Week dominated by the publication of business surveys: Markit (advanced estimate), IFO, INSEE, Istat but also among households (Europe, France, Italy, USA). First measures of the epidemic shock in developed countries.

Strong fall expected

For the world economy, this week is one of all dangers. Companies will deliver their perception of activity in March, most certainly indicating a downward break in activity.

We know so far that the Chinese figure for February had been the most mediocre in recent Chinese history, even beyond the level recorded during the great recession (see The drop in the official Chinese PMI – Is the Global Recession coming ?). And that this decline in activity in China was reflected in all countries of the world, including China, by very long delays in delivery. Chinese factories producing less, factories located in other countries were penalized by these products which did not arrive. Suppliers’ delivery times indices were trending downward everywhere. In February, companies have reduced their inventories to ensure a good level of production. In March, the situation will not be deeply changed in China, the effect of the long delays will be perceived everywhere while many Western countries are now in containment i.e. with significant drops in production.

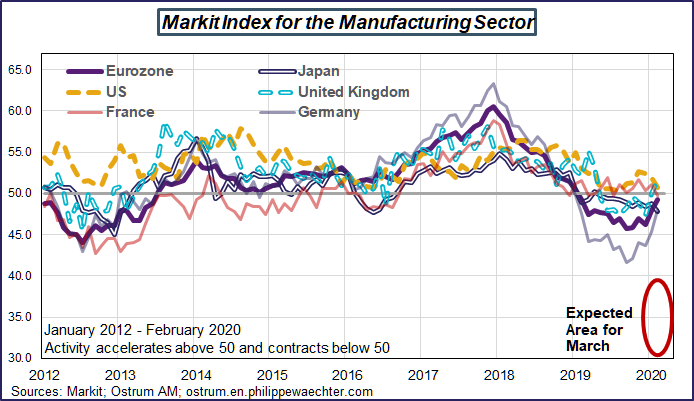

Consequently, the Markit indices which will be published on Tuesday (Japan, Euro Zone, France, Germany, United Kingdom and USA) will plunge.

The red area on the graph should be the one in which indices will be published. It is an area consistent with the figures observed at the time of the Lehman shock. As a reminder, the low points in the manufacturing sector were 31.5 in the USA (January 09), 29.6 in Japan (January), 33.9 in the Euro zone (December 2008), 32.7 in Germany (December), 34.9 in France (December) and 34.5 in the United Kingdom (February 2009).

Such a shock is consistent with what has been observed in China on the Caixin index for Markit. The index was 40.3 in February against 40.9 in November 2009. The shock could be stronger if we refer to the official PMI index which was 35.7 in February of this year and 38.8 in November 2009.

The shock will be severe in the manufacturing sector, but it will not be compensated for in the services sector. Many components of services were penalized in March, notably air transport or trade

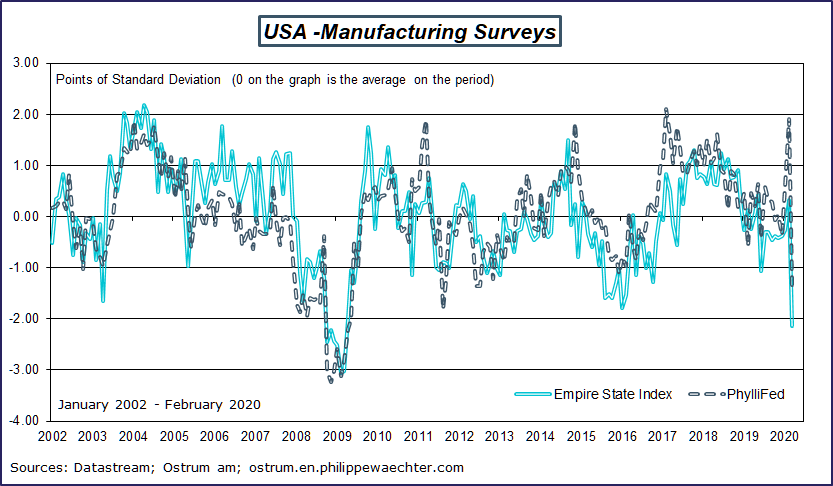

The advanced indices of the Markit survey will be released Tuesday March 24. Other major surveys will be published pending that of the ISM of the manufacturing sector in the USA on April 1 (the surveys of the New York Fed and that of Philadelphia for March are very degraded).

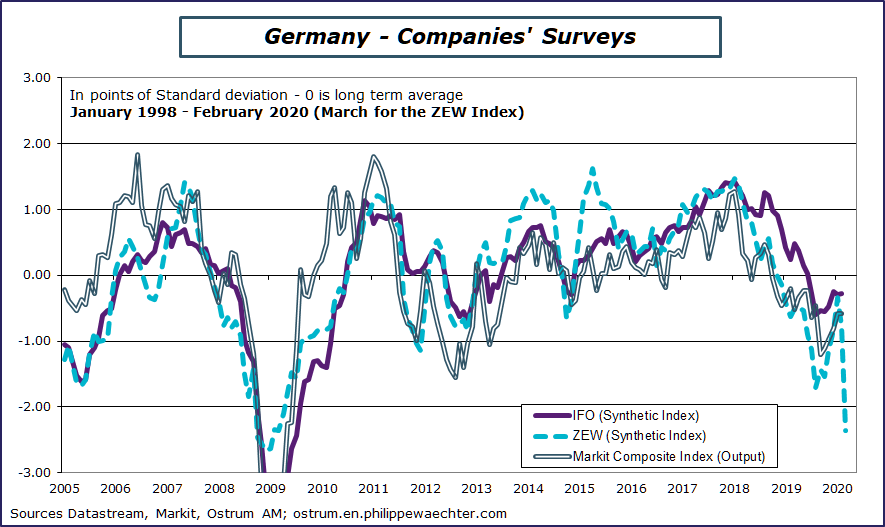

The IFO survey in Germany will be published on March 25. If its pace is consistent with that of the ZEW, the decline should be large, probably around 10 points for the synthetic index.

The business climate in France will be published on March 26. This indicator and its components, which have been significantly above their long-term average since mid-2016, should plunge significantly below it in March.

On March 27, the business confidence indexes (Istat), for March in Italy, will be published. It will be after almost a month of confinement. This will provide a life-size image of the effect of this in a European country.

The same day we will have the confidence of Italian consumers. For the same reasons it will be fascinating.

On the consumer side, the European consumer confidence index will be released on March 23 and that of France will be published on the 27th. This will most certainly be significantly below its long-term average. The final University Confidence Index for the University of Michigan will also be released on March 27.

We will thus have a more direct vision of the consequences of the epidemic and confinement on the economic situation.

The other figures to be released this week (Consumption in the USA for February, retail sales in February in the United Kingdom, durable goods’ orders in the USA, or the CFNAI in the US for February (my favorite short-term index) will represent a past that no longer exists.