Paul Volcker blazed a trail as he waged the war on inflation, and shaped the financial landscape over the past 40 years. His passing at the age of 92 signals the end of an era.

The world has just lost one of its eminent central bankers, Paul Volcker, at the age of 92. He was appointed chairman of the US Federal Reserve on August 6, 1979, a man with a mission to fight inflation, which had created uncertainty and hampered growth since the middle of the 1970s.

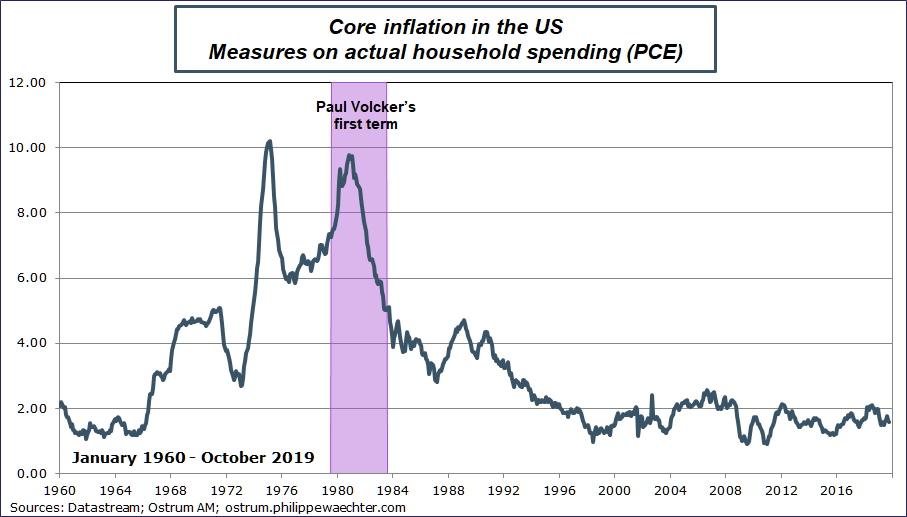

Volcker successfully got inflation under control as we can see on the chart opposite. Using the Fed’s favorite metric, US core inflation came down from 10% after the second oil shock to 4% by the end of his first term, remaining relatively stable at around 2% ever since. Other developed countries that were struggling with the same imbalance swiftly followed in the Fed’s footsteps and rolled out their own strategies to tackle inflation.

In another key achievement, Volcker initiated a new movement by promoting the role of central banks in regulating the economy.

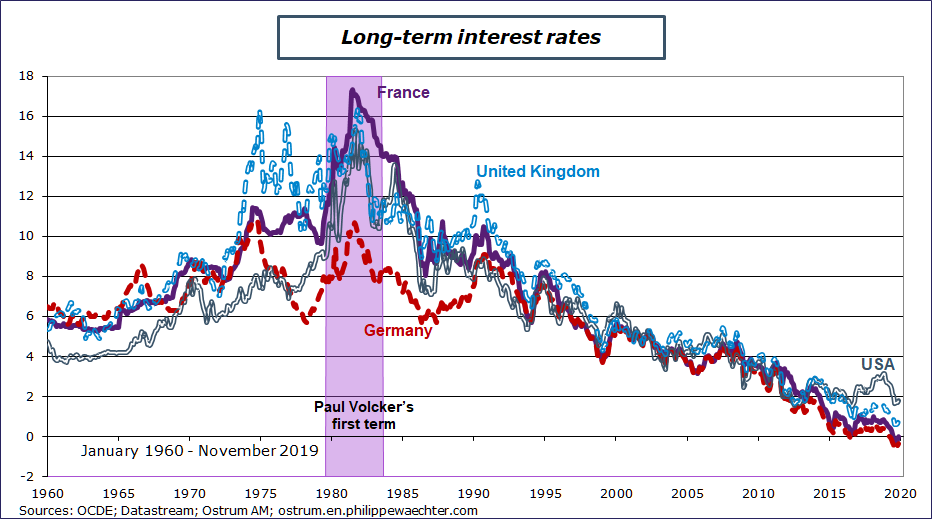

Volcker was initially appointed by Jimmy Carter at a time when finance was still very local and the financial markets were not very integrated. We can see on the 10-year interest rate chart that each of the four main economies – US, Germany, UK and France – had its own very individual momentum at the time.

The situation changed when Reagan arrived at the White House and Thatcher took over at No 10. The financial markets opened up as the US in particular needed hefty external financial resources to fund its stimulus program, and this shift towards globalization and financial integration gave the central banks a fundamental role in steering the economy and finance. With this change came the need to anticipate and manage investors’ expectations, who gradually began to react in the same way to the same signals.

This financial integration set interest rates on identical trends from 1980 onwards and especially after 1990.

Three comments on these changes shaped by Paul Volcker

Firstly,

central banks still play a central role in steering the economy and finance, but

they now have much narrower leeway and they face doubts on their wherewithal to

turn around economic trends.

On this first aspect, the central banks are straitjacketed as intervention

rates are very low and above all as fiscal policy worldwide lacks coordination.

With growth currently slow, and coordinated extensive fiscal stimulus nowhere

to be seen, central banks are keeping interest rates very low and pursuing

monetary accommodation to curb risks of a watershed for the economy. The goal

now is no longer to avoid diverging strategies between countries but rather to

keep a lid on the risks for world growth at a time when interest rates are already

very low.

Secondly, central banks face doubts on their role in regulating the economy.

Modern Monetary Theory (MMT) suggests that governments more than central banks

should be responsible for steering the economy, especially as central banks no

longer have the same leverage to act as they did in the past, as interest rates

have been very low for a very long time.

This whole situation is a bit like a pendulum swinging. After central banks

steered the ship for 40 years, the economic system needs to find new ways to direct

it if it wants to remain efficient. The central bank is still important, but would

no longer be the only key component in this new set-up.

Lastly, Paul Volcker was so successful that central bankers are in the

doldrums as they would now actually like to see more inflation.

In the projections given after the December 11 FOMC meeting, Jay Powell and the

Fed indicated that the 3.6% unemployment figure that the Fed expected for 2019 could

drop again in 2020, although without setting off a surge in inflation.

Meanwhile at the ECB, Christine Lagarde stated on December 12 that monetary policy

would remain accommodative at least until 2023 as inflation expected in 2022 is

set to remain lower than the ECB target at 1.6% vs. a goal of close to, but

just below, 2%.

Paul Volcker was behind all the transformations that have emerged since the start of the 1980s and played a key role in every one. The economy has changed over the past 40 years and the pendulum will now probably start to swing the other way. His death marks the end of an era.