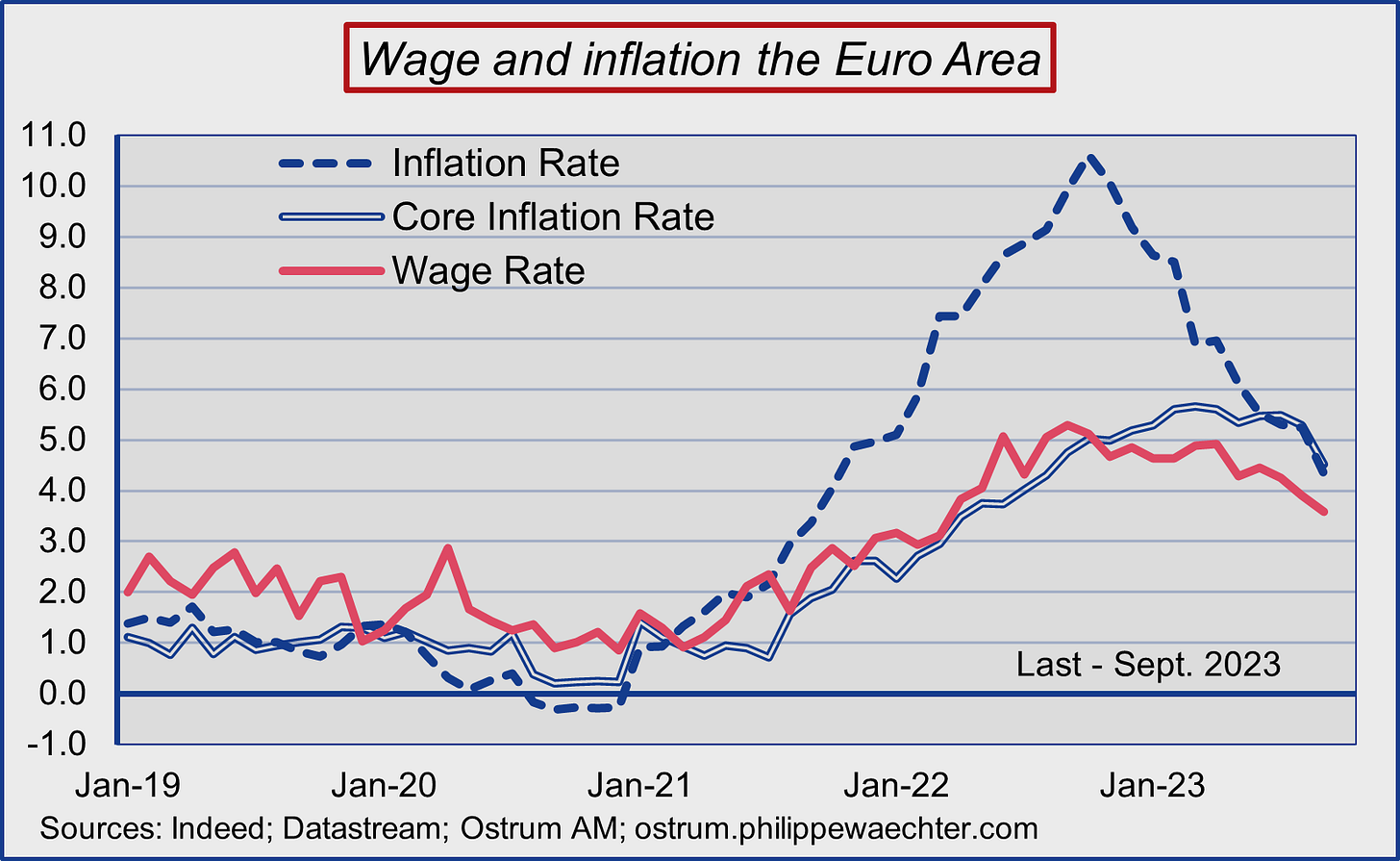

Wage dynamics are changing within the Eurozone. In September, the increase in the salary rate, as measured by the job search site Indeed, was only 3.6% compared to 5.1% at the peak of inflation in October 2022.

