Markit, ISM, US Employment Report, German Industrial Orders, Chinese External Trade but also US 10 year rate at its lowest and central banks’ credibility

Highlights

Markit Surveys in the manufacturing sector for February (March 2)

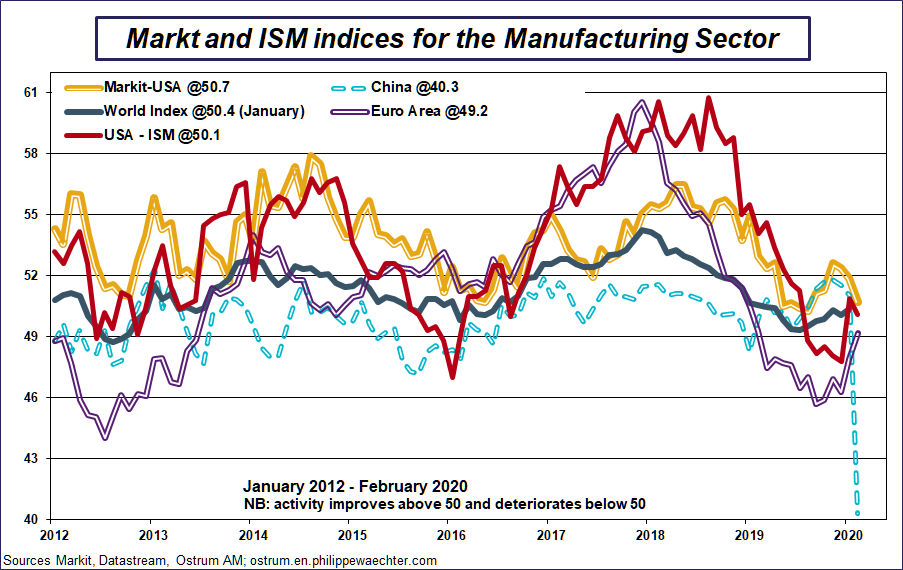

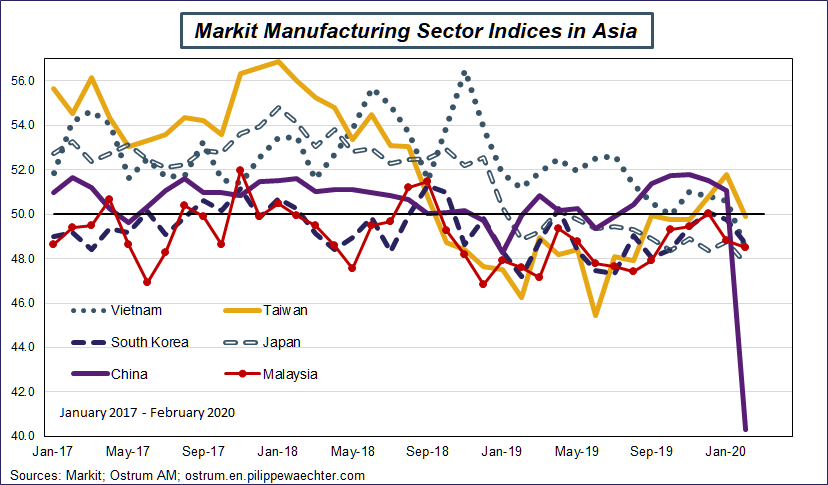

The main focus on these surveys will be on Asia. In January, indices in Malaysia, South Korea and Japan were below the 50 threshold. We expect a lower Chinese index as the quarantine started at the end of January.

The US indices (Markit and ISM) will probably remain strong as in the very short term, the US economy will take advantage of the Chinese weakness. It has already been seen with the NY Fed and Phyli Fed indices.

