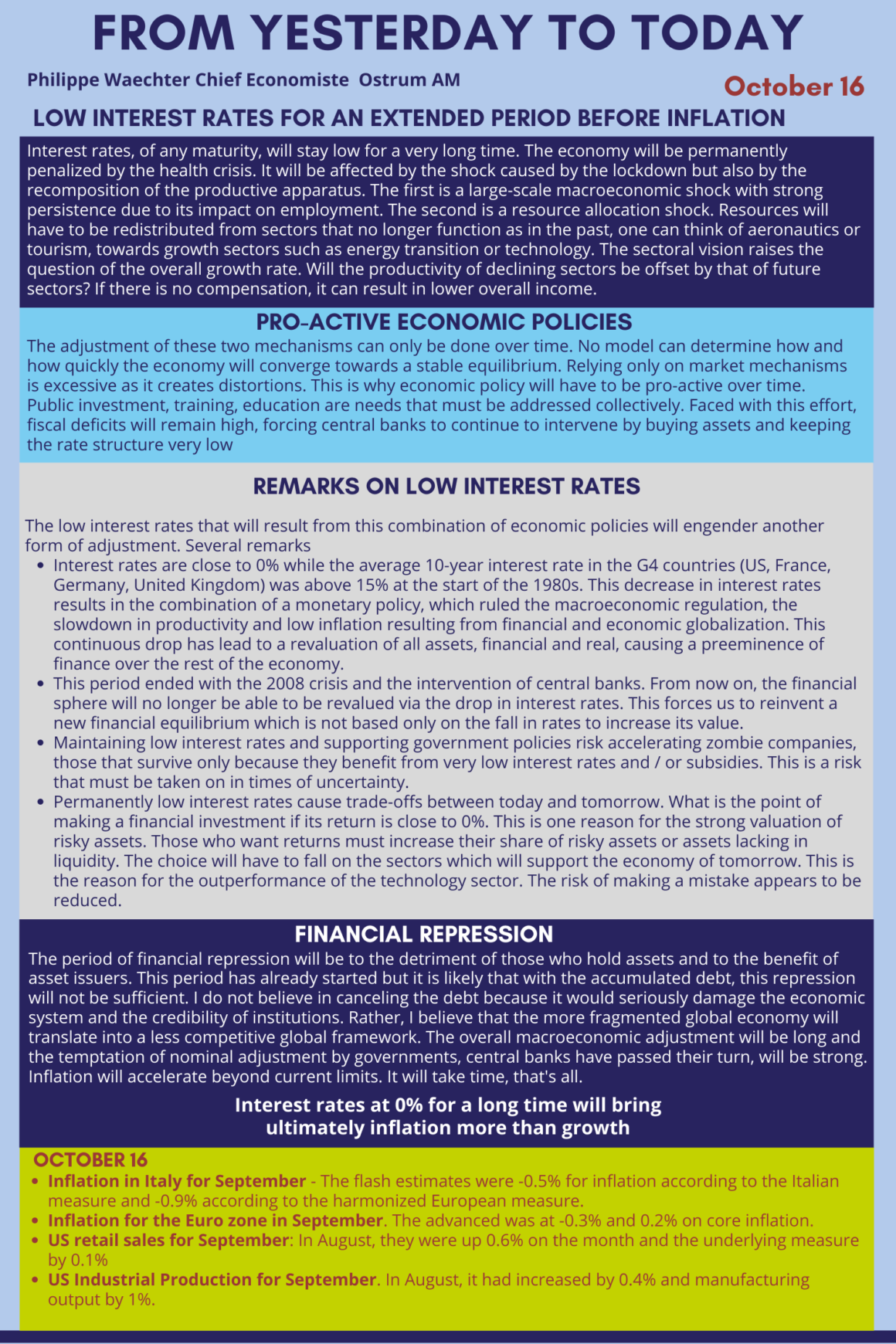

Low interest rates reflect the combination of fiscal and monetary policies. This is already translating into severe financial repression. Governments, more than central banks, will have an interest in a nominal adjustment to regain room for maneuver. This will cause more inflation.

Interest rates, of any maturity, will stay low for a very long time. The economy will be permanently penalized by the health crisis. It will be affected by the shock caused by the lockdown but also by the recomposition of the productive apparatus. The first is a large-scale macroeconomic shock with strong persistence due to its impact on employment. The second is a resource allocation shock. Resources will have to be redistributed from sectors that no longer function as in the past, one can think of aeronautics or tourism, towards growth sectors such as energy transition or technology. The sectoral vision raises the question of the overall growth rate. Will the productivity of declining sectors be offset by that of future sectors? If there is no compensation, it can result in lower overall income.

Pro-active economic policies

The adjustment of these two mechanisms can only be done over time. No model can determine how and how quickly the economy will converge towards a stable equilibrium. Relying only on market mechanisms is excessive as it creates distortions. This is why economic policy will have to be pro-active over time.

Public investment, training, education are needs that must be addressed collectively. Faced with this effort, fiscal deficits will remain high, forcing central banks to continue to intervene by buying assets and keeping the rate structure very low.

Remarks on low interest rates

The low interest rates that will result from this combination of economic policies will engender another form of adjustment. Several remarks

- Interest rates are close to 0% while the average 10-year interest rate in the G4 countries (US, France, Germany, United Kingdom) was above 15% at the start of the 1980s. This decrease in interest rates results in the combination of a monetary policy, which ruled the macroeconomic regulation, the slowdown in productivity and low inflation resulting from financial and economic globalization. This continuous drop has lead to a revaluation of all assets, financial and real, causing a preeminence of finance over the rest of the economy.

- This period ended with the 2008 crisis and the intervention of central banks. From now on, the financial sphere will no longer be able to be revalued via the drop in interest rates. This forces us to reinvent a new financial equilibrium which is not based only on the fall in rates to increase its value.

- Maintaining low interest rates and supporting government policies risk accelerating zombie companies, those that survive only because they benefit from very low interest rates and / or subsidies. This is a risk that must be taken on in times of uncertainty.

- Permanently low interest rates cause trade-offs between today and tomorrow. What is the point of making a financial investment if its return is close to 0%. This is one reason for the strong valuation of risky assets. Those who want returns must increase their share of risky assets or assets lacking in liquidity. The choice will have to fall on the sectors which will support the economy of tomorrow. This is the reason for the outperformance of the technology sector. The risk of making a mistake appears to be reduced.

Financial Repression

The period of financial repression will be to the detriment of those who hold assets and to the benefit of asset issuers. This period has already started but it is likely that with the accumulated debt, this repression will not be sufficient. I do not believe in canceling the debt because it would seriously damage the economic system and the credibility of institutions. Rather, I believe that the more fragmented global economy will translate into a less competitive global framework. The overall macroeconomic adjustment will be long and the temptation of nominal adjustment by governments, central banks have passed their turn, will be strong. Inflation will accelerate beyond current limits. It will take time, that’s all.

Interest rates at 0% for a long time will bring

ultimately inflation more than growth

________________________________________

A infographic that can be downloaded