The 10-year interest rates in the USA and in the Euro zone now look divergent. The rate differential has widened by 20 to 30 basis points between the US and Germany since the start of October. This phenomenon reflects divergent expectations between Europe and the United States, in particular on the ability to revive the economy while the risk of epidemics is returning strongly in Europe.

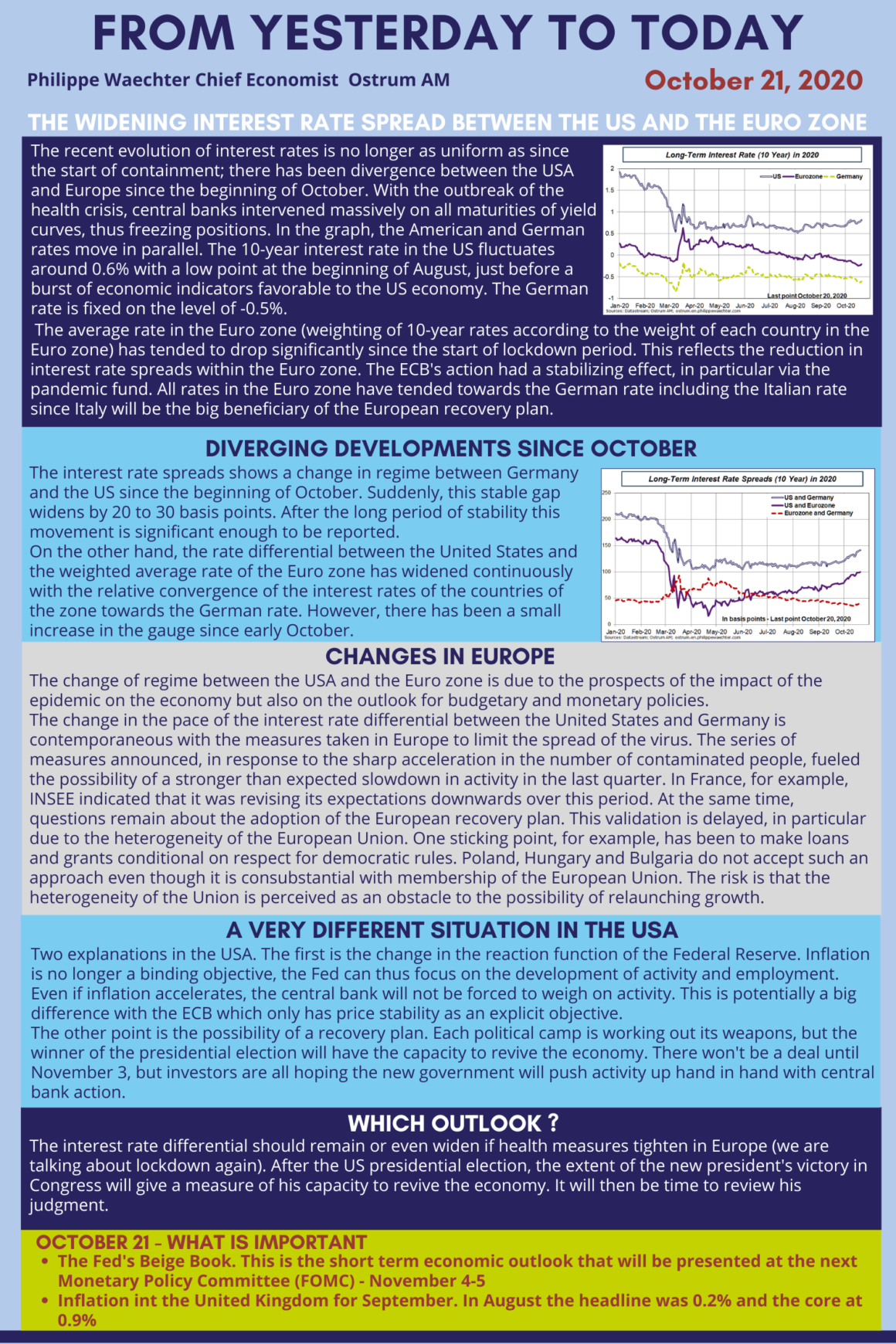

The recent evolution of interest rates is no longer as uniform as since the start of containment; there has been divergence between the USA and Europe since the beginning of October. With the outbreak of the health crisis, central banks intervened massively on all maturities of yield curves, thus freezing positions. In the graph, the American and German rates move in parallel. The 10-year interest rate in the US fluctuates around 0.6% with a low point at the beginning of August, just before a burst of economic indicators favorable to the US economy. The German rate is fixed on the level of -0.5%.

