Household savings increased dramatically during the health crisis at the risk, by reducing demand, of slowing the recovery in activity and employment. Everyone is reassured by saving but creates the risk of causing a recession (paradox of saving). The increased health risk revives the savings machine, postponing the possible positive effect of the stimulus plan.

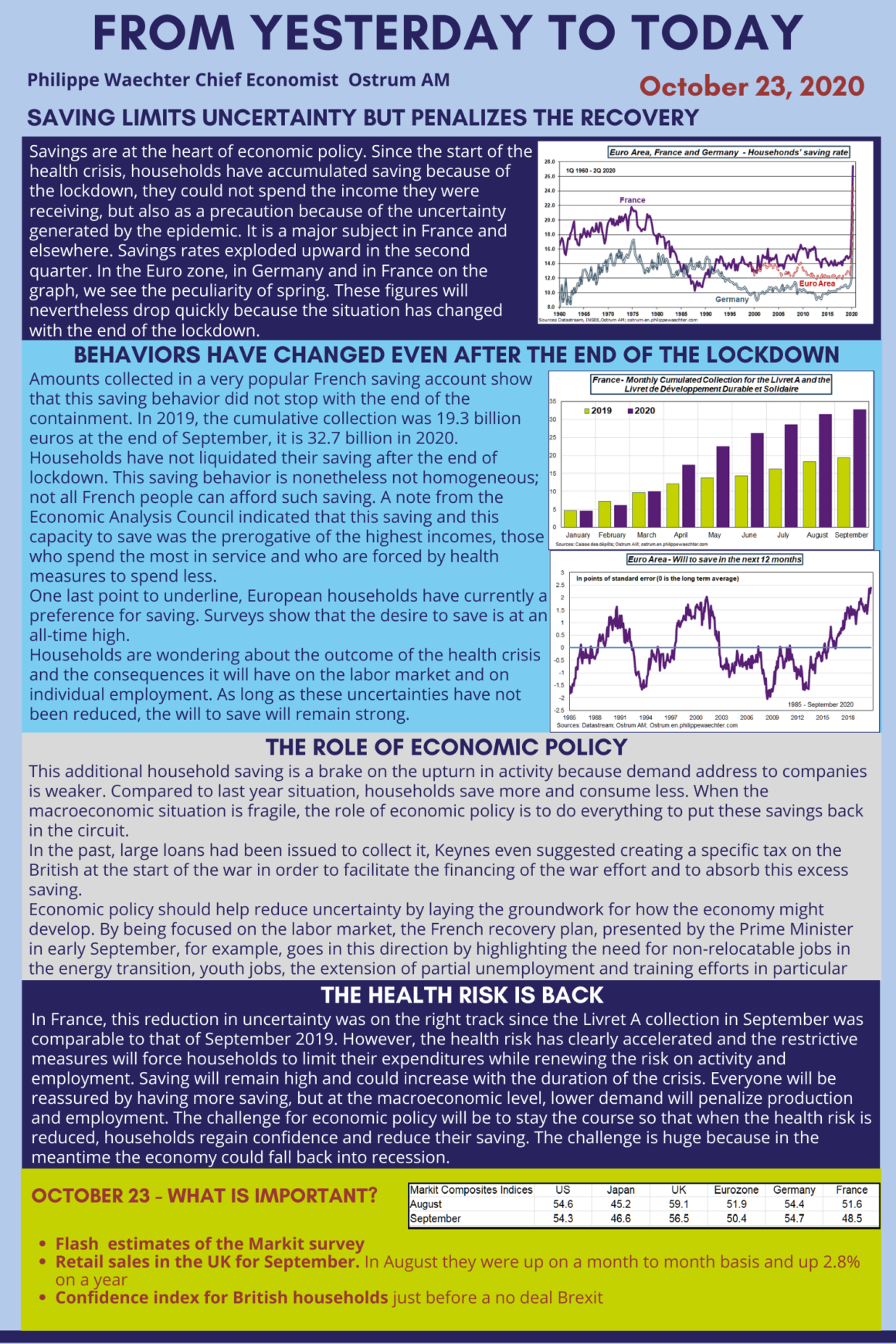

Savings are at the heart of economic policy. Since the start of the health crisis, households have accumulated saving because of the lockdown, they could not spend the income they were receiving, but also as a precaution because of the uncertainty generated by the epidemic. It is a major subject in France and elsewhere. Savings rates exploded upward in the second quarter. In the Euro zone, in Germany and in France on the graph, we see the peculiarity of spring. These figures will nevertheless drop quickly because the situation has changed with the end of the lockdown.

