The supply value chain is broken as a consequence of the Chinese containment. The recovery is slow and the epidemic is not over. Therefore, the global production will decrease. That’s the US bonds’ market message

Data associated with the pre-epidemic period are now worthless. The situation has dramatically changed. For sure, data that show resilience are better for the immediate economic backdrop but is not a guarantee that the economic profile of that specific economy will remain strong.

The US labor report last Friday was of this type. A large number of new jobs shows that the economy is growing at a robust pace. After these figures, the Federal Reserve of Atlanta suggests that the first quarter growth may be at 3.1%, one point above the fourth quarter of 2019.

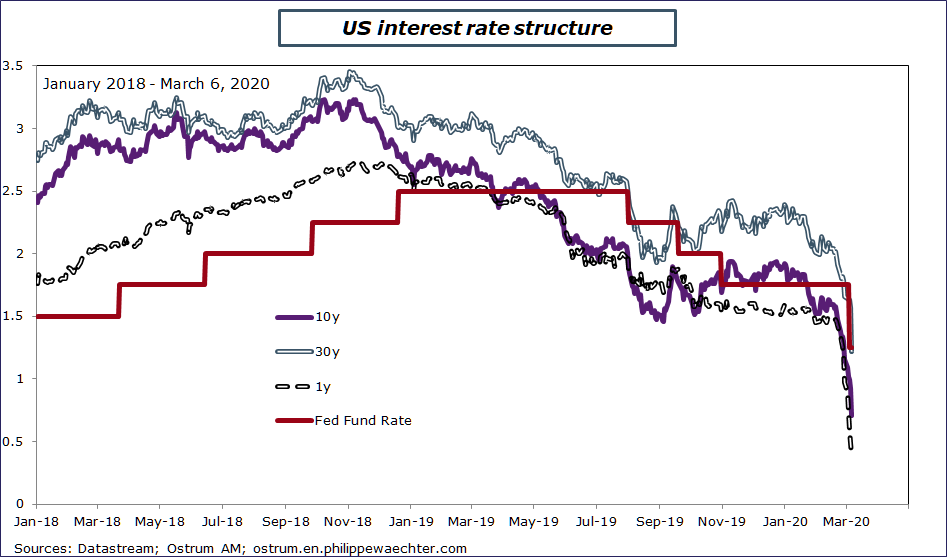

Nevertheless that’s not sufficient to reduce the uncertainty contained in the fall of the interest rates on US TBonds.

Last Friday, the 10 year rate was at 0.7%. It’s its lowest level ever. It was just below 2% at then end of last year. The 30 year rate was at 1.21% also at its lowest and also lower than the top of the Fed’s rate range [1% – 1.25%]. This is probably a signal for a new decrease (50bp) of the Fed’s benchmark rate. The question is to know if the US central bank will wait until its next meeting on March 17/18.

This uncertainty contained in interest rates reflects the dramatic change in the global economy and the global recession that is coming.

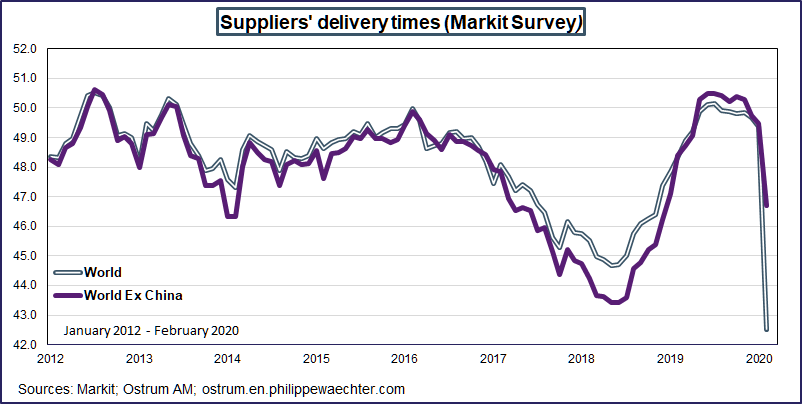

This recession is clearly coming from the coronavirus and China. In February suppliers’ delivery times increased (a drop on the graph) everywhere except in Mexico, the Czech Republic and India. An increase in supplier delivery times means that a company is not able to get on time what it needs to produce its own production. This is a measure of how the supply value chain has been broken. The major consequence is a break in the world trade dynamics. Trade has decreased in February and will continue in March.

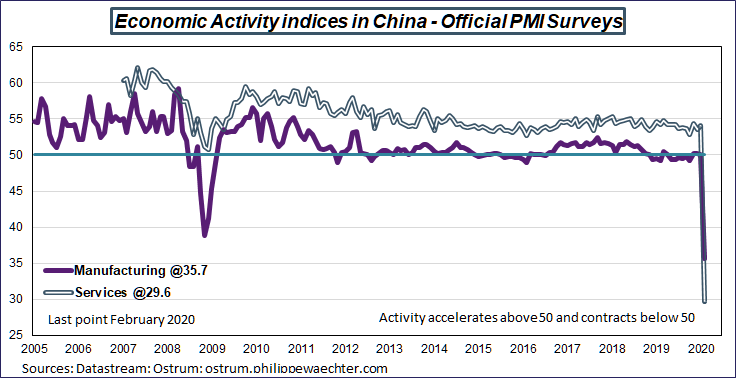

The Chinese manufacturing indices (official or Markit) dropped in February at level never seen before even in the great recession period of November 2009.

This drop in the Chinese production has limited the capacity of other countries to produce. They reduce their inventories in February but will not be able to continue in March and longer if the epidemic lasts. Therefore due to bottlenecks, production will be reduced leading to a recession (see here to measure the importance of China).

