After the attacks on oil installations in Saudi Arabia, the price, on Monday, climbed 13% over last Friday. This is an important jump, witnessing the Saudi’s decline in production by almost half of its capacity.

Immediately, Saudi Arabia announced that it would do what was necessary to quickly rebuild the destroyed facilities. At the same time, Arabs and Americans said they were ready to use their strategic reserves if necessary to avoid excessive tensions in the oil market.

However, this market has changed dramatically. Such an attack 10 or 20 years ago would have been apprehended as an oil shock, feeding the darkest scenarios. At this time, Arabia had a major role as the world’s largest producer and main regulator of the market. It was the only country that could quickly adjust its production. Arabia was the regulating country of the market. This is no longer the case. The United States is now the leading producer and its production continues to grow month after month.

The logic is not the same anymore. Americans may eventually adjust their production to reduce the losses from Arabia. It’s a completely different game that avoids getting into the logic of an oil shock

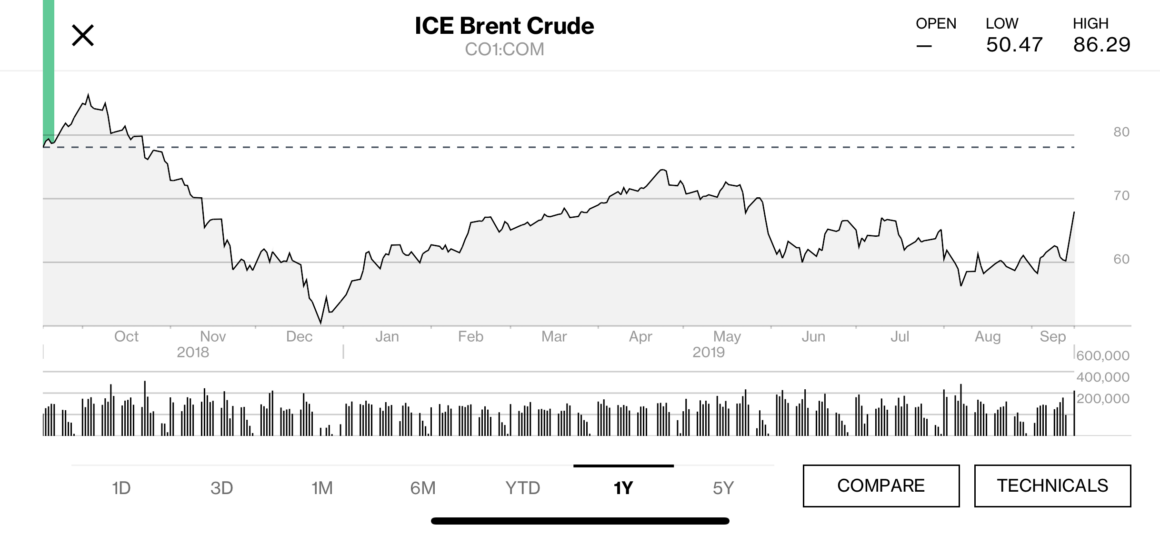

Moreover, if the price has risen rapidly but it is still below the prices observed last spring and almost 4 dollars below the average recorded in 2018. There is no danger.

For now, the rise is not strong enough and its duration too small to change rapidly the economic scenario. If Saudi rebuilds its facilities, the price may remain for some times a little higher than in recent weeks. But, the impact on inflation will be reduced. In October, last year, the price per barrel was higher than 80 dollars, even 85 dollars. This high price level then was the trigger for the yellow vests movement in France.

We could thus have a slight adjustment on prices, companies adjust the price rather quickly a few cents at best, but a negligible impact on inflation given the very high prices seen last year, significantly higher than those observed in the current period. .

An oil shock could only be perceived if tensions persisted and prices rose sharply every day. This market dynamic would then change with a persistent shift. It would also affect expectations of all the players in the economy, at the risk of provoking a self fulfilling negative shock. This is not the case.

We’re not at this stage yet as we don’t know the origins of the drones It is therefore difficult to perceive how the equilibrium has changed in the Middle East.

In 1973/74, the oil shock reflected the quadrupling of the price of oil after a very long period during which prices were very low. This is not the current configuration. Given the positions on the possible use of strategic reserves, the escalation of tensions in the oil market is far from the most likely scenario.