Behaviors have changed even after the end of the lockdown

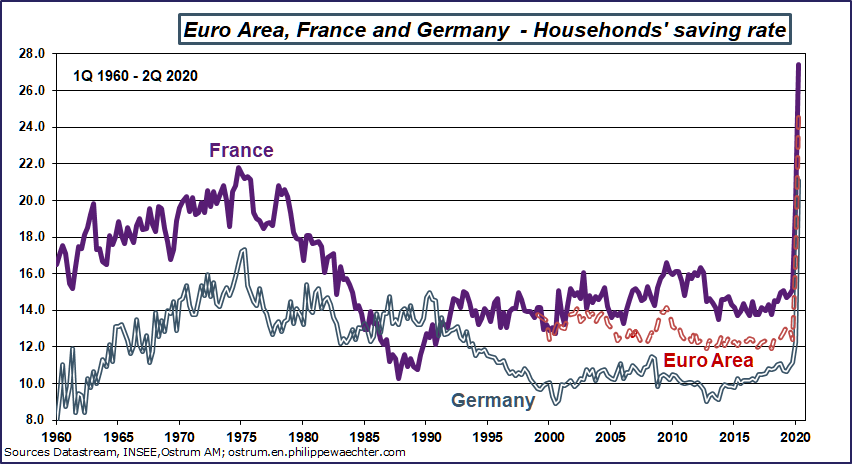

Amounts collected in a very popular French saving account show that this saving behavior did not stop with the end of the containment. In 2019, the cumulative collection was 19.3 billion euros at the end of September, it is 32.7 billion in 2020. Households have not liquidated their saving after the end of lockdown. This saving behavior is nonetheless not homogeneous; not all French people can afford such saving. A note from the Economic Analysis Council indicated that this saving and this capacity to save was the prerogative of the highest incomes, those who spend the most in service and who are forced by health measures to spend less.

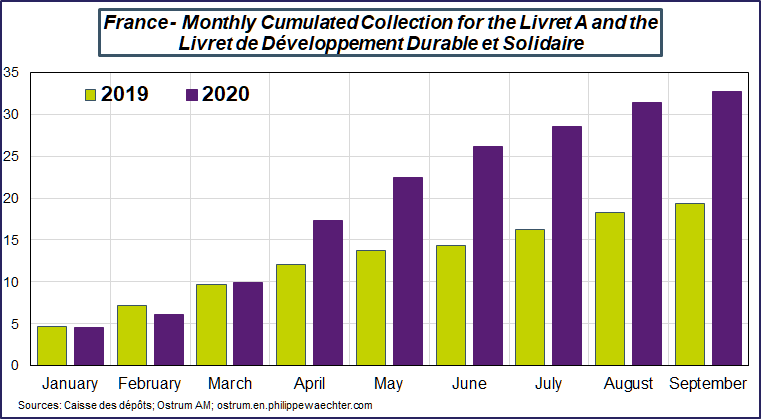

One last point to underline, European households have currently a preference for saving. Surveys show that the desire to save is at an all-time high.

Households are wondering about the outcome of the health crisis and the consequences it will have on the labor market and on individual employment. As long as these uncertainties have not been reduced, the will to save will remain strong.

The role of economic policy

This additional household saving is a brake on the upturn in activity because demand address to companies is weaker. Compared to last year situation, households save more and consume less. When the macroeconomic situation is fragile, the role of economic policy is to do everything to put these savings back in the circuit.

In the past, large loans had been issued to collect it, Keynes even suggested creating a specific tax on the British at the start of the war in order to facilitate the financing of the war effort and to absorb this excess saving.

Economic policy should help reduce uncertainty by laying the groundwork for how the economy might develop. By being focused on the labor market, the French recovery plan, presented by the Prime Minister in early September, for example, goes in this direction by highlighting the need for non-relocatable jobs in the energy transition, youth jobs, the extension of partial unemployment and training efforts in particular

The health risk is back

In France, this reduction in uncertainty was on the right track since the Livret A collection in September was comparable to that of September 2019. However, the health risk has clearly accelerated and the restrictive measures will force households to limit their expenditures while renewing the risk on activity and employment. Saving will remain high and could increase with the duration of the crisis. Everyone will be reassured by having more saving, but at the macroeconomic level, lower demand will penalize production and employment. The challenge for economic policy will be to stay the course so that when the health risk is reduced, households regain confidence and reduce their saving. The challenge is huge because in the meantime the economy could fall back into recession.

__________________________________________________________

This post is available as infographic and can be downloaded