US inflation is mainly conditioned by the pace of the price of goods and that of oil. The rush of households on goods, while inventories were reduced, is the source of this imbalance. It is not a question of wage. The supply adjustment is underway but it could be disrupted by the Fed, which now wants to intervene quickly at the risk of weighing on activity. It would be a shame when Biden is unable to push through his stimulus plans.

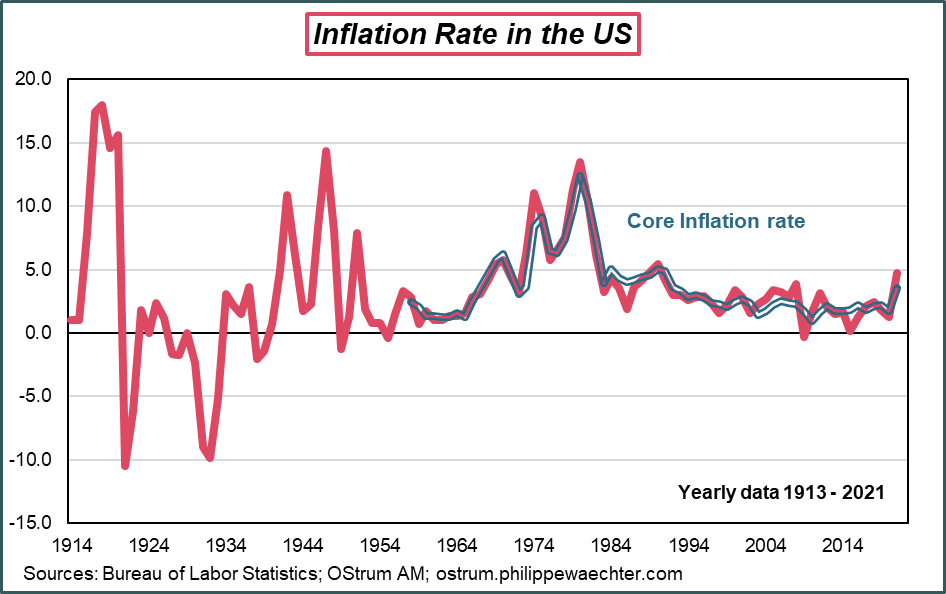

US inflation rose again in December. It was 7%, the highest level since the early 1980s. Over the whole year, the average inflation rate is 4.7%. Again this is a historically high figure.

The underlying inflation rate is also very high. It climbed to 5.45% in December and to 3.6% on average for the whole of 2021.

Three remarks

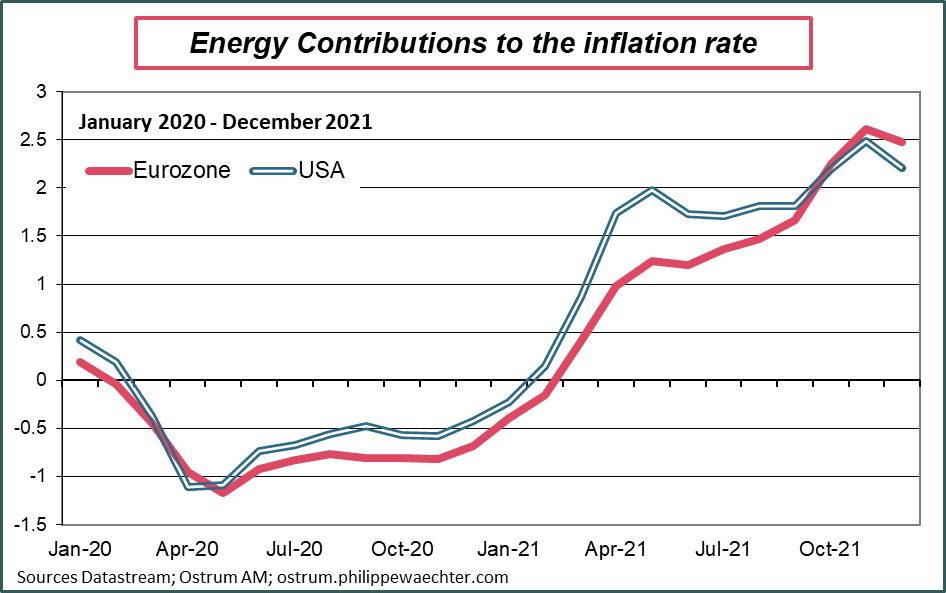

1- The role of energy is still essential even if its contribution, as in the euro zone, fell in December. This reflects the average price drop. A barrel of Brent averaged 74.7 USD compared to 81 in November. The dynamics have since reversed.

