Eurozone inflation rate and unemployment rate, US report on the labor market, German Industrial Orders, US external trade, French consumer confidence

Highlights for next week

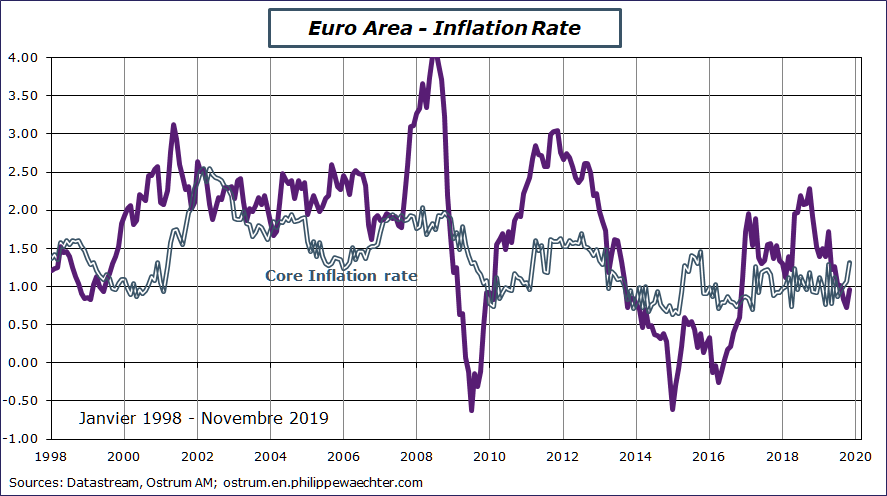

Inflation rate in the Euro Area for December (January 7)

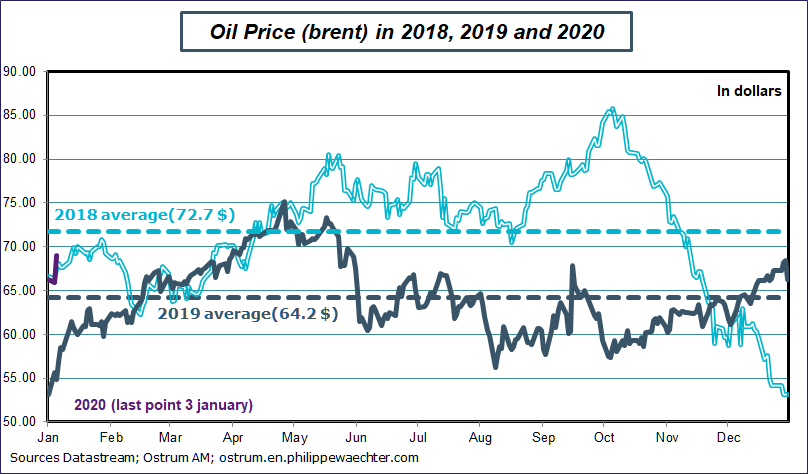

The inflation rate will be higher in December as the oil price in December this year is much higher than in December 2018. This spike has already been seen in France and in Germany. The French inflation was at 1.4% in December vs 1% in November and it was respectively 1.5% and 1.1% in Germany.

