At the central bank meetings this week, the change in tone and the measures announced have essentially reflected the end of macroeconomic catching-up. GDP has converged to a level equivalent to or greater than before the pandemic and the employment momentum is robust everywhere. It is no longer necessary to have ultra-accommodating monetary policies, the central banks validate the end of this episode.

The measures announced

The first step in the USA and in the Euro zone is to reduce the supply of liquidity put in place to deal with the health crisis. The Federal Reserve is reducing its asset purchases and this process, which will end in March, is faster than what was initially announced. The ECB stops the PEPP, the special asset purchase program to deal with the pandemic, in March 2022 but will partially compensate by a temporary increase in purchases within the usual framework of quantitative easing.

In the United Kingdom, the Bank of England started normalization with a reduced increase of 15 bp in its benchmark rate to 0.25% but without affecting the amount of its asset purchases.

What to expect on interest rates?

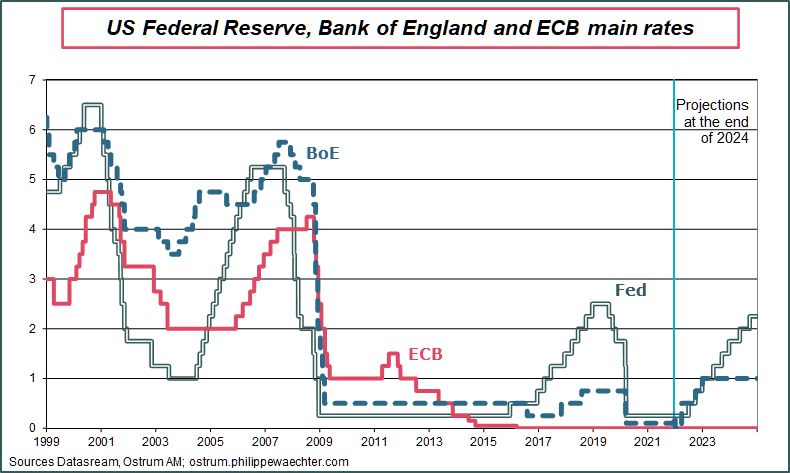

The Fed has indicated that it could hike interest rates 3 times in 2022, 3 times in 2023 and 2 times in 2024. This would result in a range of [2%; 2.25%] at the end of 2024. The pace of the rise in US rates is similar to that observed after December 2015, very slow and without magnitude. If it follows this profile, the Fed will not gain leeway to manage the next crisis.

In the United Kingdom, if we follow the projections published in November but which the Monetary Policy Committee followed in December, the reference rate could tend towards 1% in 2024, i.e. a rate level that has not been observed since. end of 2008 !!!!

The ECB has not said anything about the pace of interest rates. However, the projection of an inflation rate below target in 2024 suggests that the ECB is not in a hurry to hike interest rates.

What macroeconomic scenario for central banks?

The three central banks share the same macroeconomic scenario. With the exception of the Omicron variant, all consider that growth is solid and that inflation will hit a high in 2022 before converging towards the 2% target. In this scheme, none of the central banks wish to take the risk of destabilizing activity. Neither wants to weigh on inflation quickly because the measures that could potentially weigh on price adjustment will be taken after the inflation peak.

Central banks remain dependent on government policies

The central banks are stuck on the same macroeconomic scenario, do not wish to weigh on the economy or on inflation. They all recognize that during the next crisis, they will always have accommodating policies and that their action will then be conditioned, once again, by that of the governments.

* * *