The IMF suggests that France should revive its economy but also should plan a strategy to rebalance its public finances as soon as activity picks up. Its fear is a drift in French public debt which would weaken the construction of the euro zone.

The IMF’s remark also raises the question of stimulus, whatever the cost, which assumes that the economy, in France or elsewhere, will finally take the right turn and that the shock will have no hysteresis effects.

The IMF, in its analysis of the French economy, urges the French government to put in place the necessary measures to support activity. Economic policy must go as far as necessary, until the recovery in activity looms. It will then be time to put in place a strategy allowing French public finances to converge towards a more sustainable profile in the medium term.

There are two important points in this view of the IMF.

The first is that all that is necessary must be done to support economic activity and thus avoid a lasting and penalizing breakdown in activity. This will help maintain jobs and incomes for as long as it takes to fight the pandemic.

The second point is the need to control the pace of public finances. In its publication of last October, Fiscal Monitor, the International Monetary Fund indicates its concern about the pace of public finances in France. The measures taken, in particular in the stimulus plan, are structural measures, that is to say changes that permanently modify the state of public finances, this is the case for example of the reduction in production taxes on which we will not return, and measures which are not clearly affected by the economic situation.

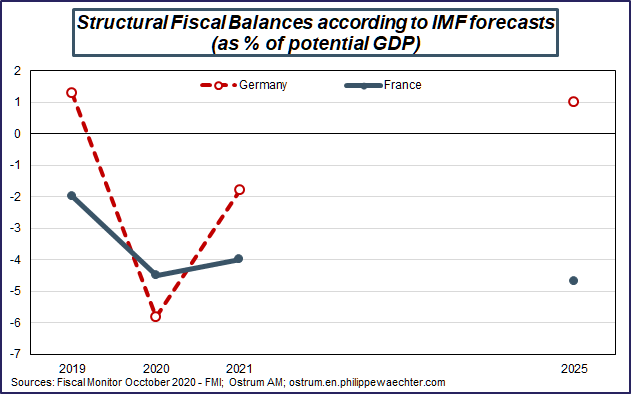

In this publication, the IMF indicated that the structural budget of the French economy would not converge in a finite time towards a sustainable trajectory and that, as a consequence, the public debt would continue to increase by 2025.

The graph opposite shows the IMF projections for France and Germany. The structural deficit in France, after its increase in 2020, would remain at similar levels until 2025. This would not be the case in Germany where temporary stimulus measures have been taken (reduction of VAT for example), allowing a return to a sustainable situation more quickly.

The worrying point for French public finances is that we do not know by what means there could be a return to a sustainable trajectory. For example, there is no commitment to reduce public spending. The recovery plan was adopted without defining a medium-term horizon to make public finances sustainable.

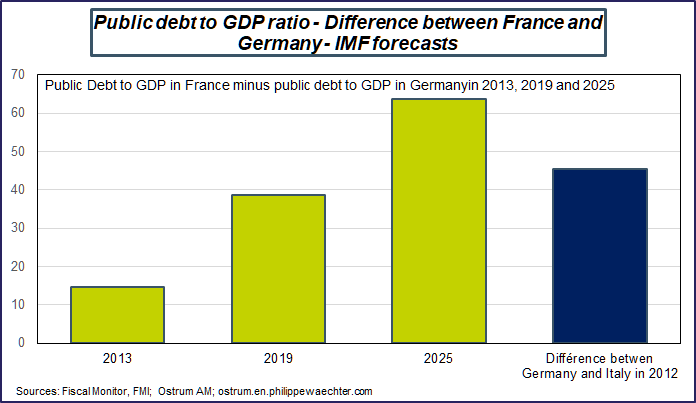

The risk is that presented in the attached graph on the gap between the public debt in France and in Germany. Without correction, the gap which was 15% in 2013 and nearly 40% in 2019 would be greater than 60% in 2025. Could the euro zone survive such a gap?

Remember that the same calculation between the public debts of Germany and Italy was 45% in 2012 at the time of the sovereign debt crisis. The IMF is worried about this situation and the French government must indicate how it will return to a sustainable pace. The future of the euro zone is at stake despite the massive intervention of the ECB. It’s a question of confidence.

A remark to conclude

Beyond the French question, the IMF’s proposal to use public finances no matter what, is based on the idea that at some point in the future, the health issue will be resolved, which is probable but also that the economy will have held up to the shock. After the Spanish flu, it was necessary to rebuild Europe in ruins after the First World War. The momentum here cannot be similar, there is nothing to rebuild. How to hold the economy at arm’s length if economic policy does not succeed, over time, in countering the deleterious effects of the health crisis and of the employment crisis that will be associated with it? We all want to hypothesize that in the end, economic activity will pick up again and that the crisis will only have been temporary. But it’s probably a little daring.

________________________________________________

The infographic of this post can be downloaded