The new measures on containment / curfew will influence the momentum of the activity. The uncertainty will create a wait-and-see attitude. Nothing to do with the general containment of the spring but these measures will limit the growth impulse at the risk of having a negative variation in activity in the last quarter of this year. This reinforces the risk of deflation as monetary policy has become conditioned by government policy, the only one capable of stimulating demand.

The containment / curfew measures adopted in many European countries call into question the dynamics of the recovery. After the second quarter broke down and the summer caught up, the last quarter of 2020 was expected to be the start of convergence towards more normalized growth. Insee, the French statistical institute, expected a quarterly growth of 1% in its economic report of September 8. Due to the increase in the number of infected, on October 6 this figure was lowered to 0%. Since, due to the implementation of restrictive measures in France, Germany, Spain, Italy and Great Britain, it is likely that the figures will be negative for the last 3 months of the year.

The situation is not specific to Europe. A third rise in the number of contaminated people is emerging in the USA. Developed countries could thus all have a discontinuity in the recovery.

The renewed uncertainty will lead to more caution, the constraints imposed on the catering, leisure and tourism sectors will weigh on turnover and therefore on the level of activity. This will not encourage households to reduce their savings. As the recent note from the French Conseil d’Analyse Economique suggested, keeping savings at a high level after the lockdown was done by high-income households who no longer had as much social spending. This phenomenon observed since the release of containment could strengthen and limit global demand.

Moreover, the renewed uncertainty will not encourage companies to rush into investment spending. These phenomena, which can be observed in the main European countries, will become stronger because trade between all these countries will be in a reduced mode. No internal or external impetus from the main trading partners within Europe is a situation conducive to a contraction in activity in the last quarter of 2020. I expect -0.5% in France and for the Euro zone.

The macroeconomic impact

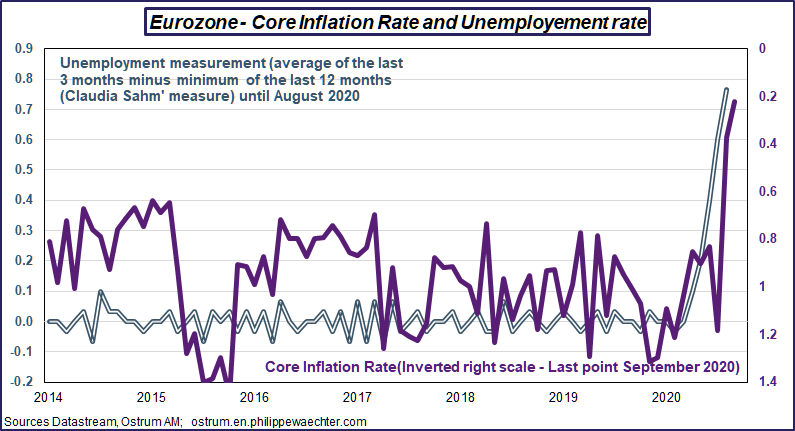

The downturn in activity and postponed growth normalization will result in a deterioration of the labor market and an increase in the unemployment rate. With regard to the graph, deflationary pressures will increase. In detail that the sectors most affected by sanitary measures are also those for which the price dynamic is the most fragile. Core inflation could therefore continue to deteriorate when it is already at an all-time low of 0.2% in September. Deflationary pressures could also increase due to the low oil price level since demand of oil is less strong.

The negative contribution of energy will remain negative. We are awaiting in the coming days information on OPEC’s strategy but we have already seen that the drop in production in the USA has not made it possible to start the price up again.

A degraded macroeconomic scenario

The labor market in which the bargaining power of employees is degraded due to the increase in the unemployment rate combined with a very low underlying inflation rate will result in very low wage increases. This will create the risk of a dynamic deflationary. The normalization of growth which would be postponed in time.

This phenomenon is all the more worrying given that, in the surveys, households wish to save more. These indicators are, in the euro zone, at their all-time high. This weakens the demand dynamic and reinforces the deflationary character of the current period.

What economic policy?

In an interview with the Greek newspaper Kathimerini, Fabio Panetta, of the ECB, indicates that the economic situation and the behavior of the ECB are conditioned by the evolution of the pandemic. In view of the current evolution of the epidemic, the return to the pre-crisis situation would be longer than expected.

It probably won’t be 2022. This point is all the more annoying as Panetta anticipates that inflation could be below the ECB’s forecast. However, this one frankly no longer has ammunition. It will have to increase the amount of asset purchases but cannot do more. It will support fiscal policy. This will be, to stimulate demand, the right instrument to avoid deflation.

_____________________________________________

Here is an infographic of the post that can be downloaded