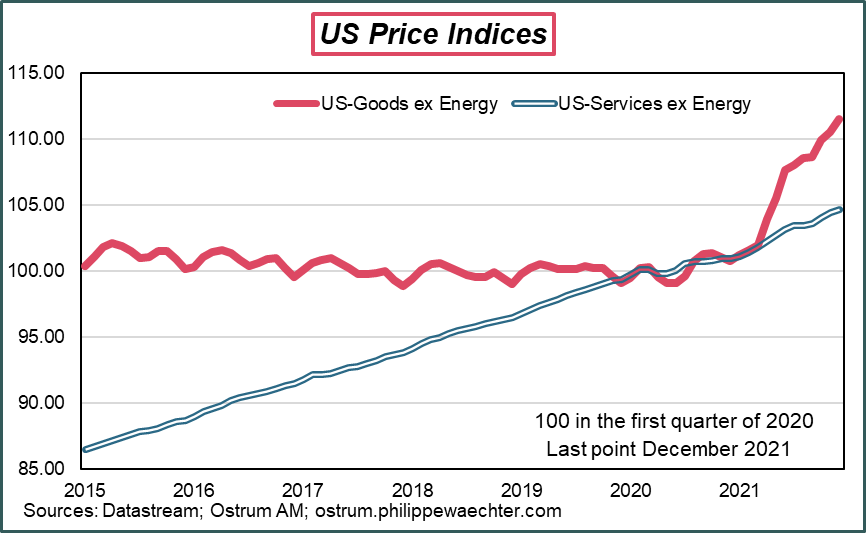

2- The acceleration in core inflation comes almost entirely from the price of goods. The graph whose indices are rebased to 100 in the first quarter of 2020 is explicit. It’s consistent with the sharp surge in demand for goods after Biden’s relaunch last March. Demand for services changed little over the period.

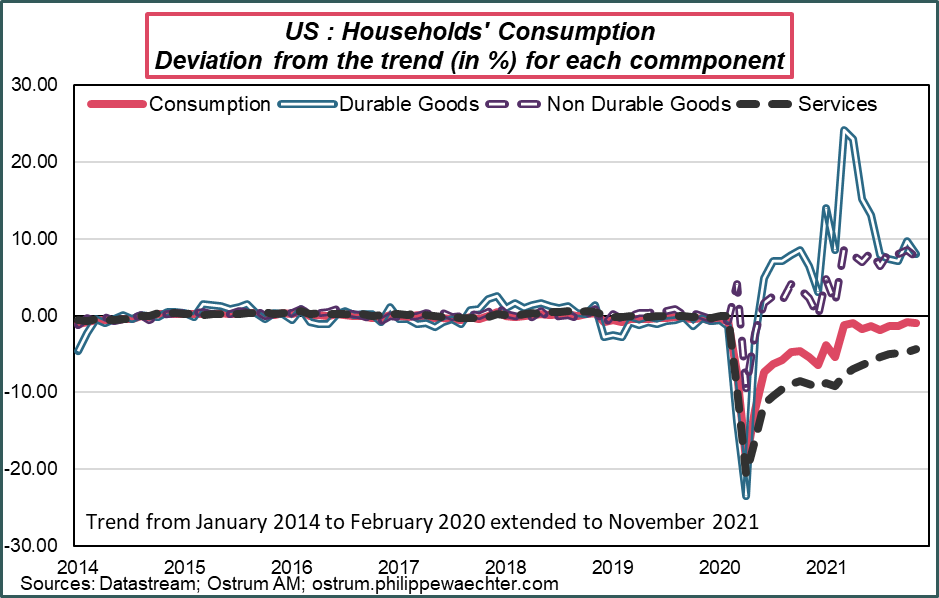

The comparison with the pace of household consumption by major items is very disturbing, suggesting that Biden’s stimulus is at the origin of this inflationary surge.

