The Federal Reserve is meeting today and tomorrow to decide on the direction of its monetary policy. The outlook for the US economy is ambiguous. The Atlanta Fed estimates that GDP growth could reach 3.5% in the third quarter (annualized rate). This would encourage the monetary institution to maintain its policy stability. However, numerous indicators suggest that the economy is already slowing significantly. This is evident in the labor market and in the commercial real estate market, where the default rate has risen sharply.

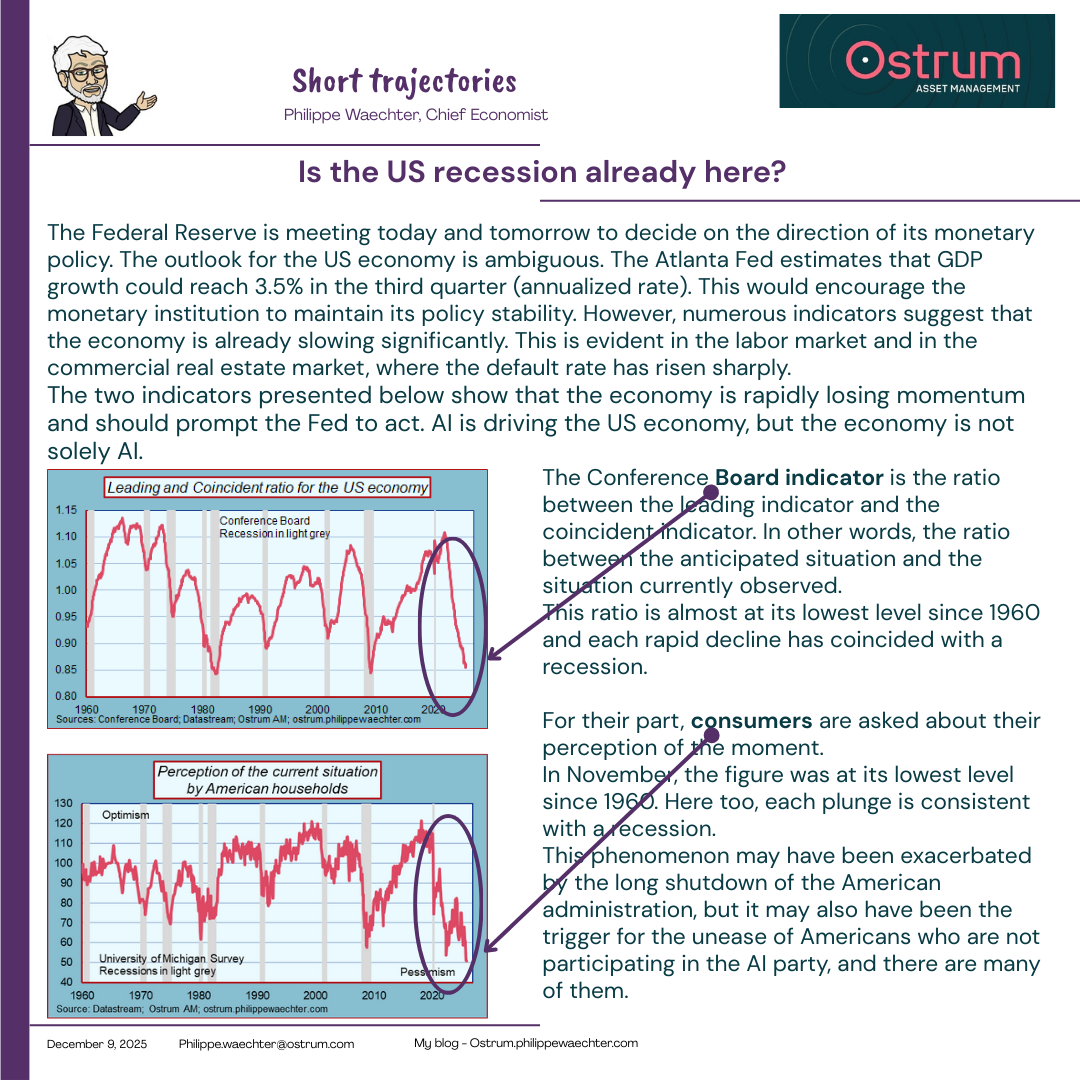

The two indicators presented below show that the economy is rapidly losing momentum and should prompt the Fed to act. AI is driving the US economy, but the economy is not solely AI.