Activity contracted during the last 3 months of 2019. Growth for 2020 promises to be more difficult.

It will be less than 1% after 1.2% in 2019.

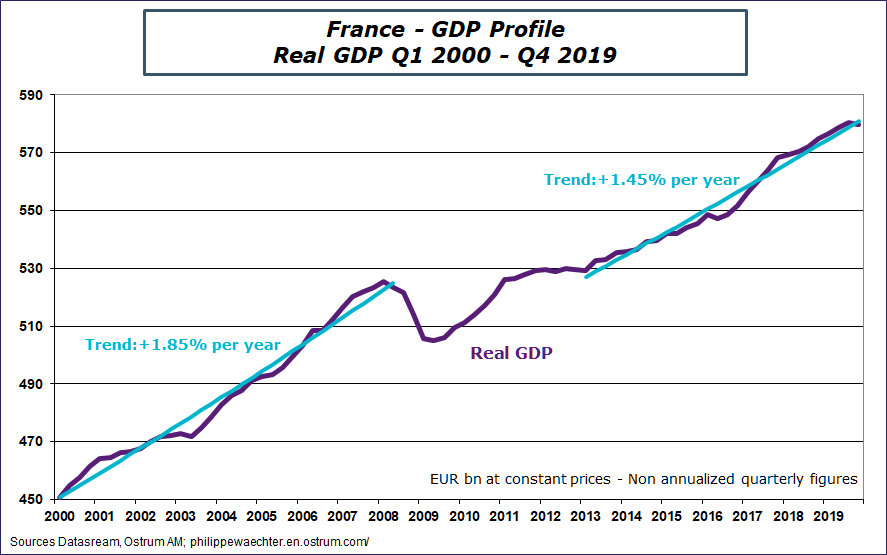

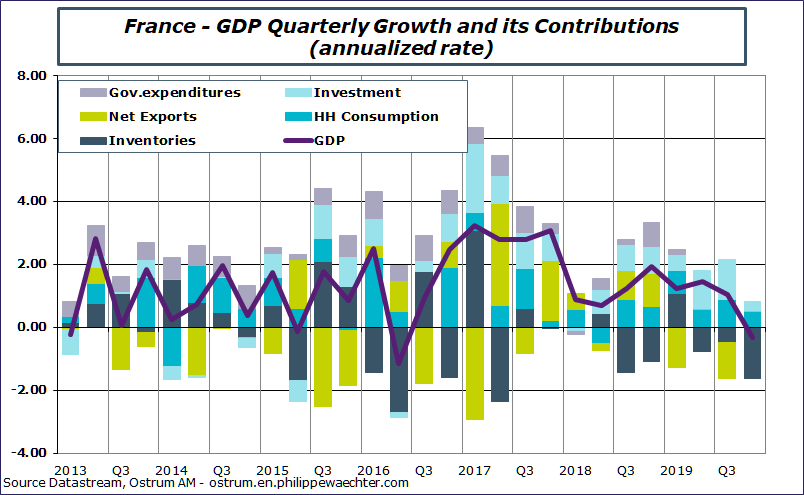

French growth was negative in the last quarter of 2019. It was down -0.3% at annual rate after +1% in Q3. For the whole year, the average growth rate is 1.2% after 1.7% in 2018. The carry-over for 2020 at the end of 2019 is just 0.16%. It’s a very weak start for the new year.

The government expects a 1.3% growth for 2020. This would be need a 1.8% quarterly growth (annual rate) for each quarter of 2020. This is way too high. The quarterly average this year was just 0.85% at annual rate. It would lead to 0.7% growth in 2020. The 2020 GDP growth will be below 1%.

The main reasons for the GDP contraction come from lower inventories and a lower momentum for the domestic demand. This latter has had a 1.6% contribution to GDP quarterly growth vs 3% in 3Q. Lower HH expenditures and lower investment, notably on companies’ side.

Higher uncertainty (local (strike) and international (trade)) has led to a cautious behavior on companies’ side. Inventories are costly when demand decreases so they reduce them and they postpone investment. They want to invest with more positive informations on their environment.

This is a framework for low growth in 2020 not for a recession. But a GDP growth below 1% will lead to meagre improvement on the labor market and a more fragile domestic demand despite a supportive economic policy. The ECB clearly will remain accommodative.

The last point is that if we follow the last government forecast in Germany at 1.1% growth for 2020, then German growth will again be stronger than in France. The cock-a-doodle Doo of 2019 from the French government will definitely be temporary