ECB meeting, BoJ meeting, ZEW survey, Climat des Affaires in France, Markit surveys, UK labor market, ECB survey on banks’ lending

Highlights

ECB meeting on monetary policy (Jan.23) BoJ meeting on monetary policy (Jan.21)

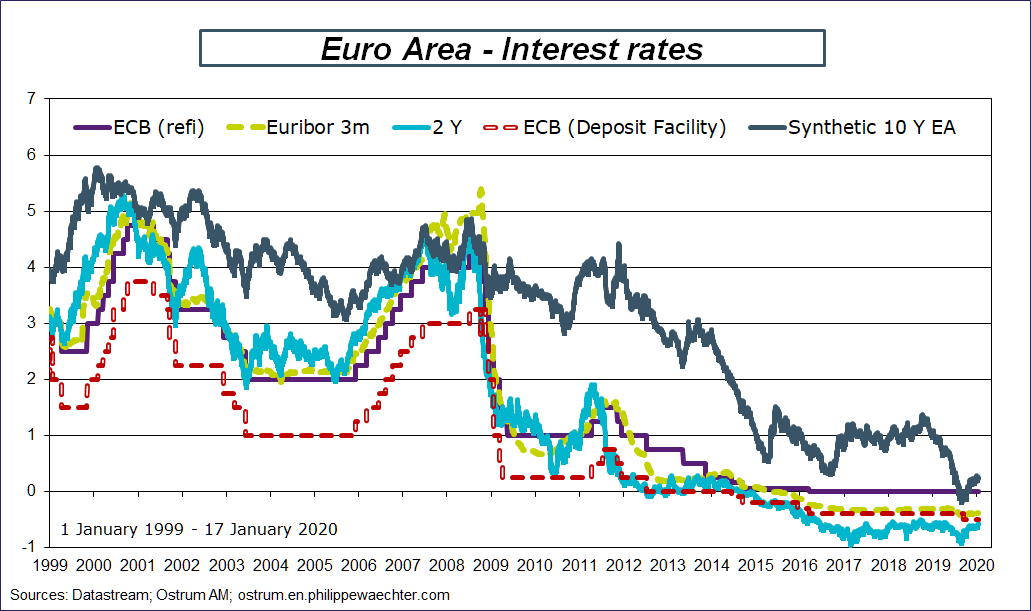

The relative stabilization in the economic activity will not create incentives for the ECB to adopt a more accommodative monetary policy. The strategic review that was announced by Christine Lagarde in December will be discussed as will be the negative impact of the negative rates on consumers’ behavior.

Nothing expected in Tokyo for the BoJ meeting.

The Markit survey for January in the Euro Area, Japan, UK and the US (Jan.24)

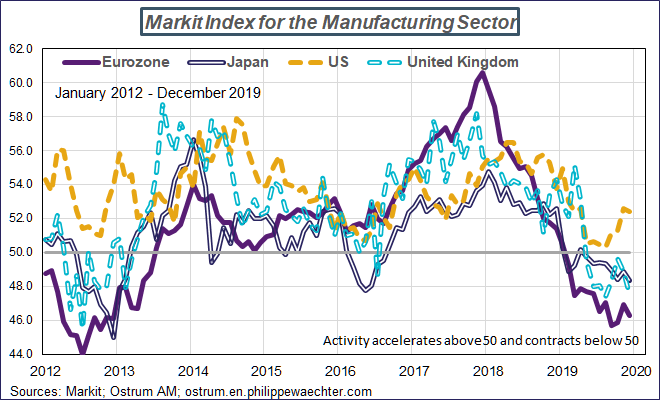

The flash estimate for January will probably continue to show the manufacturing recession in most countries. In the US there is a strong divergence between the Markit index and the ISM. The last one shows a deep recession in the manufacturing sector.

The main support for the economic activity is the services sector.