In other words, the key point to look at, in coming weeks, is the duration of this epidemic and its contagion all over the world. There is a peak in China on the number of contagious people but it doesn’t mean that the recovery is imminent. An article in the French newspaper, Les Echos, suggests that the utilization rate in factories was closer to 40% than to the targeted 75%.

The containment seen in Italy on 40% of the Italian GDP (Lombardy, Venice and part of Emilia Romagna) is a first measure of contagion, postponing the end of the epidemic. Other countries will probably have the same behavior containing some regions in coming weeks.

Data before the epidemic have therefore a low value.

In this economic backdrop, governments and central banks have to act.

In the US, the Fed has lowered its main interest rate last Tuesday (March 3). It’s now in the [1%-1.25%] range. It was just a way for the Fed to avoid distortions on the yield curve as all the rates on T Bonds were below the fed funds rate. As I mentioned above, they will have to do it again as it’s again the case. The graph is clear on this point (see here).

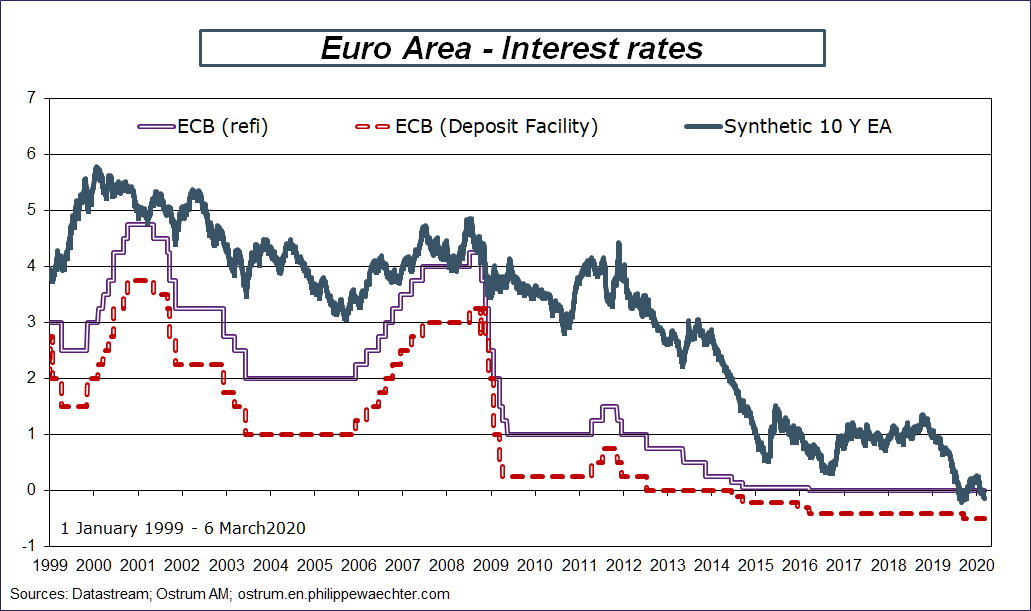

The main question now is on the ECB. The Governors’ meeting this week (March 12) will be important. The situation is different from the one seen in the US. There is no deep drop on rates even if the German rate is now close to its last summer lowest level at -0.7%.

The synthetic rate (weighted rate taking into account all the eurozone countries) is at -0.13%. A level that have been seen last summer and which is in the range of the ECB rates (Refi at 0% and deposit at -0.5%). There is no need to change this range. I do not expect a change in the ECB rates. (see here)

What can be changed is the level of corporate bonds that is purchased by the ECB.

In fact, the main task for a central bank is not to boost the economic activity. As seen above, production is limited and will not be able to respond ta a supplementary demand.

In this period of deep adjustment, the central has to limit the risk of bankruptcies. The Bank of Japan has taken measures in this way last week. The ECB could do the same by increasing its purchase of corporate bonds. It could also adjust or add new elements on the TLTRO in order to be able to add liquidity if necessary.

The ECB meeting will take place at a moment where the US dollar is quite weak and the euro strong.

This reflects the distrust in the US situation characterized by the drop of the long term interest rates.

This opens an important question for the coming weeks.

If there is a global recession, then global indebtedness will matter, notably on the corporate side. In the US, the corporate debt level, as % of GDP, is now above its previous peak in fall 2008. Therefore, what will happen in the US if a distrust appears on the corporate debt? In Europe and in Japan, central banks already purchase corporate debt and are aware that more has to be done. It’s not the case in the US. There is an asymmetric situation here which is not in favor of the US.

The last point to mention is the oil market. Last week, Russia and OPEC met to find a agreement to reduce their production in front of the deep drop in the oil price. It was a way to stabilize it. There was no agreement between the two. More than that, during the week end the Saudi Arabia has decided to add 1 million barrel per day to its production. The Saudi Arabia production will be close to 11 millions bpd. This will push price on the downside. The price could first converge to 30 USD before going lower for the Brent.

The inflation risk is low for the coming months.

Coming statistics this week

Japanese GDP for the fourth quarter of 2019 (-6.3% for the first estimate).

Industrial production figures for January in Germany (9), France, Italy (10), UK (11) and the Euro Area (12).

CPI in China for February (It was at 5.4% in January). (March 10)

CPI in Germany, France, Spain for February (confirmation after the flash estimate (13)) and CPI in the US for February (11)

Employment in France for the fourth quarter (10) and for the Euro Area (10) with the final GDP for the Euro zone in the fourth quarter (10)

German external trade for January (9) and NFIB in the US for February (10)