The Bank of England raised its benchmark interest rate by 25 basis points to 0.5%. The trend is still bullish for the next meeting since 4 members of the monetary policy committee had voted for an increase of 50 basis points.

The ECB, on the other hand, remained in line with the announcements made in December on the reduction of asset purchases and on the stability of interest rates. The probability of an interest rate hike is reduced for 2022 in view of the press release. For the moment there is no urgency since the underlying inflation rate is moderate just a little above the ECB’s target of 2%.

Meanwhile, the US Federal Reserve is stepping up and accelerating the implementation of a restrictive monetary policy. The end of the pandemic-specific asset purchase program will take place in March, the first rate hike will occur at the same time and then in June the US central bank will start to reduce the size of the balance sheet.

Two remarks on the different monetary strategies. The first explains the divergence in behavior, the second takes the opposite view.

Remark 1

Central banks face different situations and therefore respond in specific ways.

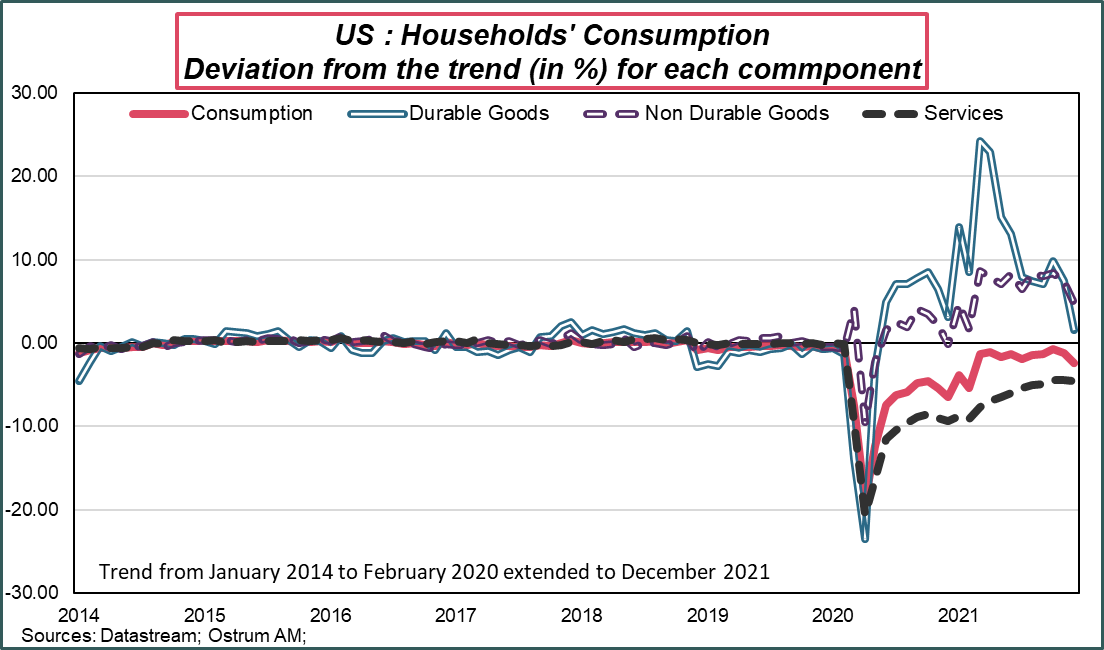

The starting point is the Biden stimulus and the distribution of “helicopter money” in March 2021 by the White House. This creates an exceptional shock on the goods market as shown in the first graph.