ZEW survey for January (Jan.21)

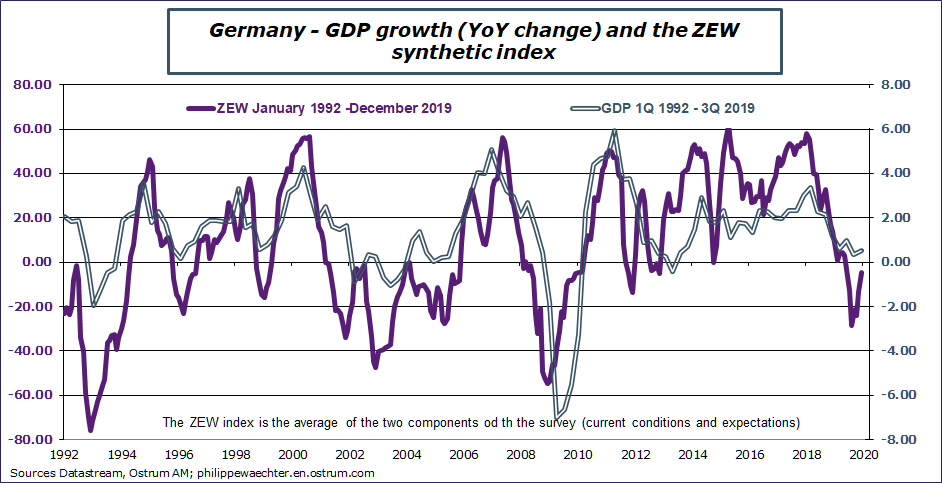

The ZEW index, measured as the average of the current situation and of the expectations indices, recovered strongly but remains in the negative territory at the end of 2019. Its level is still too low to be consistent with a reversal in the economic activity.

French Climat des Affaires for January (jan.22)

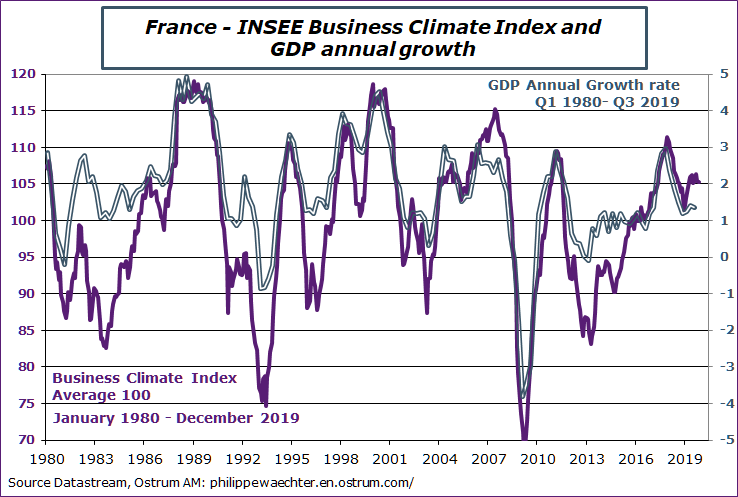

The French business cycle index is robust. The impact of the strike mainly on transportation will be limited and transitory.

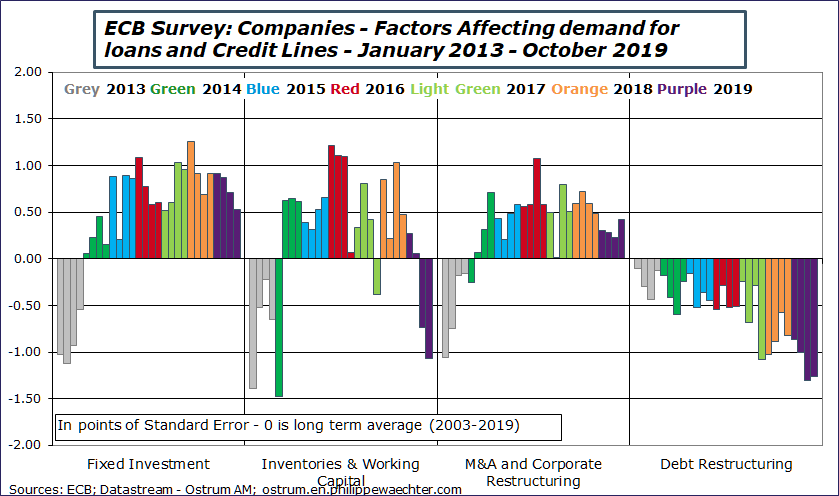

ECB Bank survey for the first quarter of 2020 (jan.21)