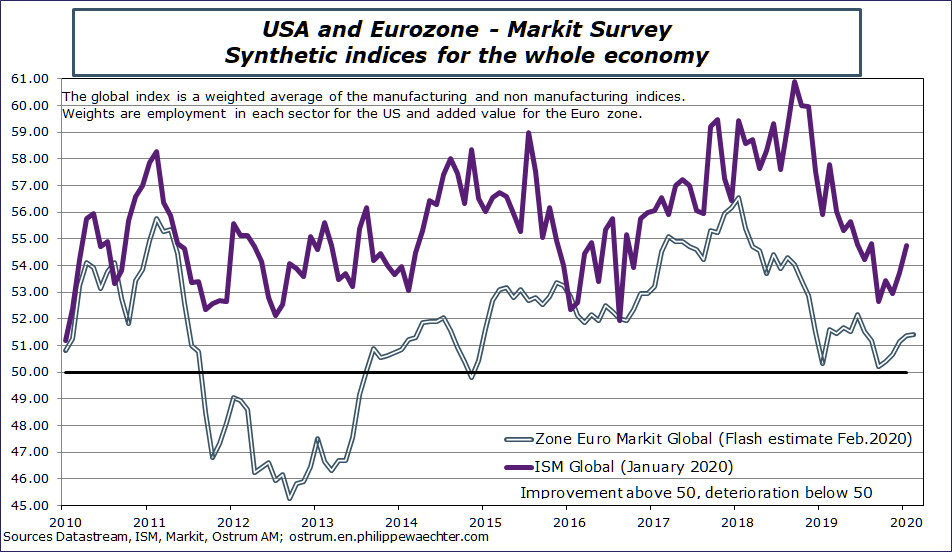

Markit and ISM indices for the whole economy (March 2 for the manufacturing sector and March 4 for the service sector)

The interesting point will be Euro Area indices. Will they remain as strong as in the flash estimate (calculated on a limited sample) or will they be weaker with the whole sample ? It will be a way to see the uncertainty on the business cycle.

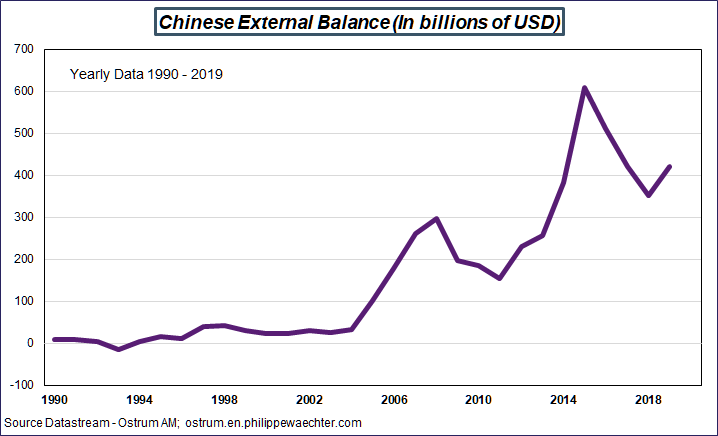

Chine external trade for February (March 7)

The impact on the coronavirus will be seen mainly on imports not on the exports. The release will take into account January and February

German Industrial Orders for January (March 6)

Numbers were already weak, they will continue at the beginning of this year. But we expect that higher uncertainty will lead to lower capital goods orders in coming months leading to lower investment for the OECD.

Euro Area unemployment rate for January 2020 and inflation rate for February (March 3)

The unemployment rate will remain close to its almost historical low (7.4%) while the inflation rate will take advantage of the lower oil price (-9.5% in February 2020 compared to February 2019 in euro)

Federal Reserve Beige book ((March 4) and Miche Barnier press conference on the Brexit negotiation (March 5)

Other Statistics

Retail sales for the Euro Area in Germany for January (March 4), Productivity in the US for the fourth quarter (revised estimate ) (March 5), US trade balance for January (March 6), Households spending in Japan for January (March 6), Industrial production for Spain in January (March 6)

Detailed Discussion

Markit Surveys in the manufacturing sector for February (March 2)

Data for February will be interesting notably in Asia where the epidemic has started. Already in January the situation was not strong in Asia. Japan, Malaysia and South Korea were already in negative territory and the recent improvement in China was already faltering. We have to expect a drop in the Chinese index as the first measures in Wuhan started at the end of January. This will have a direct impact on other Asian countries with which China has direct links (those on the graph).

For the rest of the world the impact will be mild in February. This is already what was seen with the flash estimates in Europe. The EA index has improved converging to 49.1 supported by a stronger Germany. The US index was lower than in January but was still above the 50 threshold.

Markit and ISM indices for the whole economy (March 2 for the manufacturing sector and March 4 for the service sector)

The ISM was stronger than expected in January. The manufacturing index bounced back above the 50 threshold at 50.9 after 5 months below it. With the strong NY Fed and Phyli Fed indices in mind, we can expect a stronger index for February. The idea is that in the very short term, the US industry can take advantage of the Chinese weakness. It doesn’t mean that the US economy is immune of the epidemic but it could be advantageous for it.