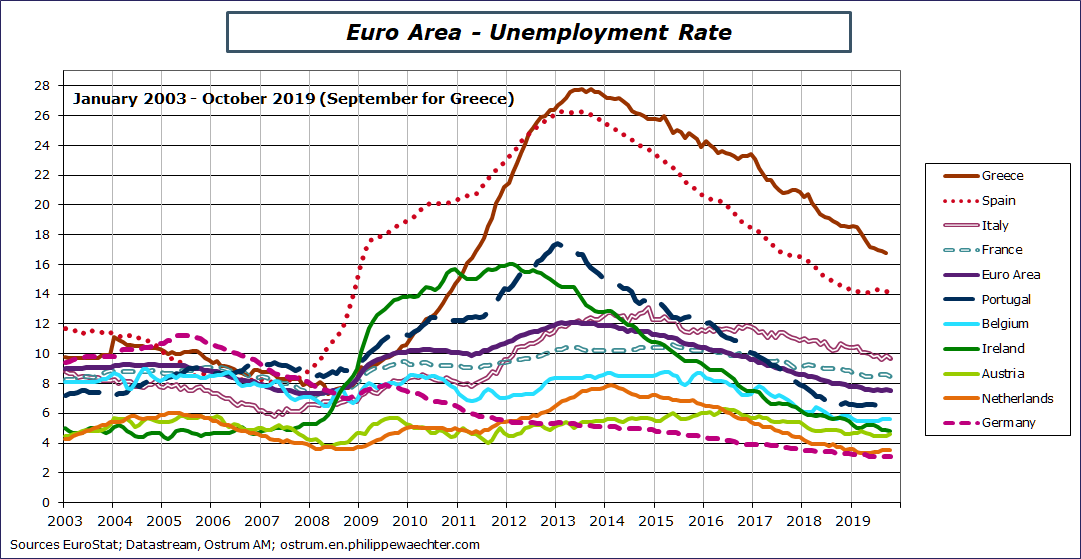

The unemployment rate in the Euro Area for November (January 9)

The unemployment rate is close to its lowest at 7.5%. Going lower when most of northern countries are at their lowest unemployment rate suppose a boost in growth expectations and much lower unemployment rate in the south of the Euro Area (France, Italy, Spain) which supposes large structural reforms. We do not expect that.

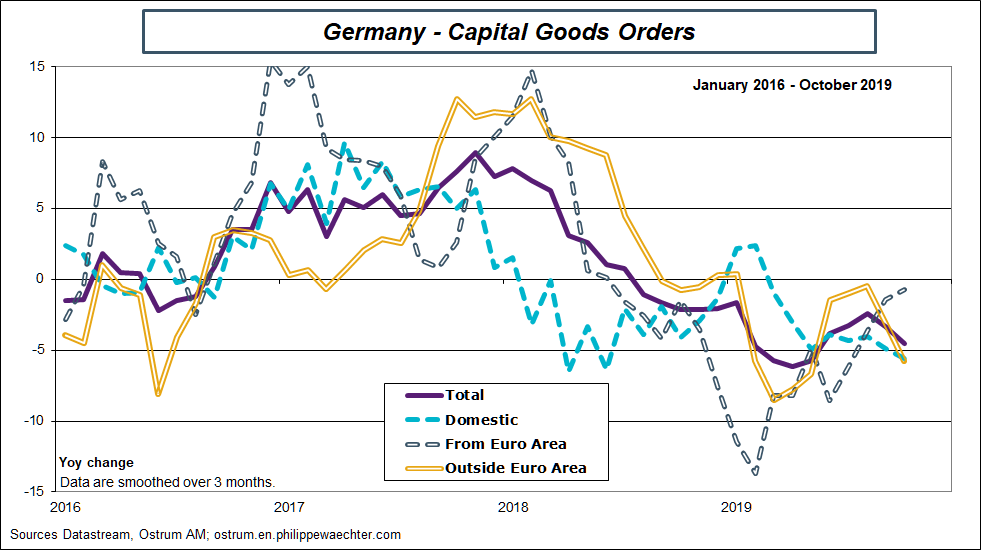

Industrial orders (January 8), Industrial production and external trade (Jan.9) in Germany for November

Industrial orders to the German industry is a real measure of corporate confidence. Past levels are weak and a rebound is hardly expected.

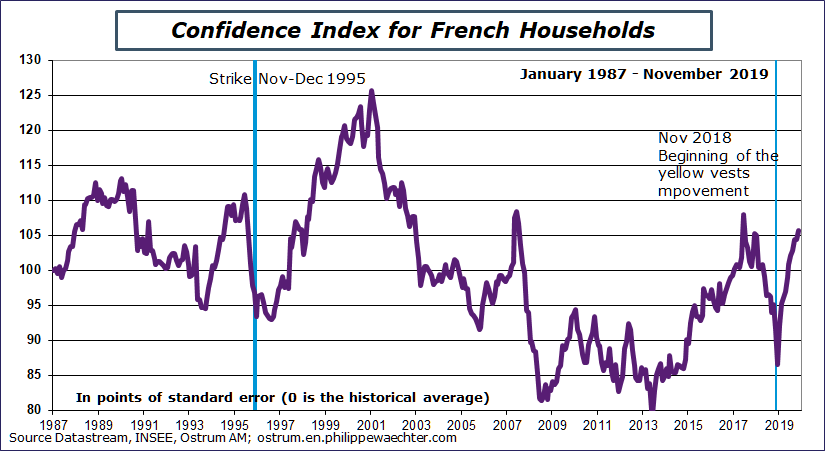

French Households’ confidence index for December (Jan. 8)

The French economy is enduring a strike since the beginning of last December. Households were very optimistic in November and they were, in majority, fighting the reform on the retirement scheme proposed by the government. Will this continue in December ?