The survey will be interesting on companies’ side. We will be focused on their demand for credit and the reasons mentioned for it. At the end of 2019, the main reasons were fixed investment and mergers. At the same time, the demand to expand the current business cycle was weak

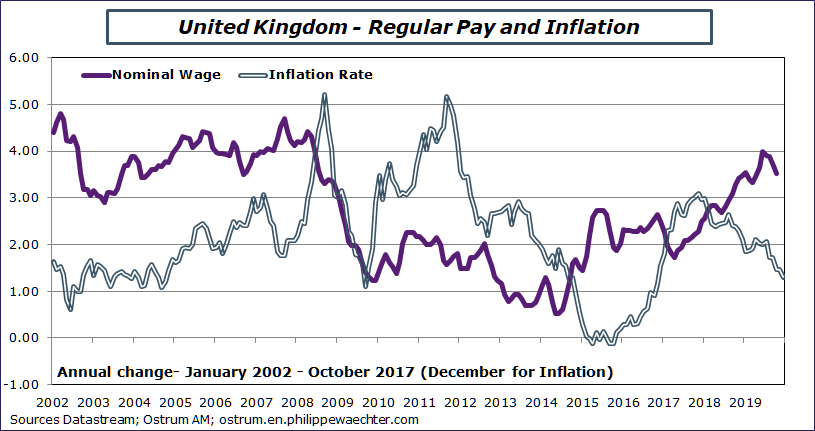

Employment in the UK (Jan.21)

The lower momentum in the UK economy will conclude, sometime in the future, by a lower dynamics on the labor markets.

Other statistics: The Chicago Fed National Activity Index (CFNAI) for December (Jan.22), the trade balance in Japan( 23), the EA consumer confidence index (23), the CPI in Japan (24) and the CBI survey on the business cycle in the UK (22)

What to keep in mind from last week ?

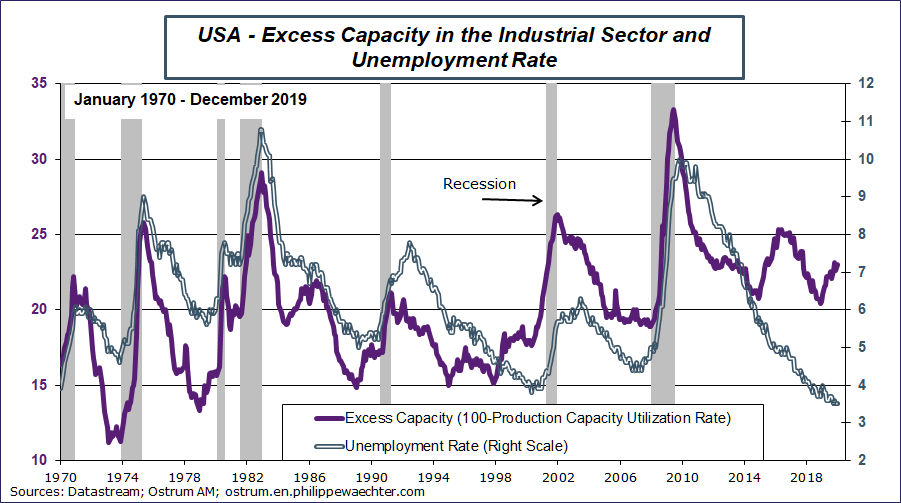

Industrial Production in the US

The index was down in December (-0.3%) while the manufacturing index was up by 0.16%. On a YoY comparison the industrial production is 0.9% lower than a year ago and the manufacturing sector was down by -1.2%.

