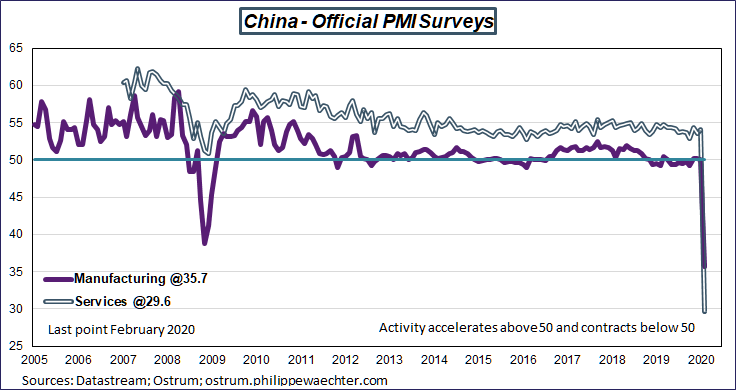

The PMI survey for the manufacturing sector dropped to 35.7 in February, way below the weakest recorded number during the 2008 financial crisis. The index was at 38.8 in November 2008.

The index for the services sector was down to 29.6.

The drop recorded in February is not a surprise but the question was on its level. Levels in both indices show that the quarantine measures taken by the government have been followed.

The question now is how the situation will change in coming weeks. According to Bloomberg Economics survey, Chinese factories were operating at 60 to 70% of capacity this week. Companies have restarted their activity but this doesn’t mean that they will converge rapidly to full capacity.

As the number of contaminated people is slowing down the activity will probably slowly improve in coming weeks. But the March surveys will probably be higher but remaining below 50. In 2008, the December index was just at 41.2.

The GDP growth will drop in the first quarter of 2020, probably around 2 percentage points (To 4%? in the first quarter? ) if we compare with 2008. In the fourth quarter of 2008, the GDP yearly growth was at 7.1 after 9.5% in the third quarter before dropping to 6.4% in the first quarter of 2009.

The negative shock will be persistent and the negative impact on the world economy will be much larger than the -0.1% expected by the IMF.

The other question is on the spillover effect on other Asian countries. Most of them depends on the Chinese momentum. We’ve seen that the Japanese February index for the manufacturing sector (flash estimate) was at its lowest since December 2012.

The last point is that we now have a measure of the negative impact of the coronavirus on the economic activity. It increases the risk of a global recession as Chinese imports represent 11% of world imports. At this moment, we cannot expect a coordinated economic policy at the global scale as many countries, US first, do not want to be involved in this type of policy.