The average rate in the Euro zone (weighting of 10-year rates according to the weight of each country in the Euro zone) has tended to drop significantly since the start of lockdown period. This reflects the reduction in interest rate spreads within the Euro zone. The ECB’s action had a stabilizing effect, in particular via the pandemic fund. All rates in the Euro zone have tended towards the German rate including the Italian rate since Italy will be the big beneficiary of the European recovery plan.

Diverging developments since October

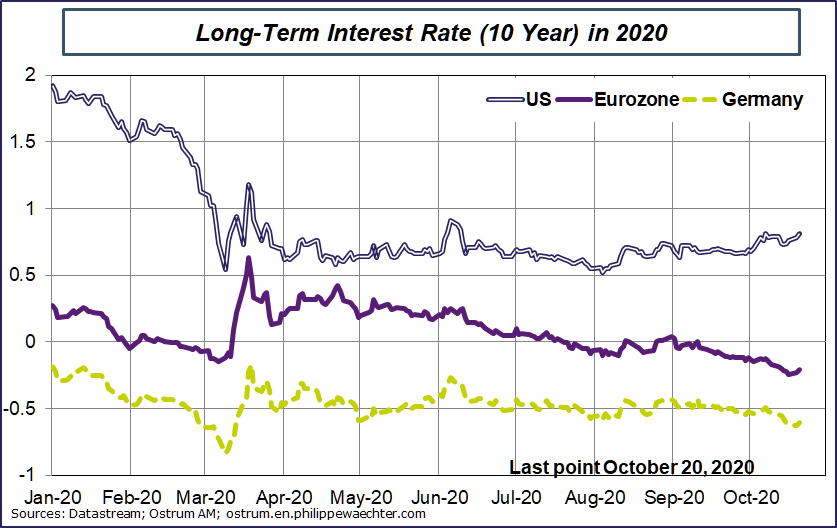

The interest rate spreads shows a change in regime between Germany and the US since the beginning of October. Suddenly, this stable gap widens by 20 to 30 basis points. After the long period of stability this movement is significant enough to be reported.

On the other hand, the rate differential between the United States and the weighted average rate of the Euro zone has widened continuously with the relative convergence of the interest rates of the countries of the zone towards the German rate. However, there has been a small increase in the gauge since early October.

Changes in Europe

The change of regime between the USA and the Euro zone is due to the prospects of the impact of the epidemic on the economy but also on the outlook for budgetary and monetary policies.

The change in the pace of the interest rate differential between the United States and Germany is contemporaneous with the measures taken in Europe to limit the spread of the virus. The series of measures announced, in response to the sharp acceleration in the number of contaminated people, fueled the possibility of a stronger than expected slowdown in activity in the last quarter. In France, for example, INSEE indicated that it was revising its expectations downwards over this period. At the same time, questions remain about the adoption of the European recovery plan. This validation is delayed, in particular due to the heterogeneity of the European Union. One sticking point, for example, has been to make loans and grants conditional on respect for democratic rules. Poland, Hungary and Bulgaria do not accept such an approach even though it is consubstantial with membership of the European Union. The risk is that the heterogeneity of the Union is perceived as an obstacle to the possibility of relaunching growth.

A very different situation in the USA

Two explanations in the USA. The first is the change in the reaction function of the Federal Reserve. Inflation is no longer a binding objective, the Fed can thus focus on the development of activity and employment. Even if inflation accelerates, the central bank will not be forced to weigh on activity. This is potentially a big difference with the ECB which only has price stability as an explicit objective.

The other point is the possibility of a recovery plan. Each political camp is working out its weapons, but the winner of the presidential election will have the capacity to revive the economy. There won’t be a deal until November 3, but investors are all hoping the new government will push activity up hand in hand with central bank action.

Which Outlook ?

The interest rate differential should remain or even widen if health measures tighten in Europe (we are talking about lockdown again). After the US presidential election, the extent of the new president’s victory in Congress will give a measure of his capacity to revive the economy. It will then be time to review his judgment.

____________________________________________

This post is available in infographic and can be downloaded