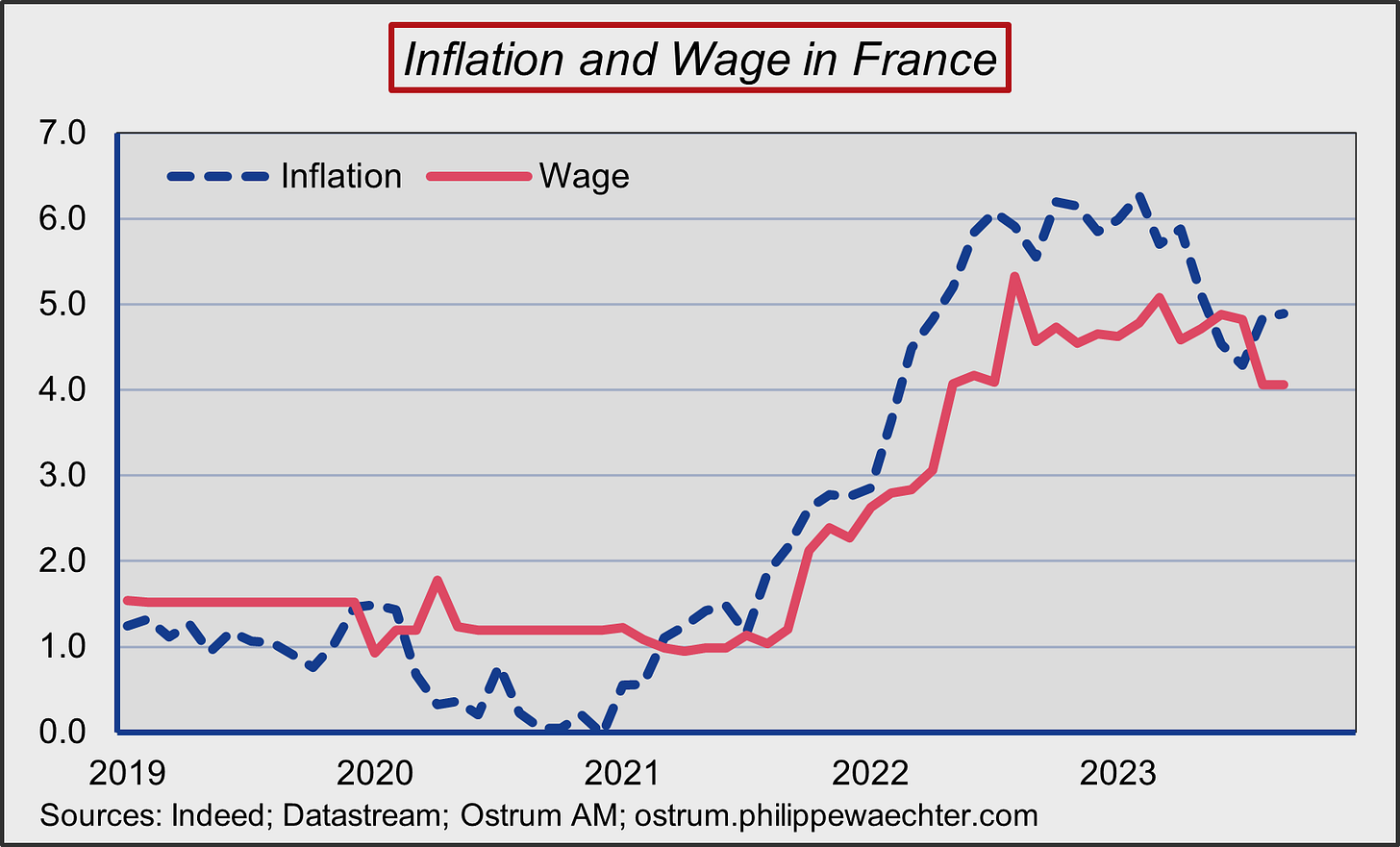

In France too, the momentum is lower than in a recent past. The salary increase, again according to the Indeed reference, is 4.1% in September.

The profile between France and the Euro zone is not directly comparable because the inflation rate does not have the same pace in the two geographical zones but also because in France there is an indexation scheme of the of the minimum wage (SMIC) to the inflation which causes the salary to “stick” to the inflation rate more closely than elsewhere.

To understand what is going to happen, particularly with regard to inflation, two phenomena must be taken into account:

The first is that in the event of a strong shock to inflation, salary negotiations are based on a catch-up dynamic. We can no longer focus solely and mainly on expectations of future inflation. However, the inflation rate is slowing down very significantly and this phenomenon will gradually be reflected in the profile of wage increases.

The second is the likely change in labor market behavior. The cycle is significantly less dynamic, as we saw again this morning with the surveys carried out by INSEE. The employment needs of companies, on a European scale, will adjust to this more limited momentum of economic activity. This will result in a change in balance in the labor market and less bargaining power for employees.

These lower pressures on wages will be reflected in a smaller contribution of the price of services to the inflation rate. However, it is this part of the price index that keeps inflation at a high level. This contribution will fall and the inflation rate with it.

The ECB’s action is complete.