The emerging countries’ environment is dramatically changing. It used to be an easy place to play but it is no longer the case. Stability in developed countries’ monetary policy was an opportunity for them. Their interest rates were higher and the spread with the US was a strong source of return.

What has changed?

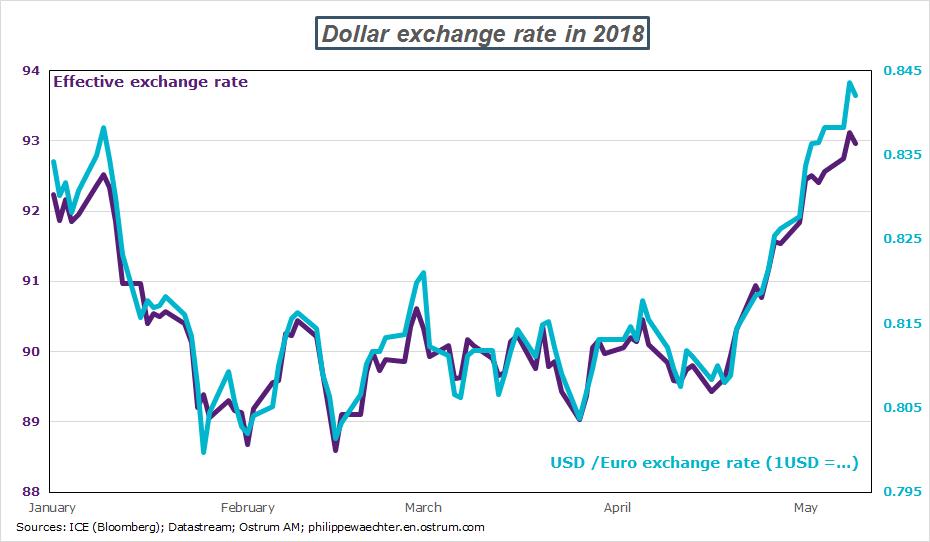

The dollar, which was perceived as weak by many investors, now follows an upward trend. Since mid-April its effective exchange rate has appreciated by more than 4%. As it can be seen on the graph, it’s also a surge vis-a-vis the euro.

Why is it so?

The main source of explanation is diverging expectations between the Fed and other developed central banks. The Fed will have to tighten its monetary policy in order to avoid large imbalances which will result from the current White House fiscal policy (see here). The current situation with full employment and a very accommodative policy mix is not sustainable. The adjustment will go through higher Fed’s rate (at least 4 hikes this year). This profile is credible as Powell and the FOMC acknowledged that the inflation rate is on its target.

The important point is the divergence with other central banks. The ECB has said that it will not change its strategy for long, the Bank of Japan said the same thing. Expectations on the Bank of England have dropped dramatically as the economy falters and the inflation rate converges to 2%.

In the past, a tighter US monetary policy led to capital outflows from the emerging countries (called Sudden stop). As the US short term rate is expected to be higher investors are back to the US. They no longer want to take excessive risks when they can have a higher return in the US. This implies a stronger dollar.

The other source of the greenback appreciation is the uncertainty that follows Donald Trump message on Iran. The political equilibrium in the Middle East will now be very different with higher risks of conflicts. This comes at the top of the trade war initiated by Trump in March. (we can also say that the impact of Trump decision on Iran is another source of trade war for European companies as they are now very much involved in Iran and will have to leave to avoid US sanctions)

This uncertainty created by the White House will accelerate the US capital inflows and a higher dollar. The risk is perceived as lower in the US than elsewhere.

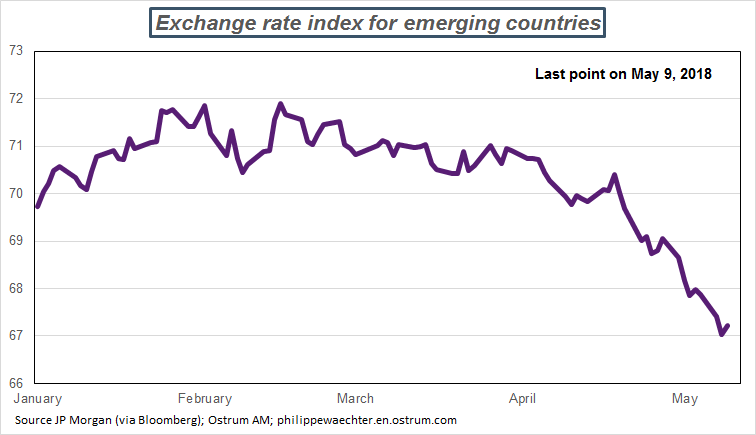

The counterpart of this story is the depreciation of emerging currencies. The JP Morgan EM currency follows a downside trend since mid-April.

A depreciation leads to more capital outflows in emerging countries and a lower willingness to invest as long as the emerging currency has not stabilized.

In other words, as we don’t know the scale of the greenback appreciation, and it can be important, the situation will weaken in the short term for emerging countries. To counterbalance this movement we can expect higher rates in some countries. But then the discrimination for investors will follow the credibility of each central bank and of each country and this can be disastrous as recently seen with Argentina.

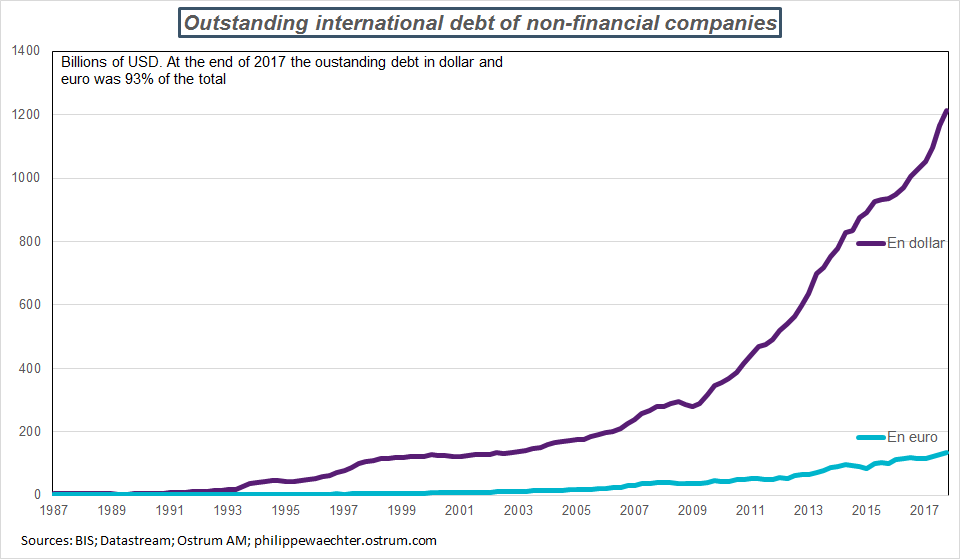

If currencies cannot stabilized rapidly, then the debt cost will increase dramatically. External debt for non financial companies is mainly in dollar, the charge of the debt can increase very rapidly creating an unsolvable equation. (remember the Asian crisis)

The world has dramatically changed for emerging countries with the new policy decided in Washington. The Fed will have to tighten its monetary policy more rapidly than expected and the White House has created sources of uncertainty. Both will favor capital inflows in the US and a stronger dollar. But it will be at the expense of emerging countries.

The rules of the game have definitely changed for emerging and investors will have to take this into account.

Philippe Waechter's blog My french blog