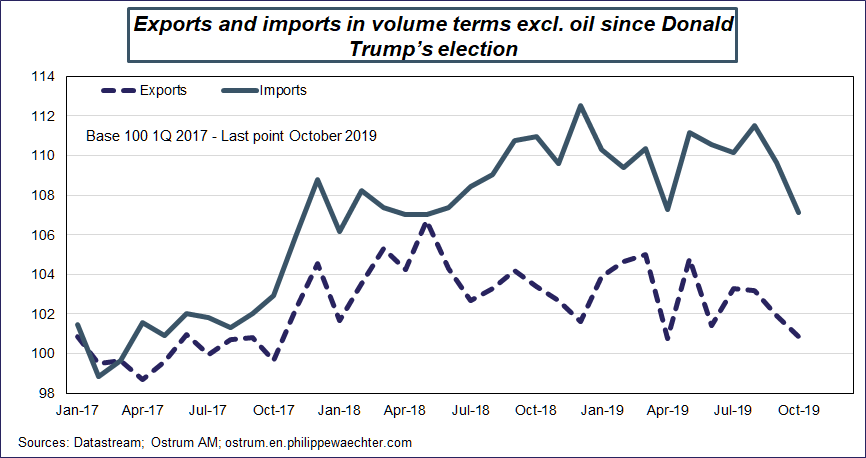

The US external trade for November (Jan.7)

Since Trump’s election, the US external trade doesn’t behave as expected despite the White House trade policy. Imports are much higher than expected and exports much lower. The agreement with China will not change the picture.

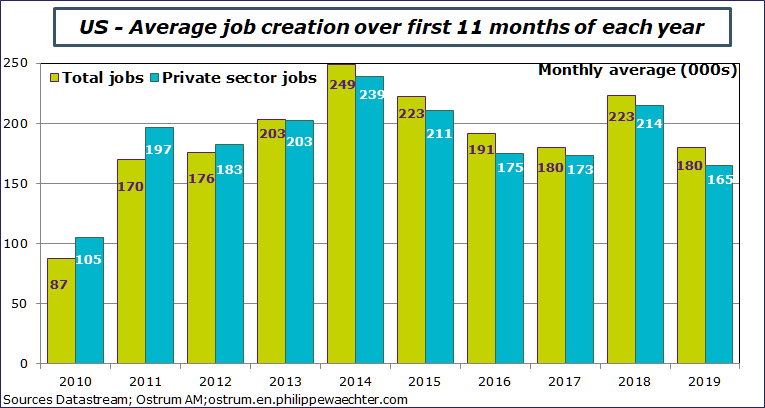

Employment in the US for December (Jan.10)

Figures were too strong in November and not consistent with the current economic momentum and the demographic profile of the US population. The Non Farm Payrolls number for December will be lower, probably way below the average of 180 000 job creation seen on average since the beginning of the year.

Other statistics: Markit service survey (Jan.6) and ISM non manufacturing survey (Jan 7), industrial production for France, Italy and Spain for November (Jan 10), retail sales for the Euro Area for November (Jan.7), the Chinese CPI for December with probably a strong impact of the pork price. UK labor productivity for the third quarter (Jan.8)This measure was particularly weak during the second quarter.

What to keep in mind from last week ?

