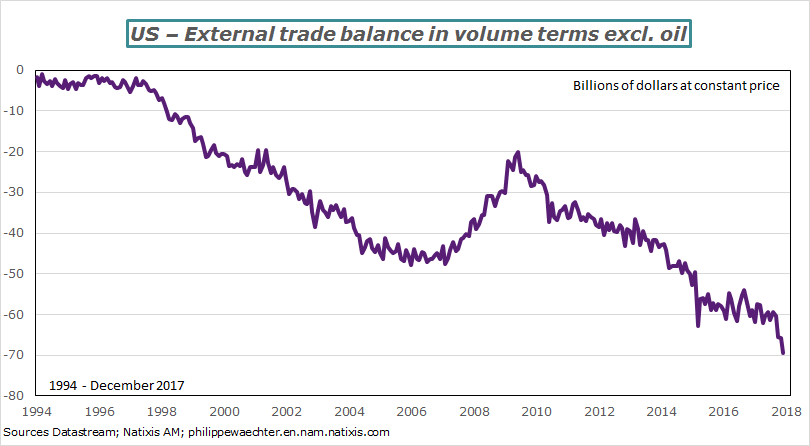

The other source of disparity is the pace of US external trade in volume terms, excluding oil. The chart below shows a sharp acceleration in this balance in the last quarter of 2017 to unrivalled levels. Over the first nine months of the year, the balance stabilized at $60 billion, and came out close to $67bn over the last three months of the year and $70bn for December alone. On an annualized basis, the deficit went from a base of $700bn to $800bn in the last quarter, which is vast and will hinder growth.

The worrying point is that the euro area’s external balance increased at the end of the year, as did China’s. In other words, the increase in imports at the root of the deterioration in the US external balance, focused on consumer goods, benefited all parties. this group of three key world trade players, the country with a deficit suffers a swift deterioration in its situation, while the other two areas enjoy an improvement.

The acceleration in US domestic demand led to an increase in demand for imports and a deterioration in its external balance, while exports did not really stage an improvement. This gives cause for concern because the upward trend in domestic demand will be further accentuated by expansionary fiscal policy: the US external position is therefore set to deteriorate further.

The current US cycle has not suffered any major imbalances, which explains its longevity. Fiscal policy implemented at a time when the economy is running on full employment is set to trigger long-lasting disparities that will set the stage for the next recession (2019/2020?) and force the US authorities (Fed) to take corrective measures, while also potentially leading to investor wariness. With the presence of China and the euro area, the US is no longer the only country controlling worldwide dynamics and current events could afford the other two areas a more leading role. The worldwide balance of power is changing and the White House does not seem to have grasped the full significance of this shift.

Philippe Waechter's blog My french blog