For the eurozone, the interesting point will be to have the complete panel of the survey (which is not with the flash estimate). Will the February numbers be as strong as they were with the flash estimate ?

Chine external trade for February (March 7)

The Chinese external trade has shown a large surplus in 2019. It’s one of the best year in terms of surplus but the dynamic was not that strong. Imports were lower than in 2018 and exports marginally higher. China has not conquer new markets but its own market was weak.

It will be too early to watch at the impact of the coronavirus on the Chinese exports but we can have signs on the import side as factory closed at the end of January and were off in February. The surplus may increase.

German Industrial Orders for January (March 6)

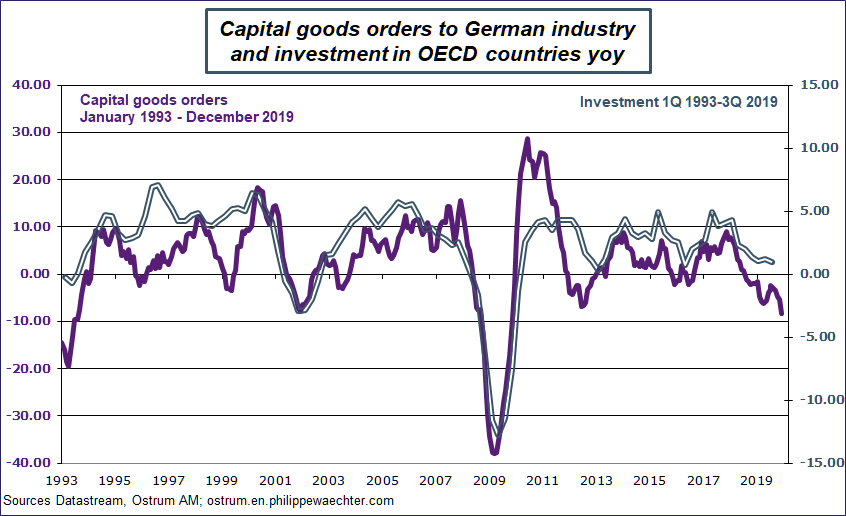

This indicator will be the one to follow in coming months notably its part related to capital goods. The capital goods order index has a profile consistent with the OECD investment. At the end of December, the index was already very low leading to negative anticipations for capital expenditures.

In coming months, larger uncertainty associated with the epidemic may imply lower investment leading to a very weak growth profile for coming years.

US Employment Report for February (March 6)

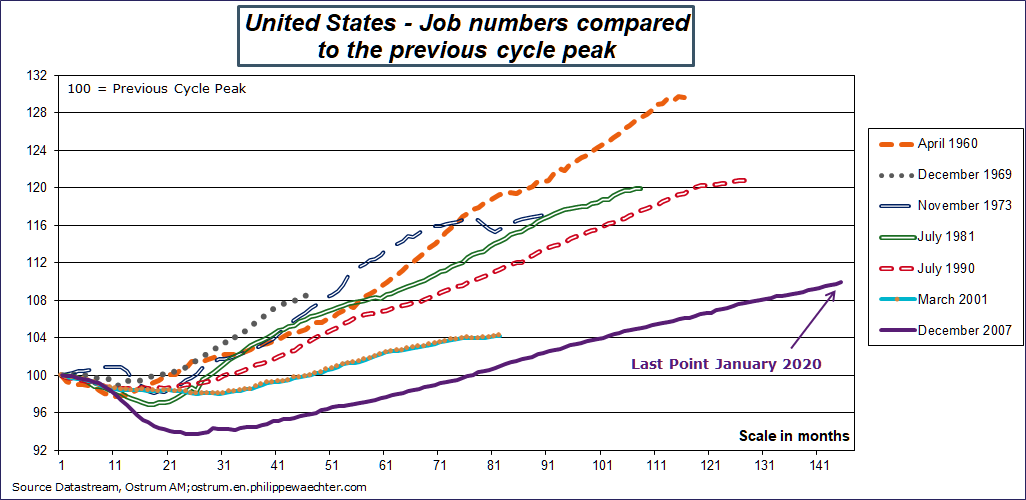

The current US business cycle is the longest ever but not the more efficient. The graph compares the employment profile of each cycle from peak to peak (according to the NBER). The cycle of the 1960’s was the most efficient in terms of job creation. The current one is the least efficient. We can see that with the number of jobs (terminal index for each curve) but also by looking at the slope of the curve. The current one is less steep than all the others.