The economic momentum is weaker in December

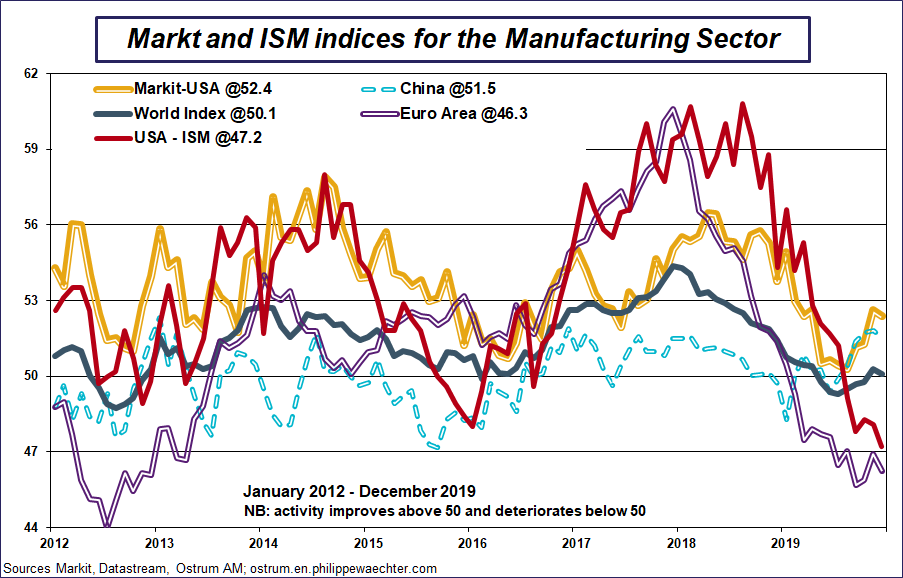

The ISM survey for December for the manufacturing sector was particularly weak at 47.2. It was the lowest number since the start of the current business cycle in June 2009. The consequence will be a weak industrial production index in December (already -1.1% lower on a YoY basis in November) and a negative contagion effect on the ISM non manufacturing survey. 2020 will be harder than expected.

At the world level, the index is back to 50.1 vs 50.3 in November. The global dynamics is limited as the Chinese index (51.5) is marginally lower than in November, the Japanese index at 48.4 is still contracting and the Euro Area is back to a level close to its lowest. In Europe, every country is weaker than in November. The risk of recession in the UK is far from being null.

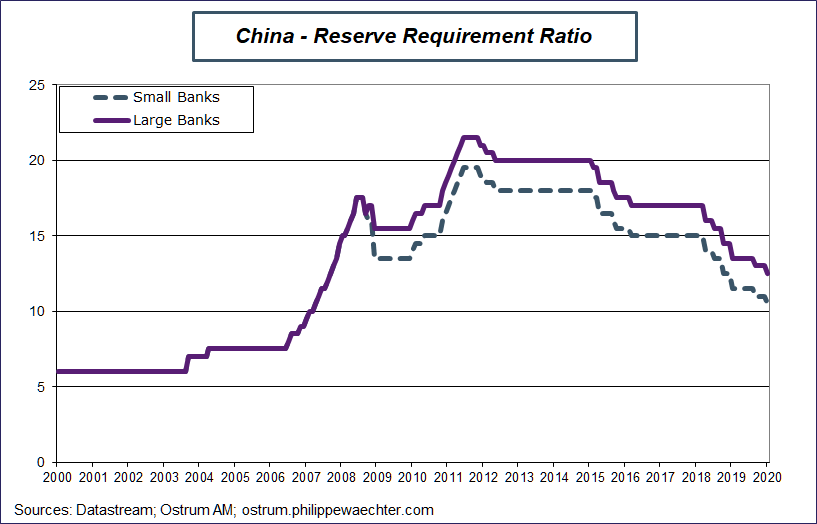

Lower reserve requirement ratio in China

In order to boost, loans and to reduce the cost of liquidity, the Chinese central bank has reduced the reserve requirement ratio. The monetary policy is expected to be supportive for growth when forecasts for 2020 are usually lower than 6% for the Chine GDP. The Chinese government doesn’t want to take risks on the labor market. A weaker labor market may lead to social unrest. Chinese authorities try to limit these risks.

The death of Ghassem Soleimani creates uncertainty on the oil market

The uncertainty created by the death of Soleimani last Thursday in Baghdad has already had a impact on the oil market. The price is not high yet but could spike in the case of a war. One consequence would be a loss in households’ purchasing power and lower consumption expenditures. The low momentum in corporate investment and the contracting world trade imply that the global growth momentum is very dependent on households expenditures. A higher oil price would reduce consumption and push the global economy into recession. (see here)

The employment momentum in Germany is lower compared to the beginning of 2019 (1.1% on a YoY basis during the first 3 months of 2019) and 0.7% during the three available months (end November)

The French inflation rate was at 1.4% in December (Oil price effect) vs 1% in November

The document is available for download