Today, tariffs on USD 34bn of Chinese imports in the US will increase and China will do the same on US imports in China. That’s a nonsense policy as it will hurt both American and Chinese people.

I thought it was interesting to come back on the globalization process as described by Richard Baldwin in an interview with ProMarket. This interview was done on March 6 and Trump just started to announced measures on tariffs. Baldwin view is now more severe on Trump’s trade policy.

In a tweet today, he mentioned Navarro and Lighthizer a close counselor on trade and the US trade representative. ”Navarro & Lighthizer want to undo the global value chains – not liberalize trade that will encourage them”

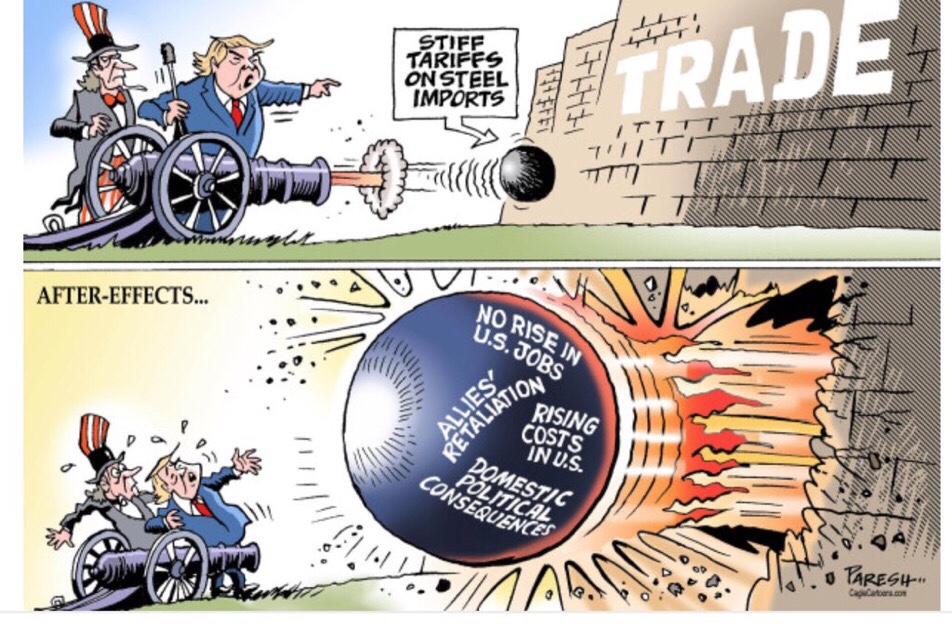

This cartoon he tweeted this morning also reflects the absurdity of the current US trade policy

Observers in rich countries are seriously “misthinking” globalization, argues Richard Baldwin—and he has taken it upon himself to correct our error.

Now head of London’s Centre for Economic Policy Research and founder of its influential economics portal VoxEU.org, at the beginning of the 1990s the professor of international economics sat on George H.W. Bush’s CEA and for over a decade now has been attempting to make sense of the changes to international trade unleashed by the IT revolution about that same time.

The outcome of this decade of thinking—and what Baldwin offers as the solution to our own misthinking—is his 2016 book The Great Convergence (which Larry Summers classed in the company of no less than Keynes as one of the five best books on globalization).

The book takes up the task of connecting the logic behind two remarkable changes to the distribution of global wealth:

1) the Great Divergence, when, starting with the Industrial Revolution in the early 1800s, the wealth of the G7 countries overtook that of the ancient civilizations, which had held the bulk of the world’s wealth for four millennia, at an extraordinary clip; and

2) the Great Convergence, which took off in the 1990s and has seen “a century’s worth of rich nations’ rise [reversed] in just two decades.”

Baldwin explains these grand processes of divergence and convergence with what he calls the “three-cascading-constraints view” of globalization. As he tells it, prior to the Industrial Revolution, production and consumption were “bundled” geographically because of three constraints on trade: high transport costs, high communication costs, and high face-to-face interaction costs.

The first “unbundling” of production from consumption happened thanks to the steam engine and other innovations in transport starting in the 1800s. Production remained geographically clustered, though, due to high communication costs that required technical knowhow to be physically near other factors of production.

This all changed with the IT revolution of the 1990s, which lowered communication costs and facilitated knowledge transfer across global supply chains. This supercharged the Great Convergence between the G7 and the emerging economies.

The third constraint—the high cost of face-to-face interaction—remains largely in place, but not for long, says Baldwin.

In a recent interview with ProMarket, he explained why he believes the cat is out of the bag for globalization and the third constraint is likely to continue to disintegrate—regardless of Trumpism, tariffs, or trade wars.

[This interview was conducted on March 6, 2018. It has been edited for length and clarity.]

Baldwin on Globalization: “A Lot of the Narrative Is Based on the US as If It Were the Whole World” –

— Read here promarket.org/baldwin-globalization-lot-narrative-based-us-whole-world/

Philippe Waechter's blog My french blog