In fact, through time, the US economy is less and less able to create jobs. Every new business cycle is below its predecessor.

The number for February will remain in line with what was seen at the end of 2019. For the whole year, 175 000 jobs were created each month in 2019 and the number was circa 200 000 during the last four months of the year and in January 2020. The question will remain on the wage profile. It is not consistent with an economy that have a record low unemployment rate at 3.7% on average since the beginning of 2019.

Euro Area unemployment rate for January 2020 and inflation rate for February (March 3)

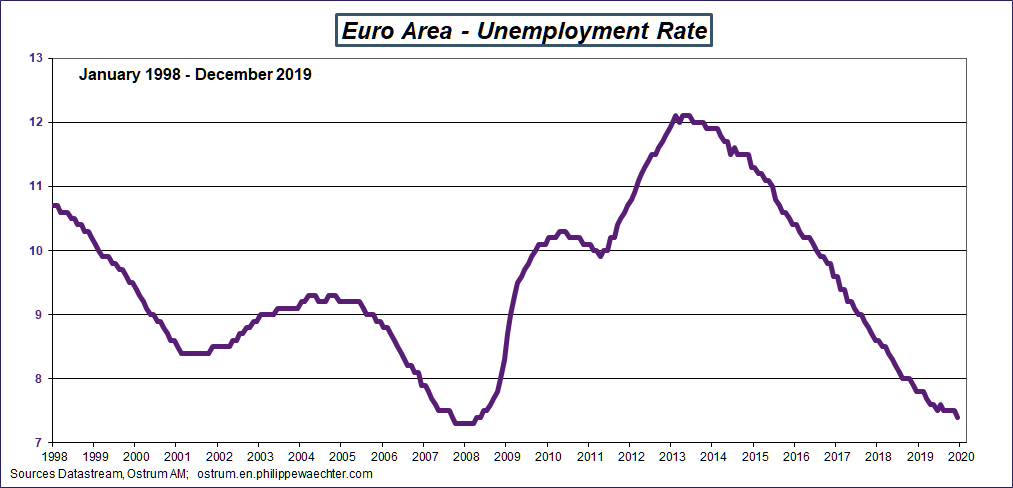

The Euro Area labor market is close to full employment. The 7.4% unemployment rate recorded in December was just a blip higher than at the end 2007.The January number will be close to this number.

The question is that this record low unemployment rate is 3.7% higher than the US one. Something has to be done.

