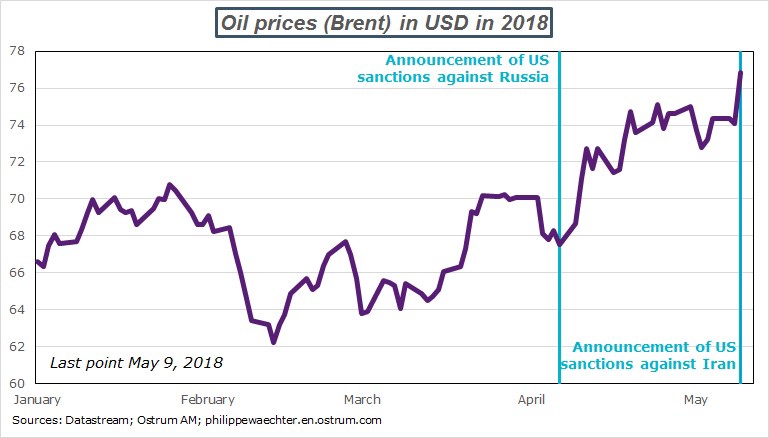

Oil price trends have shifted since the start of April, with figures set on a range of $70–75, compared with a previous figure of around $67 on average, i.e. higher than figures seen since late 2014. This reflected the impact of demand driven by world growth.

The chart below shows that trend altered after April 6, when the White House implemented sanctions against Russia, with subsequent threats on Iran merely serving to amplify this trend. This morning after Donald Trump’s decision on Iran it is above 75 as shown on the graph.

Sanctions dent one of the world’s largest oil producers, a group that includes Saudi Arabia and the US. Russia would have to keep on investing to sustain production at current levels, but this often requires using foreign technologies and who would take the risk of violating sanctions by financing the Russians and incurring the wrath of the US? So this obviously leads to uncertainty on Russia’s future production.

Meanwhile, the question mark over the situation between the US and Iran on the nuclear agreement also has kept the pressure on.

Donald Trumps’s decision, yesterday, to pull out the US from the Iran nuclear deal is a source of concern as it will increase uncertainty in the Middle East. His decision will create strong heterogeneity in the region, increasing dramatically the risks of conflicts. Since yesterday’s decision we have already heard very different point of views that are not spontaneously consistent one with each other.

On the oil market, Iran is a large producer (almost 10% of the OPEC production and 3.9% in the world). Constraints that have been put by the US president on foreign investment in Iran is clearly a source of concern as its production will be limited in the future. Qatar is also targeted by the US sanctions on Iran as Qatar was clearly supported by this latter.

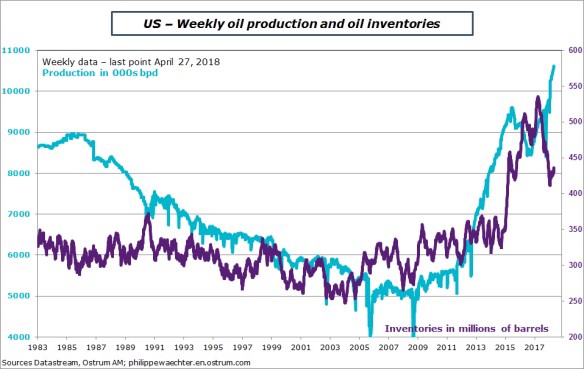

All else being equal, continued US sanctions against Russia and measures against Iran tend to push up oil prices, which works to the benefit of US producers. Production continues to grow fast on the other side of the pond, while stocks have now stabilized. The US is the big winner in the current situation, as production has never been so high.

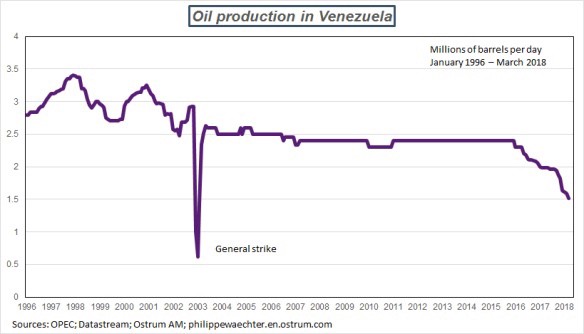

In terms of sanctions, the next target for the US could be Venezuela after the next presidential elections on May the 20th. Expectations on the Venezuelan production are on the downside and sanctions could imply lower production to 1 million barrels per day.

In coming weeks, the oil price will be on the upside as sanctions on Russia, Iran and may be Venezuela will constrain three major producers. We cannot expect that the oil price could come back rapidly to a neutral level. There are pressures on the upside for prices (75–80 range in the short run) and a now a risky environment for growth even in the US which is the main beneficial of the current White House strategy.

Trump thinks that the world economy is a zero sum game. Facts will demonstrate that he is wrong.