The Chinese economy is normalizing. The health alert phase has passed and growth is resuming. It is rather self-centered and is no longer a source of strong impetus for the rest of the world. This will create new imbalances with the USA and Europe and will lead to new tensions. The health crisis has accentuated the disparities. A new balance is rapidly emerging.

The Chinese economy is turning the page on the pandemic, growth is back. Vigilance is maintained to avoid any return of the virus, but behavior is returning to pre-Covid crisis.

Two indicators on this point: the number of hours worked has returned to its pre-crisis level. Discussions on the supply side momentum are therefore resolved. The other indicator concerns the expenses associated with social interactions (restaurant, alcohol, cigarettes, etc.). They are comparable to those before the crisis. This is a strong signal from Chinese households. They no longer hesitate to go out because the uncertainty linked to the epidemic has clearly reduced. The Chinese lockdown has been very hard and potentially remains so, but this shows that once the situation is under control, the dynamic can return as before the crisis.

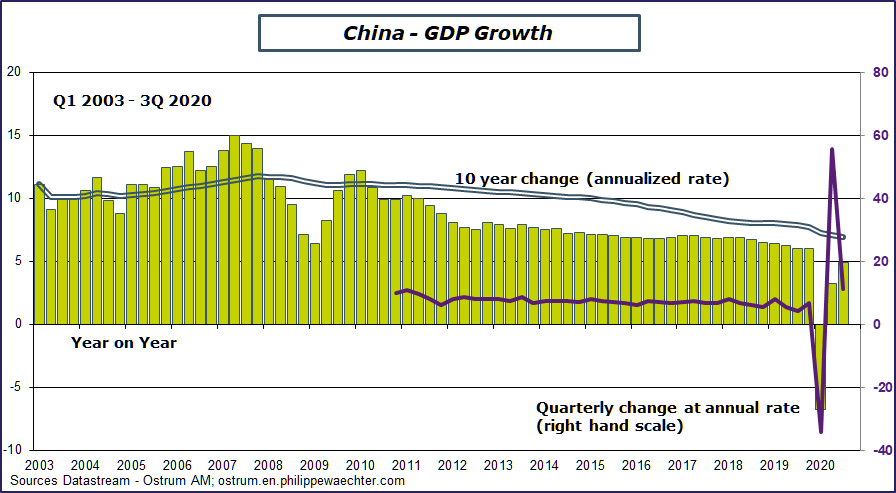

The Chinese growth momentum

Growth was 4.9% over one year in the third quarter of 2020. Over the quarter, GDP increased by 2.7% (non-annualized rate, 11.25% annualized) after 11.7% in the second quarter (56% annualized rate) and -10% over the first 3 months of the year (-34% at an annualized rate).

Since the start of the year, the average growth has been only 0.7%. If the expansion continues during the months of October to December, then for the year as a whole, the Chinese economy would grow between 2 and 3%. This upward movement is expected to continue into 2021. Let us recall that in the IMF’s forecasts for October 2020, China is the only economy which has a higher level of GDP in 2021 than in 2019 (pre-crisis level). China is the sole contributor that allows world GDP to be comparable. to that of 2019.

Some Benchmarks

In the recovery phase of the Middle Kingdom economy, we first witness a catch-up in production before observing an accelerating recovery of private demand in the third quarter. Industrial production is up 1.2% year-to-date compared to 2019 while retail sales continue to contract since the beginning of the year.

This suggests that public demand and infrastructure investments have been strong over the period. This is indeed what we see as consistent with the increase in indebtedness of local governments and public enterprises (SEO). Here is a replica of what happened after the 2009 financial crisis but on a lesser scale. Debt continues to rise, however.

It also suggests that the Chinese have managed to export heavily and maintain an external balance surplus. This is the other key to explaining the behavior of the Chinese economy. Exports grew strongly while imports had a more limited dynamic. China has not been a source of impetus for the global economy, contrary to what was observed after 2009. Purchases were more targeted. Brazil took advantage of it on iron ore, the USA on agricultural products … but there were no purchases at all costs.

The Labor market momentum

The labor market has been very dynamic since the start of the year. The number of jobs created is almost, after 9 months, on the objective of 9 million which had been set. This dynamic of the labor market has also reflected the desire to develop activity internally (extensive productivity) rather than to import. Here we find the often mentioned idea of a more self-centered Chinese strategy. In this labor market, the number of internal migrants has returned to a level close to before the crisis. The economy is back on track and income is increasing.

The normalization of growth is also reflected in a fall in the savings rate in the third quarter. This should continue and allow the economy to find a source of rapid internal expansion in private demand over the next few months.

A new equilibrium

The Chinese situation is normalizing and the economy will return in 2022 to the growth norm of between 5 and 6%. In the meantime, its rather self-centered mode of development will cause difficulties in the rest of the world because the Middle Empire will not be the source of impetus that could have expected.

This will cause tensions with the rest of the world, which is still looking for the recipe to find a more robust dynamic. Tensions with the USA, even if Joe Biden is elected, and with Europe will be high.

It’s a leadership issue.

The health crisis has really accelerated the transitions.

_______________________________________________

This post is available in infographic that can be downloaded