The French government expects activity to contract by -11% in 2020. This assumes rapid convergence of the economy towards 100% of its pre-crisis capacities. In this case, the crisis would be quickly erased with a V-shape. On the other hand, if the health shock has a more persistent negative impact on activity and employment, the return to a “normal” situation will be much longer.

The arbitration between the two will depend on the effectiveness of economic policy, especially in its ability to reduce uncertainty for consumers and businesses.

As the world becomes less cooperative, Europe joins forces to find a common solution to this crisis and to enter into a more collective logic. It is rather a good signal that lengthens everyone’s horizon and gives hope.

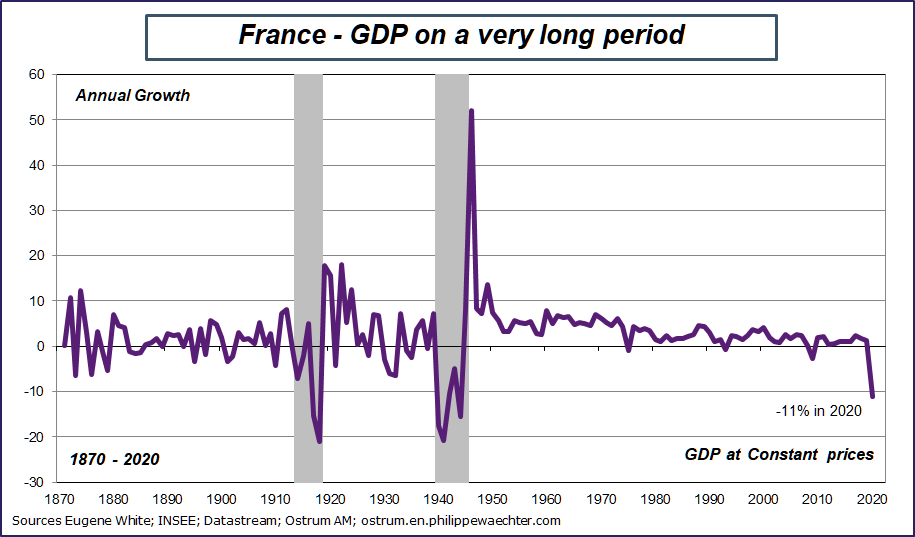

The French government has revised downwards its forecasts for the economic activity in 2020. It now expects a contraction of -11% on average over the year against -8% previously. This figure would therefore be the lowest ever recorded by the French economy outside of war periods (grayed on the graph)

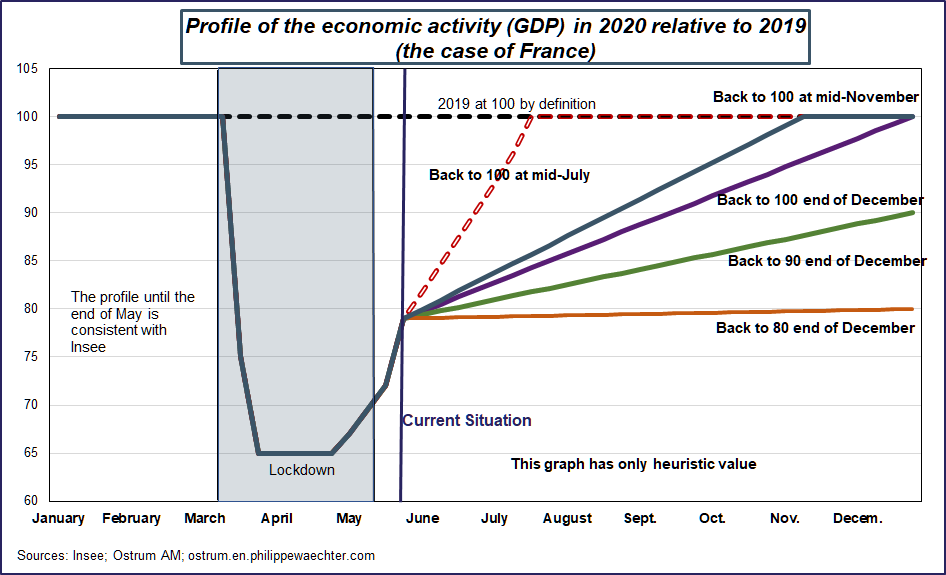

The profile for 2020 is known for the first two quarters. Over the first three months, GDP contracted by -5.3% compared to the last quarter of 2019. Over the three months of spring, the decline could be close to 20%. The month of confinement in April caused a historic drop in activity, as all the surveys of business leaders indicate. The rebound in May and June will not compensate for this break.

The major question is that of the profile of the last two quarters of 2020.

Until the end of May I settled on the information provided by INSEE on the evolution of capacities used in the French economy. The French statistical institute calculated that during the confinement period, the shutdown and constraints on many activity sectors resulted in an economy operating at only 65% of its capacities. The primary objective is to return to 100% of capacity. It is the path to this pre-crisis level that will be key. It will condition the actual development of activity over the whole of 2020 but also the profile of the years to come.

Several situations can emerge

1 – The shock does not show persistence. The economy converges very quickly to 100% of its capacity in July. In this case, the contraction in activity over the year would be -8%. The carry over growth for 2021 at the end of 2020 would then be 8.6%. It is a very favorable situation. This -8% figure was the old government forecast. It looked rather optimistic when it was published.

2 – The second possible profile is to see the economy converge towards 100% of its capacities at the end of 2020. The decline in activity over the whole year would be -12.4% and the carry over growth at the end of 2020 for 2021 would be 9.5%. The carry over growth is higher than in the previous case because the average figure for 2020 is lower in the case of a long convergence.