The rupture is not a question of wages but of demand dynamics, otherwise the demand for services would have increased sharply and the associated price index would have shown a rupture.

Inflation is therefore of the type observed after a period of rationing as well as after a war (see the first graph).

We also note that despite its rapid increase, the housing component (shelter), whose contribution to 1.34%, the highest since the pre-crisis period, has a reduced impact on the profile of the service price index.

It is therefore necessary to monitor the stressors in the goods sector in order to understand the future trend of inflation.

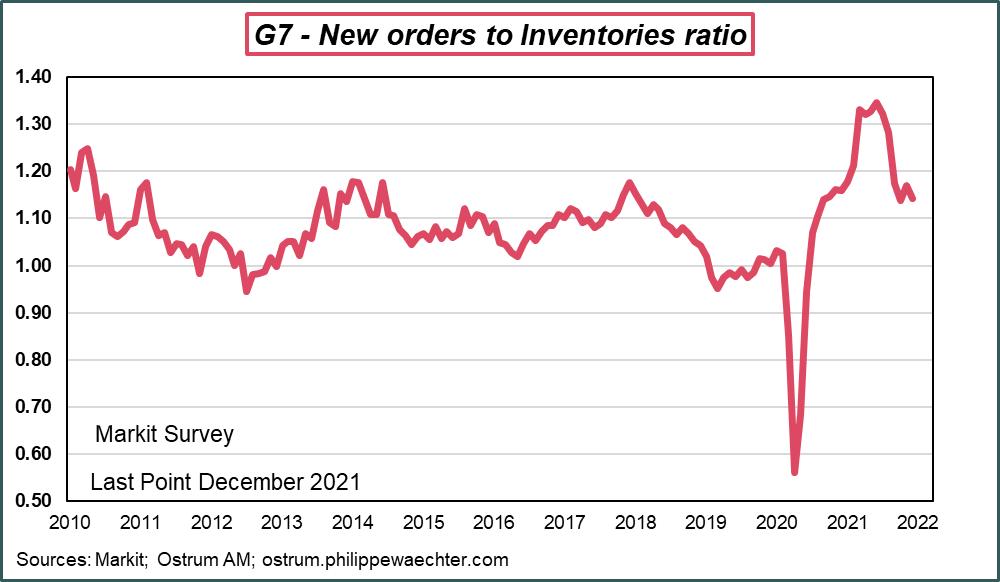

Reading the surveys, tensions are now lower than during the summer, as the graph shows. for G7 countries.

3- In view of the profile of past inflation, and by reproducing the average monthly profiles, the average inflation rate would be 4.4% in 2022 but 1.8% on a sliding scale at the end of December. For core inflation, the average rate would be 4% and 2.1% on a sliding scale.

These are only benchmarks because the beginning of the year will still have a high inflation rate pushing up the figure that will actually be observed.

A few concluding words

To launch a large-scale stimulus when the economy is in imbalance is to take the risk of creating another bias.

This is probably what happened in the USA with all the stimulus packages that have been implemented to try to make the economy converge on its previous trend. From this point of view, the Euro zone has generated fewer imbalances.

American households, after having touched their helicopter money associated with the recovery, have focused their spending on goods.

The particularity of the period is that it was that of rationing first of all on goods and services and then only on services due to health constraints. The lifting of rationing on goods has encouraged households to rush for goods abandoning services. Without this rationing on services, the effect of the recovery would have been more diffuse, better distributed and manufacturing companies would not have suffered as much from this lack of inventories at the time of the rush.

The Fed is now mobilizing on this situation at the risk, by wanting to intervene too quickly, to hamper the adjustment underway in the industry while Joe Biden is unable to pass his two new stimulus plans. The economy risks being quickly constrained.

The Fed is right to want to come back in the game because its credibility is at stake, but to wish to intervene too quickly it could quickly modify expectations (increase in real rates) and weigh on activity and growth.