In the event of conflict in the Middle East, the economic measure of the shock is the oil price profile. On many occasions, the outbreak of conflict results in a drop in production and a significant increase in the price of black gold.

The Middle East represents almost 1/3 of world production; a conflagration in the region can have strong effects on production and prices.

The World Bank, in a recent report, reviews the conflicts in the Middle East since the first oil shock of October 1973. Each time, oil production is affected, falling by 2 to 8% while the price increases, potentially go up to 100% increase as during the invasion of Kuwait by Iraq.

So far, oil has not been the indicator of tensions that it generally is in the Middle East. The price of a barrel of Brent is almost 10% cheaper than on October 6, the day before the start of the conflict. But the two belligerents are not oil producers.

The risk is the extension of the conflict to other countries in the region. This would then be the likely catalyst for a shock on production and prices. The World Bank is considering such scenarios without, however, measuring the consequences on the economy.

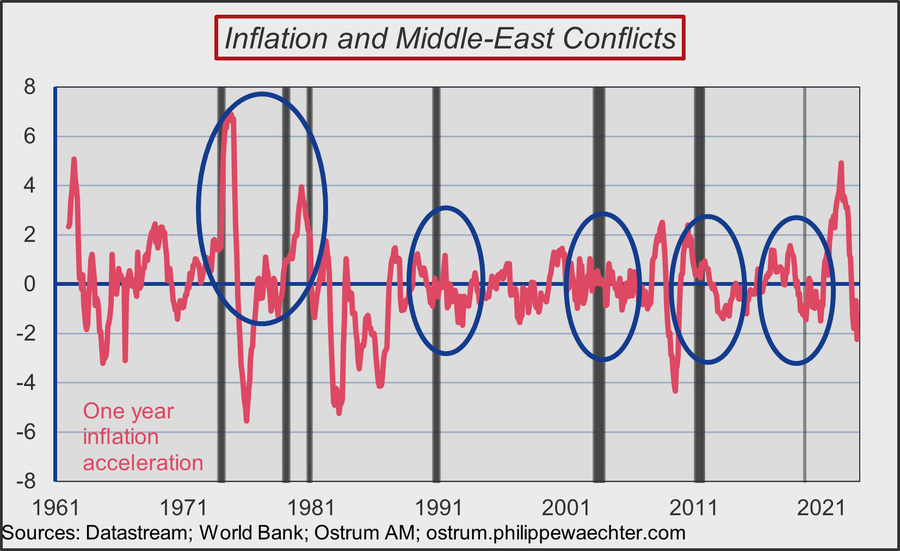

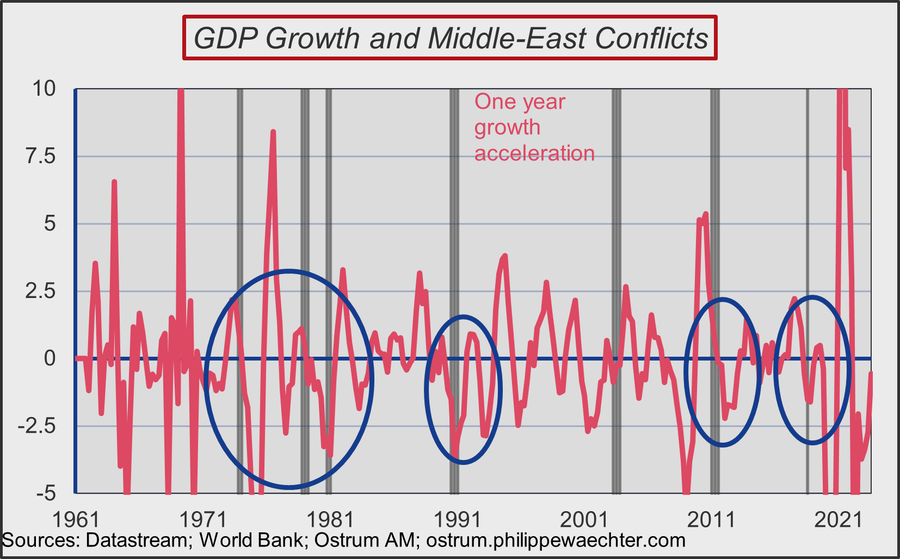

By taking up the events mentioned by the World Bank (and listed at the bottom right), I looked at their impact on inflation and growth in France. In each graph, the acceleration is shown (difference in inflation (growth) over one year) with the different conflicts in a vertical line in the order of the list.

The impact on inflation was very clear during the two oil shocks. But this is much less significant afterwards.

On the other hand, activity measured by the difference in GDP growth over one year appears more systematically penalized. Each vertical band corresponds to a change in the pace of the activity.

Activity is more sensitive than inflation to conflict because it carries high uncertainty. The effect on interest rates was strong during the first two oil shocks but little marked afterwards. The rate reduction movement was not affected by the conflicts.

France and the Eurozone are still trapped in an inflationary episode. An extension of the conflict could perhaps revive nominal tensions but surely penalize growth.