Should we change the inflation target?

If inflation is permanently higher and for an extended period, central banks will quickly feel cramped with a 2% target.

The economy changes radically with the energy transition. Central banks must also take this into account. Changing the level of the inflation target is a way to adapt to this new environment without losing credibility.

In an article in the French newspaper, Les Echos, Olivier Blanchard suggests that central banks change their inflation target to set it at 3% instead of 2%.

Why 2%?

Since the 1990’s, central banks have set or have had an inflation target set at 2%. This figure is associated with price stability.

A lower target was not desirable due to the risk of deflation associated with too little price change. Central bankers rightly dislike deflation because it can profoundly change behavior and penalize growth and employment.

In an old report, the Boskin Commission stated that inflation measured by the CPI was generally somewhat higher than “true inflation”. This gap was around 1.3% until 1996. From then on, choosing a target that was too low meant taking the risk of being in deflation. The 2% target could then be chosen.

However, there is no theoretical basis that would identify an optimal inflation rate tending towards this magic number.

Blanchard’s Argument

His point can be summed up as follows: the main risk of persistence of inflation passes through wages. He highlights this point in a recent paper written with Bernanke, the former Fed chief. The other sources of inflation may diminish (the effects of Biden’s stimulus plan), reverse (the price of energy) but employees do not want to see their purchasing power permanently reduced. They can claim over time at the risk of causing persistence effects.

Therefore, we must either put up with this risk of persistence of having inflation register a little higher for longer, or do everything to converge quickly towards the 2% target and regain some normality.

Blanchard remarks that the central banks, by not wanting to deviate from this 2% target, take the risk of permanently penalizing the labor market. Indeed, if wages are the first source of persistence, reducing their evolution significantly means forcing the economy into recession to reverse the too robust labor market’s momentum.

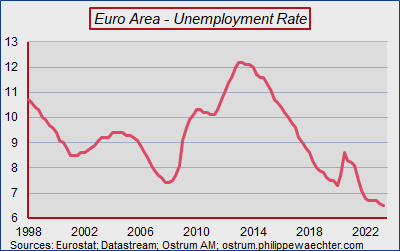

In a paper written in 2015, with Larry Summers and Eugenio Cerruti, Blanchard concluded that every recession has a long-term cost and that is why we must avoid taking this type of risk. So fighting at all costs to finally break the labor market is an arbitrage that could quickly lead central banks to higher interest rates than those currently observed. In the US and the Eurozone, job creations are strong and the unemployment rate is at its lowest. To reverse this dynamic would be penalizing.

Yet this is the position reiterated by Christine Lagarde last week during the ECB seminar in Sintra. The European Central Bank shares the idea that the persistence will come from wages but instead of accommodating it sees the obligation of a restrictive policy in the long term, hoping not to cause a major recession.

Blanchard suggests that rather than going down this path, it may be better to live with higher inflation and gain flexibility of adjustment.

He suggests 3% whereas 4% could have more marked effects on the consumer. By advocating 3%, he indicates that it is not a very different figure from 2% and that the change would not upset the consumer.

Gita Gopinath’s remarks

In her remarks to Sintra, Gita Gopinath, former chief economist of the IMF, suggests that the economy of tomorrow could be more inflationary than in the past.

Two main reasons:

- The first relates to supply constraints with restrictions on trade and direct investment directly affecting the fluidity of production processes.This is first of all the lesson of the period of the pandemic and the recovery that followed. It is also the consequence of the constraints placed on exchanges (see US/China relations) or on the desire to favor bilateral exchanges (cf. the words of Jack Sullivan that I mention in the first part of the first issue of “ Macroeconomic Turbulence”(in French)).

- The second reason is the consequence of the adjustments that will mark the long period of the energy transition. The resulting upheaval will have inflationary effects. It may also be a good thing to facilitate macroeconomic adjustments (I mention this question in the second part in “Macroeconomic Turbulence”).

The risk is then to have an inflation rate that is permanently higher than in the recent past, due to a disrupted macroeconomic environment that no longer has much to do with what we knew before the pandemic.

Moreover, as Gita Gopinath points out, the references we had in the past, such as the Phillips curve which links inflation and activity, are no longer as relevant as they could be.

If inflation is permanently higher and for a long time, central banks will quickly feel cramped with a 2% target.

The economy changes radically with the energy transition. Central banks must also take this into account. Changing the level of the inflation target is a way to adapt to this new environment without losing credibility.