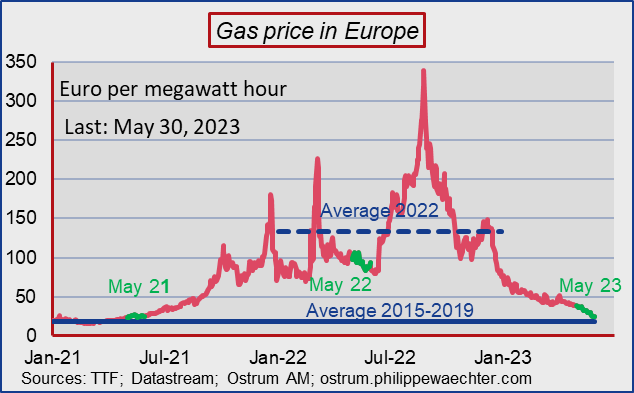

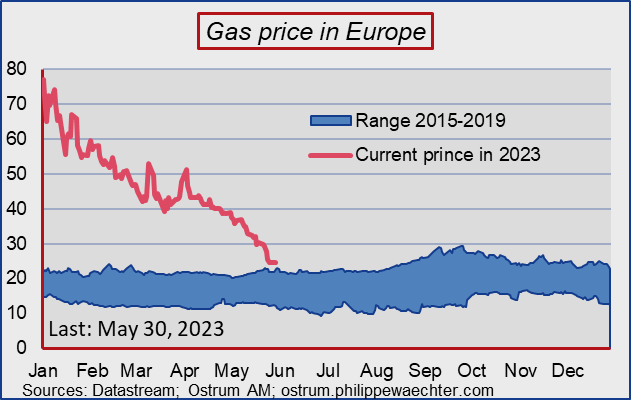

The major factor in Europe is the fall in energy prices. A major cause of the rise in inflation in Europe, the downward trend in gas, oil and electricity will change the situation.

The current price is close to the range seen before the health crisis when the gas price was not an issue.

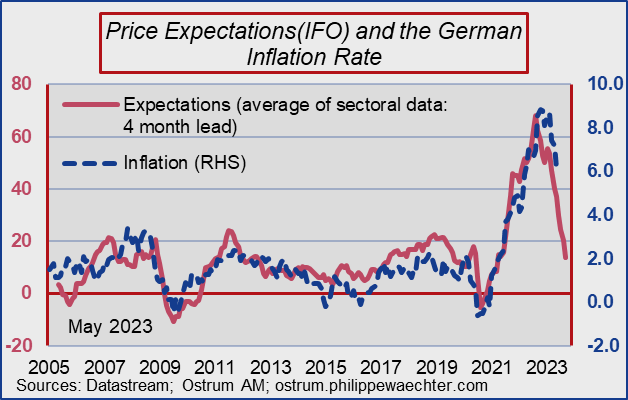

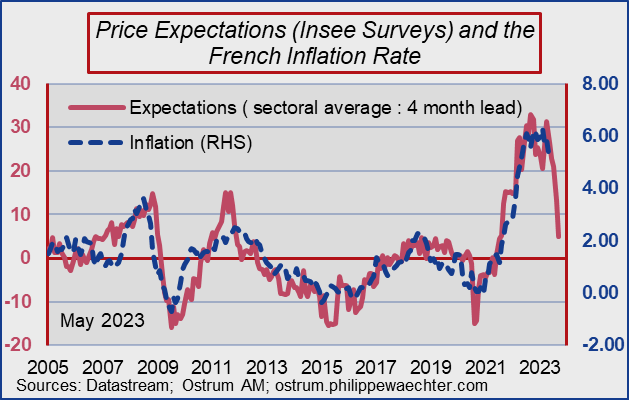

Business leaders are not mistaken. In May, the IFO survey in Germany and the INSEE business climate in France suggest a sharp reduction in the variation in sales prices expected by companies. In both countries, these expectations, very well correlated with the inflation rate, tend towards 2% on the horizon of the beginning of autumn.

Germany

France

The fall in the price of raw materials and the price of energy restores margins to companies, also reducing the uncertainty associated with the price volatility generated by high inflation.

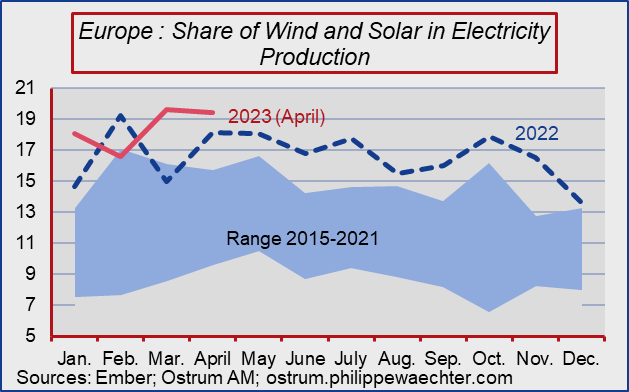

Companies will be able, next fall, to negotiate new energy contracts at much lower prices. The absence of tension on the price of energy, the rapid progress of renewable energy in the production of electricity (19.5% in April 2023), the reassuring news from EDF on its capacity to supply he electricity and abundant gas reserves should make it possible to spend the next winter in a more serene way

Price assumptions for 2024 will be much lower than those made for 2023.

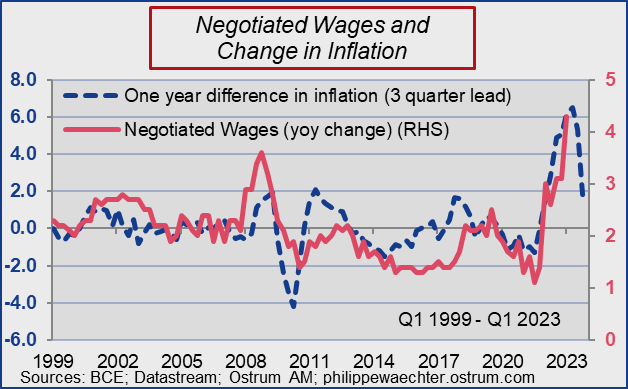

Companies will have higher margins. This will allow them to accept higher wages without having to adjust their prices upwards. In addition, the slowdown in current inflation will result in more modest catch-up effects on wages in the coming months compared to what has been observed recently. In fact, wages are adjusting to the past variation in prices, but inflation is slowing down. As a result, the high point of wage growth is near, may have passed.

The slowdown in inflation could thus be faster than expected, restoring purchasing power to households and businesses. The labor market could then remain robust and maintain the dynamics of demand.

The change in the energy price léans that terms of trade will improve dramatically for the Eurozone. The transfer from Europe to the rest of the world to pay energy will ne reduced on a large scale. This is already seen on the European trade balance. The amount saved in Europe will feed domestic demand in a context of reduced uncertainty as the inflation rate will be much lower.

All this could have a little air of energy counter-shock resembling that of the mid-1980 s’.