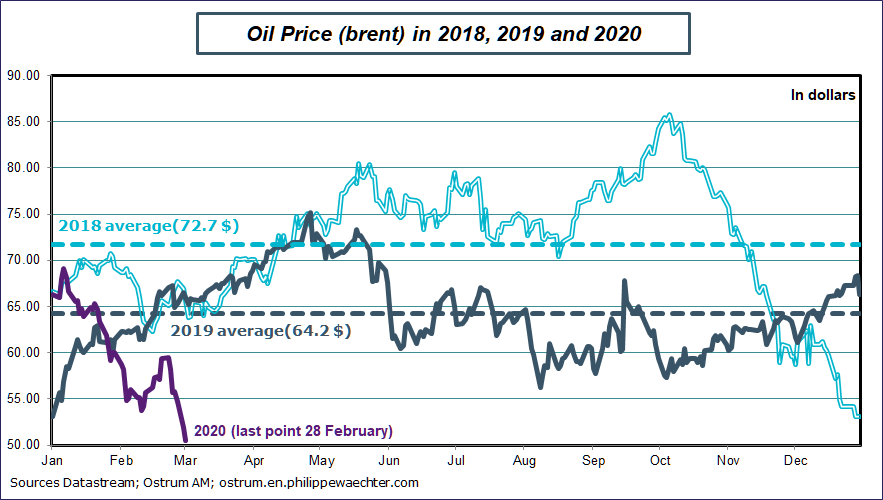

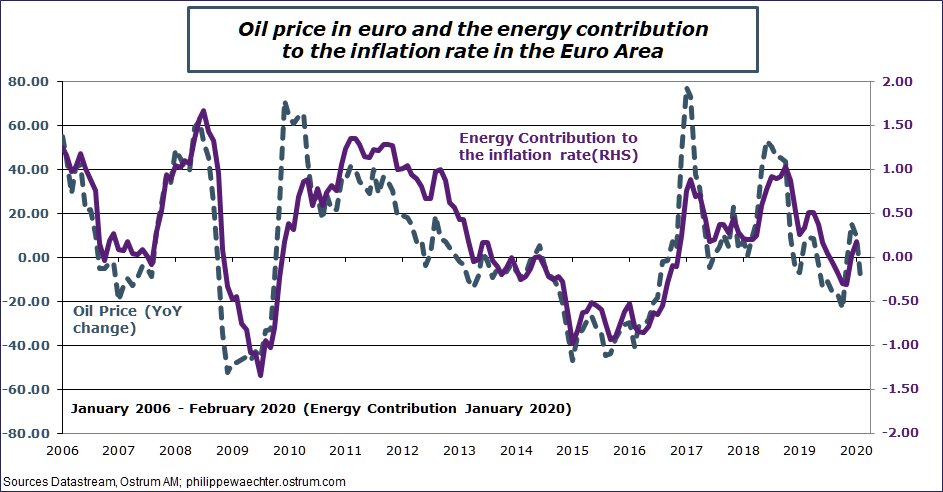

The inflation rate will be released with a lower oil price. As of February 27, the average oil price for February, in euro, in 9.5% lower than in February 2019. It should push inflation lower in February or March

What to keep in mind from last week ?

Impact of the coronavirus

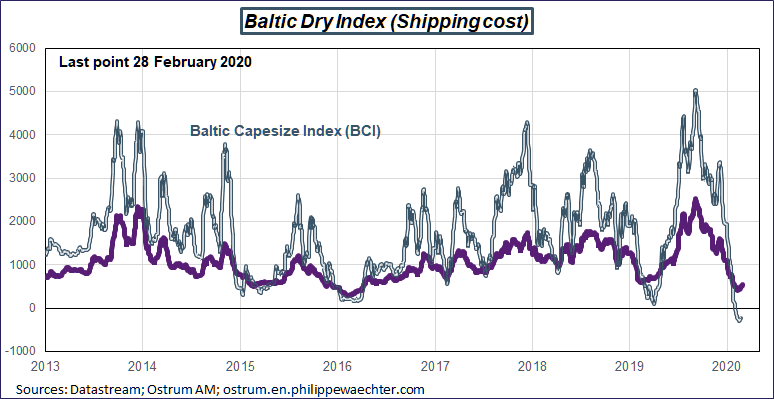

The first measure of the impact of the coronavirus was seen on freight with the deep drop in the Baltic Dry Index and the negativity of price for very large cargo ships.

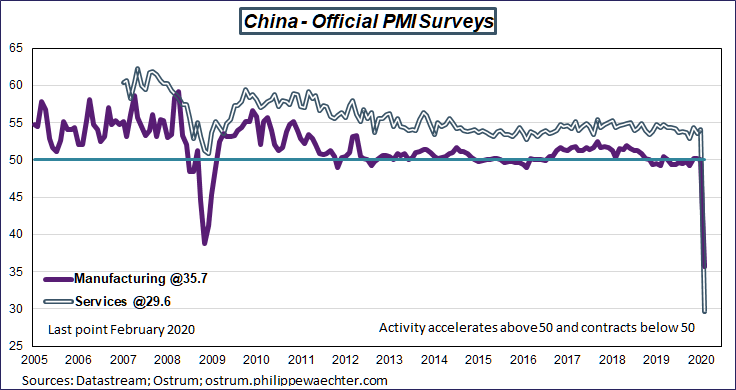

But the first assessment on macro data was the Chinese PMI for February. The second graph shows the official measure of the economic activity in the manufacturing and in the services sector.

The most impressive is on the manufacturing sector where the level (35.7) is below the recorded figure of November 2008 after the Lehman moment (38.8). This is a measure of the strong negative shock on the Chinese economy. In December 2008, the rebound was limited at 41.2. Do not expect a rapid recovery.