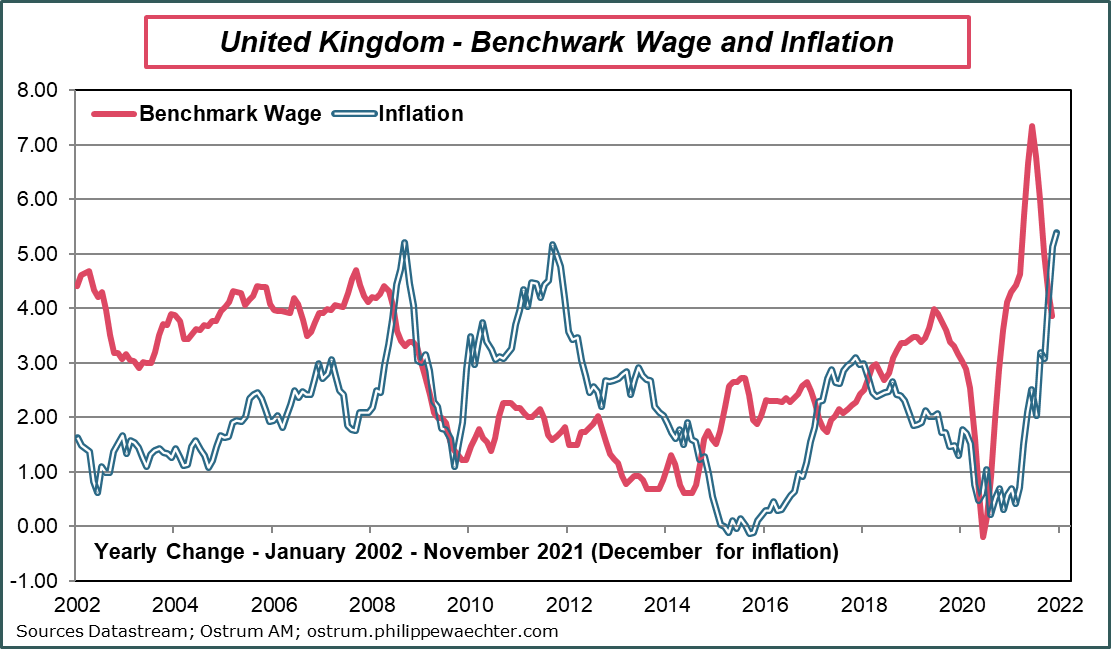

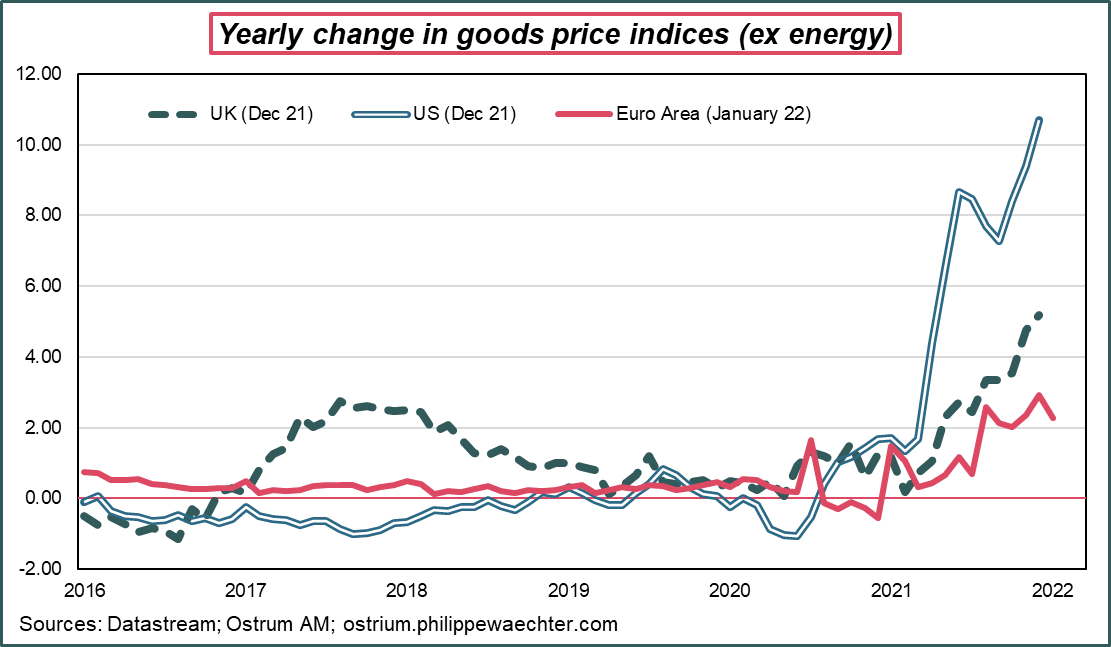

The consequence in the US is an exceptional rise in the price of non-energy goods. In the euro zone, the absence of a similar stimulus does not cause the same tensions. In addition, the large European market allowed adjustments without excessive tensions. In the United Kingdom, the increase in wages during the recovery was large and prices are now catching up. The inflation rate was 5.4% in December and the BoE is expecting close to 7.5% in the spring. The British are paying for their isolation with a labor market that is no longer as competitive or as open as it once was.

