Public debt would be at its highest in 2021, higher than at the end of World War II. Growth will not make it possible to reduce the ratio of public debt to GDP, forcing central banks to remain very active, conditioning their action on the fiscal policy that will be carried out. The independence of central banks has passed.

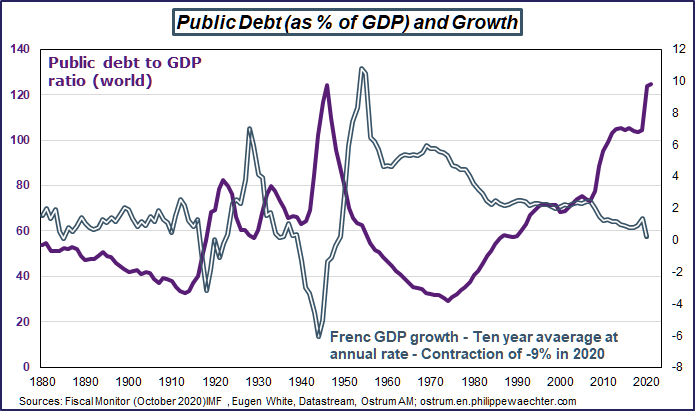

Global public debt could reach 124.7% of global GDP in 2021 according to the latest issue of the Fiscal Monitor of the International Monetary Fund (IMF). This level was approached in 1946 at the end of the Second World War with a ratio of 124.1%. Since 1880, the phases of rising public debt have corresponded either with a conflict, the two world wars, or with the great depression of the 1930s. States spent to finance the war and paid in debt which was repaid after the war is completed. We can clearly see this mechanism on the graph. I have included French growth on average over 10 years over the entire period. Growth collapses during the conflict and then resumes quickly since it is necessary to rebuild after the conflict. The ratio of public debt to GDP then falls.

The 1970’s Breakup

From 1880 until the mid-1970s, the public debt profile has been explained by the momentum of shocks and growth. Since 1975, the public debt has only increased. It is first and foremost the response to the disruption in productivity observed at the time, but also to the two oil crises. The arrival of Ronald Reagan at the White House was also a factor of public debt expansion in the United States, extending the upward trend already noted with a spectacular fiscal stimulus policy.

The public debt to GDP ratio stabilized in the 1990s. The rise in US productivity and the convergence towards the Maastricht criteria in Europe have helped.

The Financial Crisis and the pandemic

Since the financial crisis of 2008/2009, a new player, central banks, has entered the game. Until then, public debt management was mainly a matter between a country’s treasury, its residents and, since the beginning of the financial globalization of the 1980s, of non-residents. Central banks now have a considerable role in managing public debt. This break is major because suddenly the public debt no longer seems to have any limit. Global public debt has grown from 73% of global GDP in 2007 to 123.9% in 2020 and 124.7% in 2021 according to the IMF.

To cope with the two crisis, financial and pandemic, governments widened public deficits and financed them through debt issuance. This debt was then bought by the central banks. These are operations of the Quantitative Easing type. This has resulted in an unprecedented rise in central bank balance sheets. That of the ECB thus went from 13% of the GDP of the euro zone in the last quarter of 2007 to 52.7% in the second quarter of 2020. In the USA, the balance sheet rose over the same period from 5.7% to 34%. The intervention of central banks was also frankly accelerated during the health crisis. Since February 2020, the ECB has bought 71% of government issues in the zone against only 57% in the US. This made it possible to keep interest rates low, thus limiting the impact of the increase in public debt on the public accounts.

Central bank independence in question

The intervention of central banks radically changed the mechanism underlying the dynamics of public debt. It is no longer considered as exceptional financing to respond to a negative shock. Financial globalization had already altered this role. This was even more so with the decline in productivity as economies had put in place social systems whose balance required higher growth than the economy could provide. Short-termism won out over the overall balance. The two crises confirmed this point and brought central banks into the game to reduce constraints.

However, potential growth is lower than before the financial crisis and there will be no catching up in growth unlike in post-war periods. Public debt to GDP ratios will remain high, forcing central banks to still intervene massively. Interest rates will be very low for a very long time to come. The economy will lose in efficiency.

The action of central banks has become conditional on the fiscal policies that will be implemented. The independence of central banks is therefore now a thing of the past.

The infographic below is the text above and can be downloaded