The latter case is one that resembles the scenarios of the IMF or the European Commission. Once the health crisis is over, the economy, supported by governments and the ECB, returns to its full potential to grow.

3 – The profile chosen by the government to arrive at the -11% figure is based on a convergence towards 100 in mid-November. Activity would fall by -11% in 2020 and the carry over growth for 2021 would be 11.1%. In this context, the activity momentum has a consistent pace with the pre-crisis period as soon as the last quarter of 2020. The shock has little persistence. The economy is very reactive after the end of the lockdown and gets back into working order without a hitch.

4 – In the fourth profile the shock of the first half has persistent effects on activity and employment. The economic activity is penalized by many companies in difficulty and in default after the containment period. Employment is deteriorating very quickly and the unemployment rate rises quickly beyond 10% as Muriel Penicaud (French labor minister) suggests on June 2 in an interview with Le Figaro. The demand from households and businesses does not have the expected robustness. In addition to health concerns, there is uncertainty about employment, which leads to cautious behavior.

Convergence out of 100 does not happen at the end of 2020. I have assumed that at the end of the year the capacity used is 90%. Economic policies have not been as effective as hoped. The fall in activity would be close to -15% and the carry over growth for 2021 at the end of 2020 would be + 3.9%.

5 – The last assumption is that where the activity does not accelerate compared to the end of May. The capacity is around 80% of what the French economy can do. The economy is penalized by the shock with no real ability to rebound at the end of the containment period. In this case, activity would contract by almost -18% and the carry over growth would be -2.1%.

The graph summarizes these various hypotheses. The red dotted curve is that of convergence in mid-July, the gray curve is that of convergence in mid-November, it is consistent with the government’s forecast. Then three curves with either full convergence in December (purple), 90 (green) or 80 (orange).

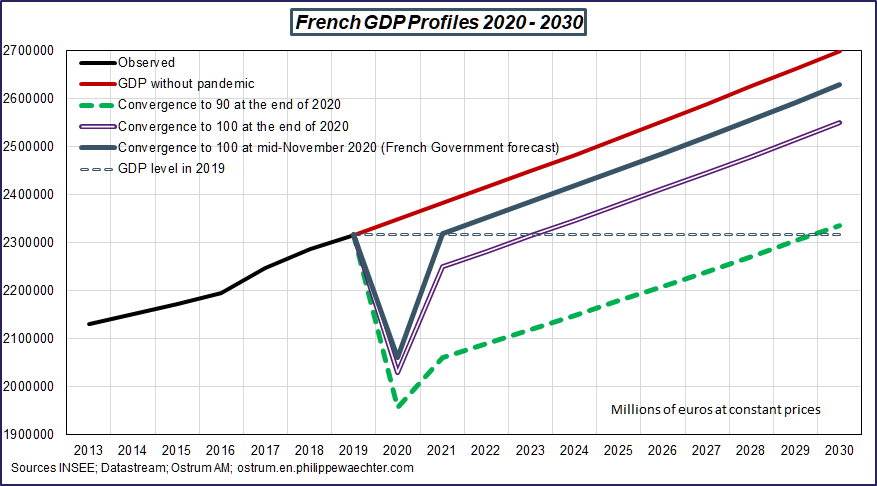

The most likely profile for the French economy will be between the government’s forecast and convergence to 90 in December. I make the assumption that beyond the effect of carry over for 2021, growth will stall on the trend observed before the health crisis is 1.4% per year and will remain at 1.4% per year thereafter.

The graph below proposes three trajectories which reflect the pace of French GDP over the next few years.

Taking into account the government’s forecast for 2020, French GDP would converge to that of 2019, that of the pre-crisis, as soon as 2021. The V-shaped profile is that adopted by the government.

In the case of convergence to 100 at the end of December, the return to 2019 GDP takes place in 2024.

If convergence is slower (90 in December 2020), then the pre-crisis GDP is not found until 2030. The persistent effects of the health shock on employment and business failures penalize activity over time. We cannot then speak of a V-shape.

The role of economic policy in countering the lingering effects of the health shock will be major in the coming months. It must both be a source of impetus, via public investment and incentives to consume, but also a way to reduce uncertainty. On this point, we must mention the trajectory that the French economy could take in the coming months. Credible history must allow everyone to extend their economic horizon in order to take more risks.

Consumption and investment must grow again to force the economy to converge as quickly as possible to the threshold of 100 and thus make it possible to eliminate the effects of the health shock .

The world has become less cooperative recently. But Europe; taking the opposite path, has the will to pool its dynamics in order to face the consequences of the shock of the pandemic. This European rupture must go quickly so that we can lay the groundwork for a trajectory favorable to the European Union and which would be likely to reduce uncertainty.

Economic policy and European dynamics should make it possible to move as far as possible from the green dotted line on the graph. From this point of view, action on employment and training will be essential so that beyond the health crisis, the usual macroeconomic uncertainties take over.

Annex

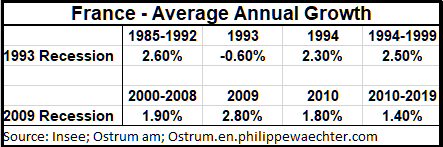

In the discussion, I did not include an excessive rebound likely to put the French economy back on its previous trajectory. This phenomenon was seen when productivity growth was strong. The economy was agile and robust enough to quickly fall back on the previous trend. This is no longer the case.

In the French case, we see that during the last two recessions, growth in the year after the recession is no different from what it was before the recession. This is why I am stuck on 1.4% which is the average growth since 2010. The table gives the paces of the French economy around these two recessions.