The consequence of these three particular situations is a major divergence on the price of goods (ex energy); very strong in the US as a result of the spectacular recovery, significant in the United Kingdom due to the rise in wages but moderate in the Euro zone in the absence of recovery and with a virtuous global adjustment.

Given these data and the source of the shock resulting from the US stimulus, it is normal that monetary policies are not similar. It would not be desirable for the ECB to constrain the internal market of the euro zone in the absence of additional tensions. On the other hand, the Americans and the English are forced to do so to reduce existing tensions. The ECB is therefore legitimate to maintain low interest rates and not to tighten its monetary strategy beyond the elements purely linked to the health crisis (PEPP).

Remark 2

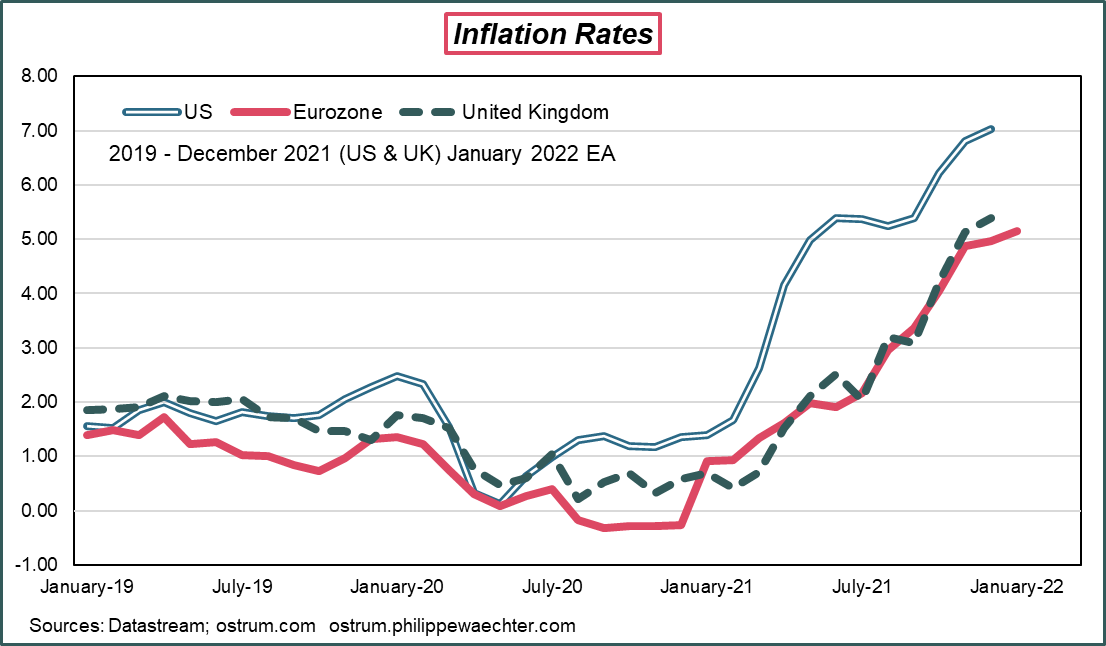

Despite these differences in macroeconomic scenarios, the inflation rate is very high everywhere. The graph opposite demonstrates this. Central banks’ target have been largely exceeded. The main reason is rising energy prices. In the euro zone, it explains more than half of inflation.

Yet central banks have no direct impact on the energy market. This is why they are reluctant to act.

In the case of the euro zone, tightening monetary policy would amount to making financial conditions more stringent for economic players without there being any impact on energy prices.

However, if central banks do nothing, they encourage economic players to adopt much higher inflation expectations. This would led to an inflation premium increasing the trend of wages or in that of long-term interest rates. This could lead to more persistent inflation. No one wants such a change because the economy could suffer in the short term.

This is the dilemma for central bankers. In the US and Great Britain, non-energy prices are rising as we have shown, so central bankers are justified in toughening their stance. In the euro zone, this is not the case but the ECB does not want a profound change in expectations. It will be forced to act if inflation does not turn around quickly. It will surely do so because nobody today controls the energy market and it is the energy price that decides the rate of inflation. The risk is to cause a recession in Western countries.