Consumption expenditures dropped after the VAT rate hike last October. The GDP was down by -6.3% at annual rate in the last quarter of 2019.

No recovery is expected in the short term

and GDP growth will be negative in 2020.

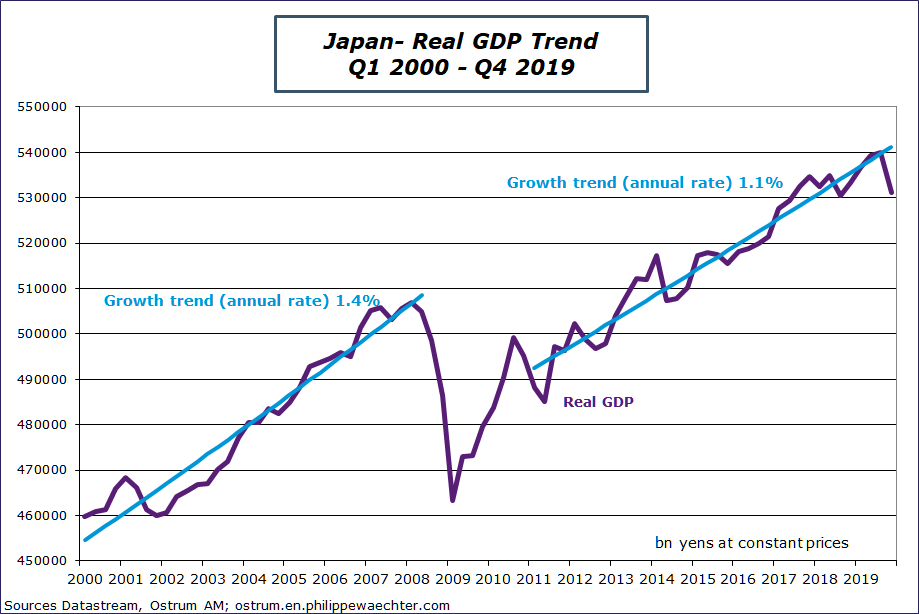

The Japanese GDP shrank during the fourth quarter of 2019. At annual rate, it was down by -6.3% after +0.5% in the third.

For 2019, on average, the GDP growth rate was 0.8% after 0.3% in 2018. The carry over for 2020 at the end of 2019 is -1%. This means that GDP growth in 2020 will hardly be above 0%. With growth at 0.5% (non annualized) at each quarter in 2020 then the average growth would be 0.2%. The quarterly average growth since 2016 is 0.19%. With this number for each of 2020 quarter, the 2020 GDP change would be negative at -0.6%.

