The risk associated with coronavirus has provoked

the state of emergency declared by the White House,

forcing the Fed to collapse its intervention rate. The fiscal policy will have to be proactive to avoid a too deep recession

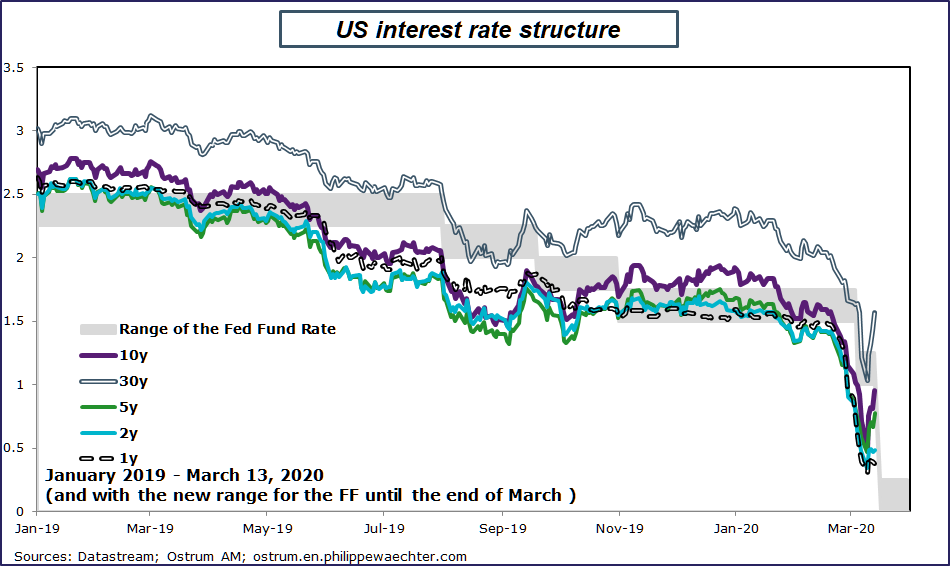

The Federal Reserve just lowered its benchmark rate by 100 basis points. The new fed fund range is now between 0% and 0.25%. At the same time, it is resuming its purchases of T Bonds for USD 500 billion and MBS of agencies (securitization on real estate) for USD 200 billion. In addition, swap agreements with the other major central banks are once again activated in order to guarantee the liquidity of transactions on an international scale and avoid any blockage in international financing.

The American central bank takes into account existing and future ruptures linked to the coronavirus. It wants to create the conditions that will allow the efficient functioning of the financing markets of the US economy with the drop in rates and the already observed increase in the size of repo. It also wants to allow internal credit to continue to function and officially restarts the Quantitative Easing mechanism. Finally, the swap agreements must make it possible to limit the blockages in the financing of world trade in order not to return to a situation close to that of 2008 when world trade had contracted sharply for lack of financing.

The main reason of this move is the risk associated with the epidemic. The situation has accelerated in the United States with the establishment of a state of emergency by the White House and the rapid increase in the number of cases of contamination.

I was expecting 50 basis points before the meeting on Tuesday and Wednesday but the Fed went stronger because of the White House alert state. As in Europe now, it is up to fiscal policy to be active in limiting the risk and taking charge of the decline in activity that is looming in the USA. The likelihood of escaping a US recession is now limited.