The other point of the comparison, is that both reflect very different causalities. In 2008, the activity stopped because of the financial crisis. The funding of external trade dropped dramatically everywhere and the real world trade index was down -6% between October and November 2008. Improvement of financial conditions by central banks and a coordinated fiscal boost have led to a rapid and strong recovery. In 2020, it’s a supply shock. Improvement of the financial conditions will help in avoiding bankruptcies but a stronger demand momentum could lead to disequilibrium as supply is constrained. People cannot go to work in factories so the extra demand would first reduce inventories but then could add pressures on prices.

The spillover effect on the Chinese shock is already noticeable in other Asian countries. PMI Markit indices dropped below the 50 threshold in all of them.

As we do not expect a rapid recovery in China and because the current shock has created a deep disorganization in many Asian countries we expect that the contagion effect will last.

I think that the first half of the year will be penalized. Growth will be lower almost everywhere.

In terms of forecasts, the IMF expect a -0.1% of global growth compared to its central scenario at 3.3%. The OECD had a forecast at 2.9% for 2020. It now reduces it by 0.5% to 1.5% depending on how the epidemic spreads over the world. I think we could be at least at -0.5% for 2020 for the global growth if the situation do not stabilize at the beginning of the second quarter.

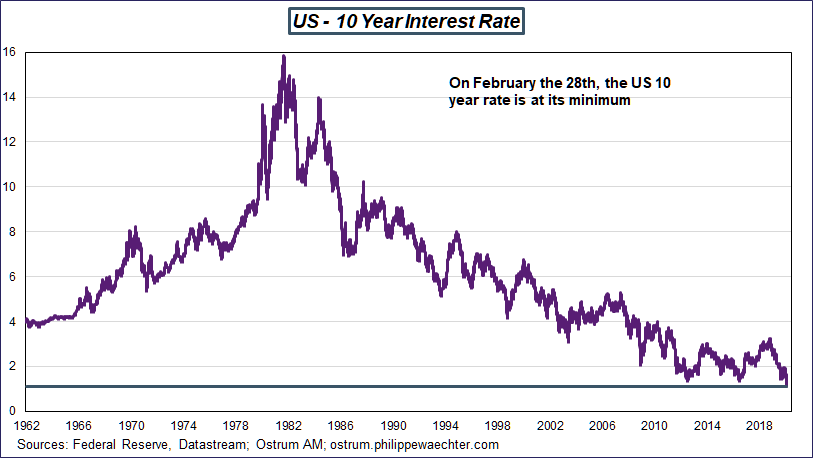

One immediate consequence of the deep financial adjustment is that the US 10year interest rate is at its lowest ever. On daily date since the beginning of 1962 (and longer on monthly date), the interest rate recorded was the lowest ever. It’s below 1.1% today. In Germany the 10 year interest rate is lower than -0.60% less than 10bp of the lowest recorded last August.

This movement reflects the large uncertainty at the global level. We’ve seen this type of episode last summer when, in August, Trump wanted to tax all the Chinese products that were imported in the US. Interest rates went to -0.70% in Germany and close to 1.5% in the US. The current episode creates more uncertainty as the situation is not dependent on people’s decision. We’ve seen that after August, the US have postponed tax decision, lowering uncertainty and pushing rates on the upside. Now, no one can decide and the situation will depend on the discovery of a vaccine or on the impact of higher temperature as winter is almost over. But no one knows.

In the short term and according to what Jerome Powell said last Friday, the Fed is ready to act and to lower its benchmark rate. We expect that a 50bp drop can be expected at the March meeting (17-18 March). Nothing is expected from the ECB. The Bank of Japan has already bought a large chunk of ETF to try to stabilize the equity market.

The role of central banks here is to try to stabilize financial markets, not to boost economic activity.

One major impact of the financial panic is the lower oil price. As it can be seen on the second graph on the right, the Brent is currently close to 50 and way below last year level. This means that the headline inflation rate will be lower than expected this year as the energy contribution will be negative at least for the first months of 2020.

On the top of that, the growth slowdown is not consistent with more tensions on the labor market. Therefore, the core inflation rate will probably be down in coming months. Central banks will be in a kind of malaise as their interest rates are already very low while they haven’t been able to boost inflation before. The inflation rate will converge to the deflation zone (below 1%) and central banks will not be able to change the trend. Their credibility is at risk.

The document can be downloaded here