The day before the ECB meeting, the January 2022 inflation figure sheds light on the question of monetary policy. Should it be a little restrictive or should it maintain the accommodating bias she has had for a very long time?

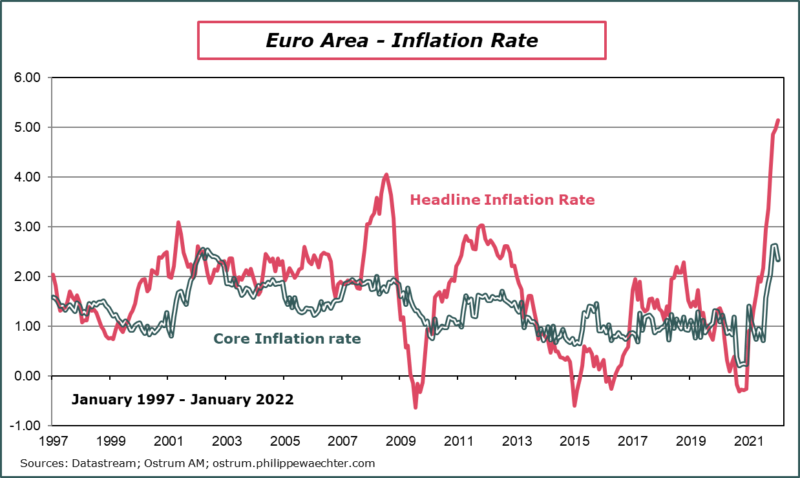

The inflation rate was 5.1% against 5% in December 2021. At the same time, the underlying inflation rate fell to 2.3% against 2.6% in December.

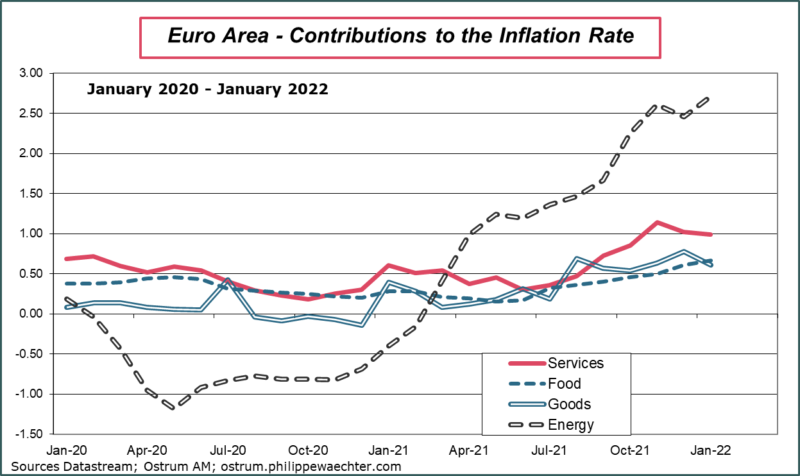

This indicates that the acceleration in the inflation rate does not come from internal nominal tensions in the economy. These would rather tend to fall in conjunction with the fall in the underlying rate.

The rise in inflation is mainly due to energy, whose contribution increases from 2.5% to 2.7%. The contribution of food is also increasing, but to a lesser extent.

Imagine that the ECB toughens its tone and becomes restrictive? Who would be penalized? The actors of the economy of the Euro zone, households and companies while the nominal tensions are lower. This would penalize the economic activity of the area while behaviors do not create risks of persistence of high inflation.

Energy producers will, on the other hand, be able to continue to let prices rise. ECB action would have no impact on them and inflation could continue to rise. The equilibrium on the global energy market, essential in these times of energy transition, is not the domain of the ECB but of governments.

With inflation stemming largely from international energy prices, constraining the Eurozone economy with a restrictive monetary policy would penalize households and businesses in the zone, preventing them from fueling growth as nominal tensions ease.

A restrictive ECB policy would increase the risk of recession without changing the profile of international energy prices. Clearly that would be a mistake.