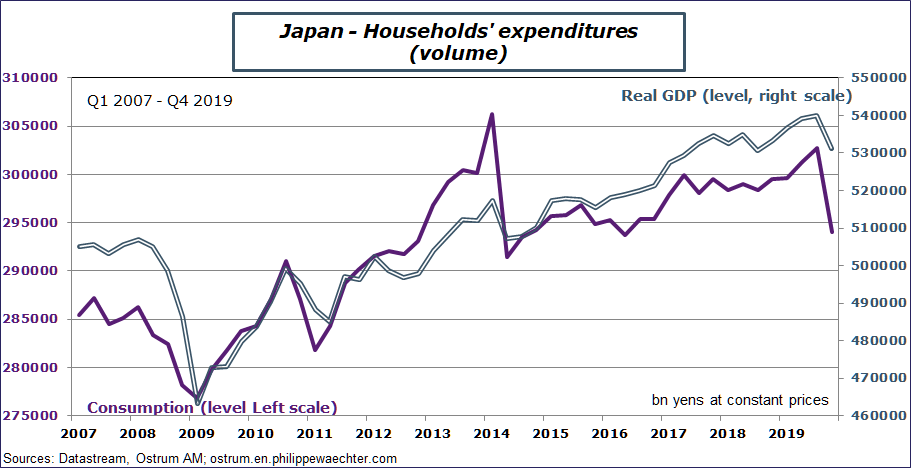

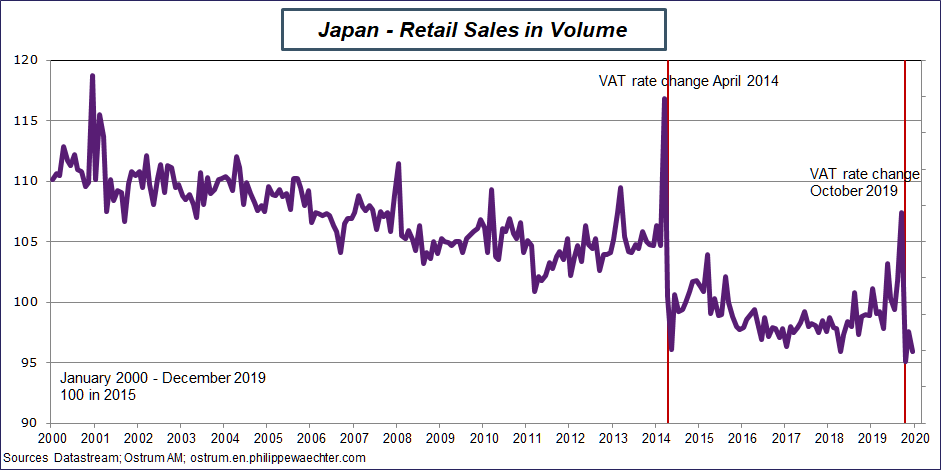

The main reason for weakness is the VAT rate hike in October (from 8 to 10%). In April 2014, the government already hiked VAT rate (from 5% to 8%) and the effect was already a deep slump in consumption expenditures. The same measure of economic policy has led to the same result in terms of drop of consumption and drop of GDP. In the second quarter of 2014 the GDP was down by -7.4% at annual rate.

The lower purchasing power implied by the rate hike has pushed expenditures on the upside, the month before the hike and then a deep drop after it. In 2014 and 2019 the story was identical.

The story is not over. In 2014, the recovery in the third quarter was low. GDP was up by only 0.3% at annual rate after the -7.4% drop in the second. In other words, we cannot expect a strong recovery at the beginning of 2020 even before thinking of the impact of the coronavirus.

We see on the graph that consumption expenditures were on a downside trend until the end of 2017. We cannot expect a pattern of consumption that could be deeply different from what was seen after 2014.

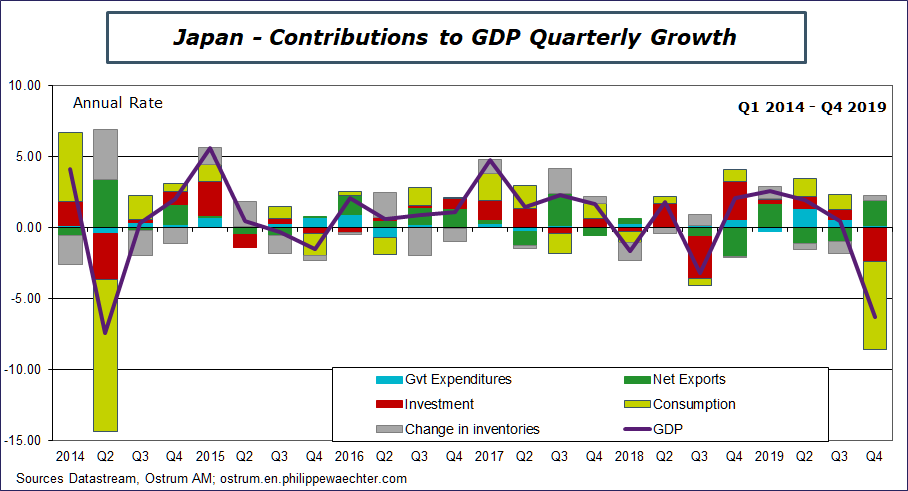

Contributions to GDP quarterly growth show a similar pattern than in 2014 even if the effect on consumption is currently lower. The main difference is that in 2014, the contribution of inventories was very strong. Investment was already negative and the government didn’t compensate the negative effect of the rate hike by stronger public expenditures.

The last point is the net exports positive contribution. It is not good news because it reflects lower exports and lower imports. Imports’ contribution is therefore positive and larger in absolute value than exports’ negative contribution. In 2014, exports had a very strong and positive contribution while imports had a strong and negative contribution.

In other words, with a weak domestic demand and strong uncertainty on world trade we cannot expect a rapid recovery in Japan. Growth will probably be negative in 2020.