The interesting point on the US economy is the strong divergence between the excess capacity index and the unemployment rate. Since 2015, there is a divergence between the two. Before, they each represented the US business cycle with a reversal of the cycle that was first seen in the excess capacity. Now a change in the excess capacity is no longer linked with a change in the unemployment rate. The question may be on the importance of the manufacturing sector in the US business cycle or may be on the change on the US labor market that makes it less sensitive to the business cycle ?

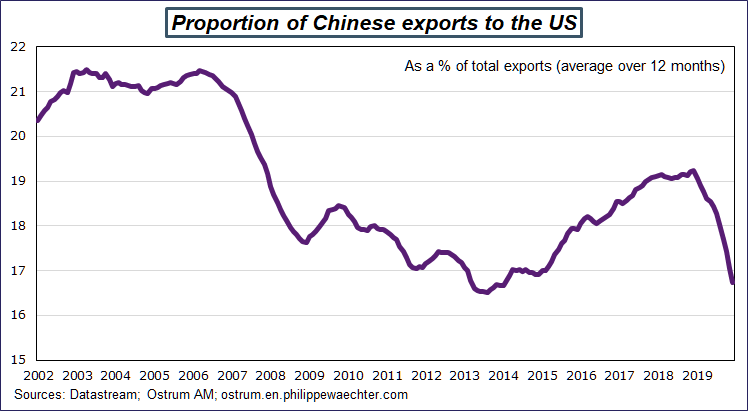

The US – China trade agreement

The US trade policy has had an important impact on the Chinese exports’ profile as it is shown on the graph. The Chinese exports to the US are almost at their lowest level.

The trade agreement is mainly based on the 200 bnUSD that China will purchase to the US during 2020 and 2021 (the reference to measure these 200 bn is 2017). It will be mainly agriculture products, commodities (oil) and industrial products. Three remarks

1 – As it is a bilateral framework, the Chinese purchases will be done at the expense of other countries (Brazil on soybean). It reflects the US idea that a multilateral world is costly for the US. This is not necessarily WTO compatible.

2 – The impulse effect on the world economy will be close to 0. It will lower uncertainty and this may be a boost for growth.

2 – There are no prices associated with these purchases. How things will work ?

3 – It’s an incentive for China to develop its business outside the US

4 – This doesn’t end the trade conflict between the two countries. The technological leadership which is the heart of the trade dispute was not directly discussed.

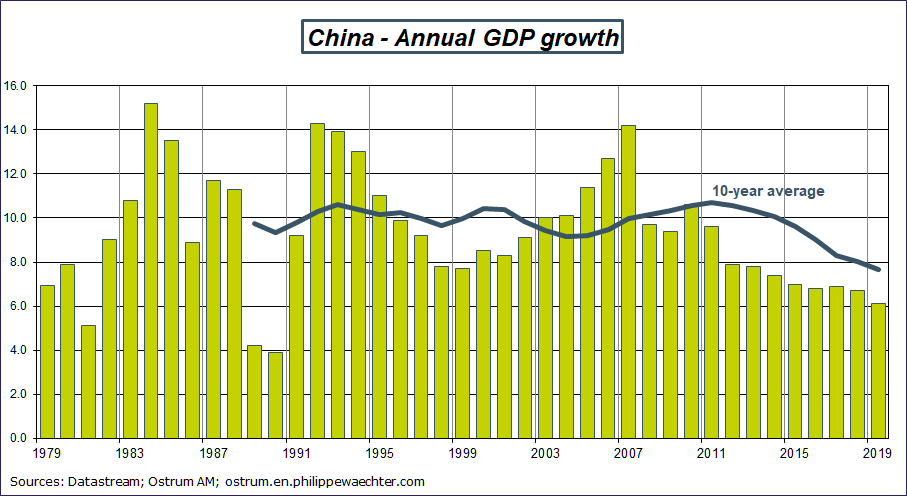

The Chinese growth was at 6.1% in 2019 after 6.7% in 2018.

The Chinese growth will continue to slow in coming years as the services sector is more and more important providing less and less productivity gains.

The detailed version of this post can be downloaded