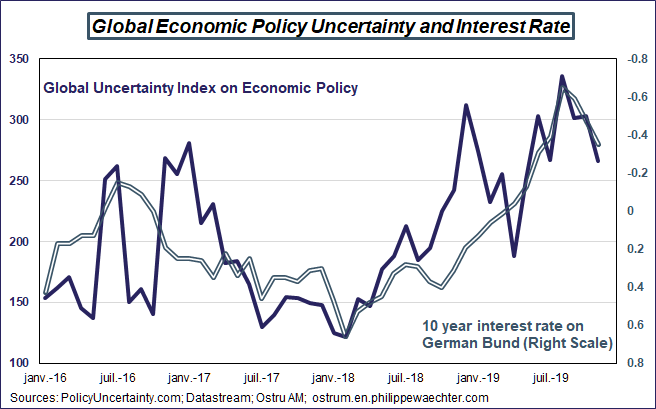

The increase in economic policy uncertainty is well correlated with the fall in the 10-year interest rate in Germany. An illustration

The graph is an illustration of the link between economic policy uncertainty and behavior’s adjustment via the pace of the German 10-year rate (risk-free asset). The drop in rates since 2018 has its source in the non-cooperative nature of economic policy and the uncertainty that this creates.

This is not a surprise since higher uncertainty increases the search for a risk-free investment. Over a longer period, the two indicators appear consistent but not as precise as what is observed since 2016.

The bet for 2020 will relate to the reduction of

uncertainty about global economic policy

The Brexit issue (again) and the discussions between Chinese and Americans will be essential to grasp this uncertainty.

In a year of presidential elections in the US, it’s probable that China will again be an excellent scapegoat for Donald Trump. The phase 1 agreement on trade with China is a win-win agreement in agriculture. Nevertheless almost 2/3 (64.5%*) of the Chinese products in the US will be taxed and circa 60% (56.7%) of the US products in China will have tariffs. This provides opportunities for tension as the US manufacturing sector quickly falters. China will once again become a scapegoat to convince the Republican electorate. We could then see the return of significant international tensions because the Chinese have no reason to leave the monopoly of tensions to the Americans. We could then see a drop in long rates.

Cf Chad Bown